- Canada

- /

- Construction

- /

- TSX:BDGI

Badger Infrastructure Solutions (TSX:BDGI): Exploring Valuation Following Strong Results, Rebranding and Infrastructure Sector Tailwinds

Reviewed by Simply Wall St

If you have been keeping an eye on Badger Infrastructure Solutions (TSX:BDGI), you might have noticed its stock is grabbing more attention lately. The company just reported quarterly results that landed well with investors, showing off healthy top- and bottom-line growth. Its latest rebranding is more than a fresh coat of paint; it signals Badger’s commitment to infrastructure services, especially with its specialty in non-destructive hydrovac excavation. With momentum building in the sector thanks to rising infrastructure spending and growing talk of data center upgrades, investors are naturally wondering if this is a trend with legs.

After these updates, Badger’s stock has surged over 60% so far this year. The past three months have seen a 25% run, piling onto an impressive 90% three-year return. This surge has tracked above both sector peers and the broad market, suggesting new optimism not just about Badger’s fundamentals but also broader enthusiasm for companies linked to capital spending and technology upgrades. While the company's strategic moves have grabbed headlines, they are part of an ongoing story of steady growth and evolving sector opportunities.

So with shares on the move, is Badger Infrastructure Solutions offering more upside, or are investors already paying up for its next phase of growth?

Most Popular Narrative: 2.7% Undervalued

The most widely followed narrative suggests Badger Infrastructure Solutions is currently undervalued by a small margin, with analysts expecting near-term performance aligned with future earnings growth and sector momentum.

The accelerating buildout of critical infrastructure projects, such as data centers, airports, light rail, and power generation or transmission, is driving robust demand for Badger's non-destructive excavation services. This trend is expected to support strong revenue growth as government and private sector infrastructure spending rises across North America.

What is fueling talk of hidden upside in Badger Infrastructure Solutions? The narrative points to an aggressive mix of operational improvements and ambitious financial targets that underpin the consensus on valuation. Want a closer look at the factors sparking debate among analysts, and which bullish numbers are underlying their fair value outlook? The details behind these future projections may surprise you.

Result: Fair Value of $58.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, input cost inflation or a downturn in infrastructure investment could dampen Badger’s momentum and challenge the current fair value narrative.

Find out about the key risks to this Badger Infrastructure Solutions narrative.Another View: What Does Our DCF Model Say?

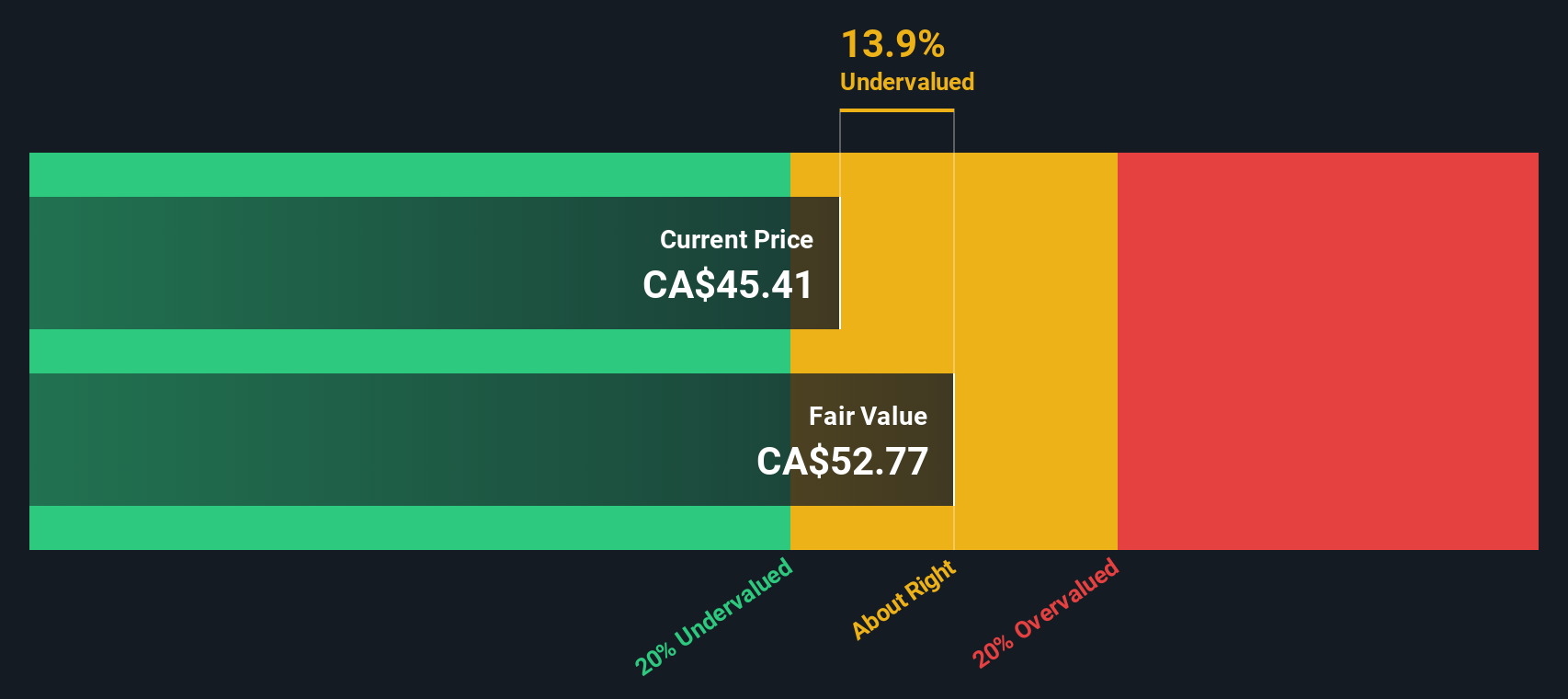

While the consensus valuation relies on analyst forecasts and industry momentum, our SWS DCF model offers a different angle. It also suggests Badger Infrastructure Solutions is undervalued. The question is whether this provides confirmation or if it is simply a coincidence.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Badger Infrastructure Solutions for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Badger Infrastructure Solutions Narrative

If you have your own view on Badger Infrastructure Solutions or want to dive deeper into the numbers yourself, you can quickly build your own analysis and shape your perspective in just a few minutes. Do it your way.

A great starting point for your Badger Infrastructure Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t wait on the sidelines while new market stories are unfolding. Take charge and uncover investment angles you might have overlooked with these targeted screens:

- Unlock high-yield potential by checking out stocks offering steady payouts with dividend stocks with yields > 3%.

- Catch the momentum in artificial intelligence breakthroughs by scanning the most promising companies in tomorrow’s tech sector through AI penny stocks.

- Accelerate your search for undervalued gems that could be flying under the radar by using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Badger Infrastructure Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDGI

Badger Infrastructure Solutions

Provides non-destructive excavating and related services in Canada and the United States.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives