- Canada

- /

- Aerospace & Defense

- /

- TSX:BBD.B

Does Winning Defense Contracts Broaden Bombardier's Competitive Edge in Aerospace Innovation (TSX:BBD.B)?

Reviewed by Sasha Jovanovic

- Earlier this month, L3Harris Technologies announced the selection of Bombardier's Global 6500 aircraft, in partnership with Korean Air and ELTA Systems, to deliver airborne early warning and control solutions for the South Korean Air Force, alongside new defense and business jet orders from Sojitz Corporation and a service agreement with SNC for the US military.

- These developments highlight Bombardier's expanding presence in both international defense and premium business aviation, reinforcing its role as a key supplier of advanced and specialized aircraft platforms.

- We will now examine how Bombardier's role in high-profile defense contracts shapes its broader investment narrative and future outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Bombardier Investment Narrative Recap

For investors, the Bombardier story centers on confidence in sustained demand for large business jets and the company’s ability to harness momentum in both premium and defense aviation. Recent multiyear defense and service contracts further support forward visibility for Bombardier’s backlog, but do not materially change the most important short-term catalyst, expanding high-margin aftermarket services, or reduce supply chain and delivery risk, which remains acute given ongoing inventory build and logistical headwinds.

Among the recent announcements, the 10-year agreement with SNC for Bombardier Defense stands out. By locking in aftermarket service commitments on Global 6500 aircraft deployed for specialized U.S. military missions, Bombardier reinforces its focus on recurring, service-driven revenue streams, an area that is now the clearest catalyst for margin and earnings growth.

However, with spare parts and technical support facilities already at capacity, there is a risk that...

Read the full narrative on Bombardier (it's free!)

Bombardier's narrative projects $10.2 billion revenue and $980.5 million earnings by 2028. This requires 5.4% yearly revenue growth and a $531.5 million earnings increase from $449.0 million.

Uncover how Bombardier's forecasts yield a CA$199.52 fair value, in line with its current price.

Exploring Other Perspectives

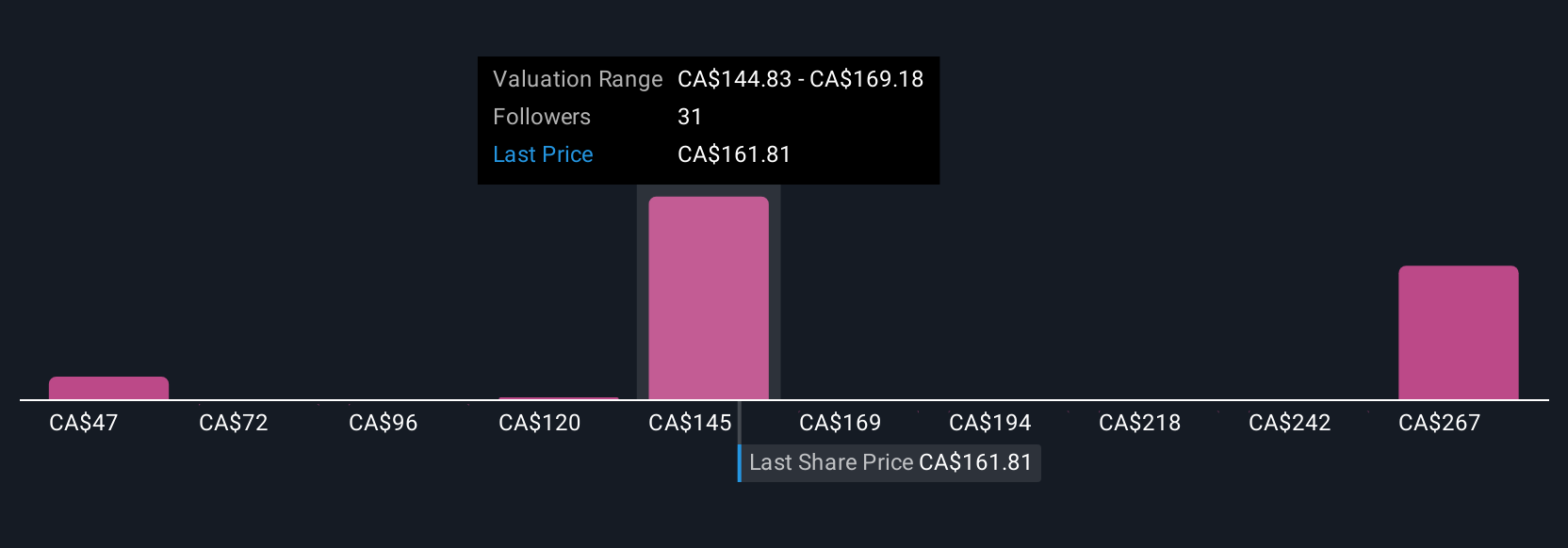

Ten community fair value estimates for Bombardier span from CA$47.40 to CA$280.25, reflecting a wide spectrum of investor views. While aftermarket services are becoming a key earnings driver, you may want to explore how differing opinions account for ongoing supply chain challenges.

Explore 10 other fair value estimates on Bombardier - why the stock might be worth as much as 41% more than the current price!

Build Your Own Bombardier Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bombardier research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bombardier research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bombardier's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bombardier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BBD.B

Bombardier

Engages in the design, manufacture, and sale of business aircraft and aircraft structural components worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives