- China

- /

- Semiconductors

- /

- SZSE:002459

3 Stocks That Could Be Undervalued By Up To 48.2%

Reviewed by Simply Wall St

In a week marked by cautious earnings reports and mixed economic signals, global markets have experienced volatility, with major indices like the Nasdaq Composite and S&P MidCap 400 Index reaching highs before retreating. Amid these fluctuations, investors may find opportunities in stocks that appear undervalued, particularly those with strong fundamentals that could potentially weather the current market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.85 | US$37.48 | 49.7% |

| Proya CosmeticsLtd (SHSE:603605) | CN¥97.24 | CN¥194.47 | 50% |

| Arteche Lantegi Elkartea (BME:ART) | €6.10 | €12.20 | 50% |

| Elica (BIT:ELC) | €1.725 | €3.44 | 49.8% |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 50% |

| Bangkok Genomics Innovation (SET:BKGI) | THB2.68 | THB5.35 | 49.9% |

| BayCurrent Consulting (TSE:6532) | ¥4902.00 | ¥9762.93 | 49.8% |

| Redcentric (AIM:RCN) | £1.20 | £2.39 | 49.8% |

| Beijing LeiKe Defense Technology (SZSE:002413) | CN¥4.72 | CN¥9.39 | 49.8% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$273.91 | US$546.14 | 49.8% |

We'll examine a selection from our screener results.

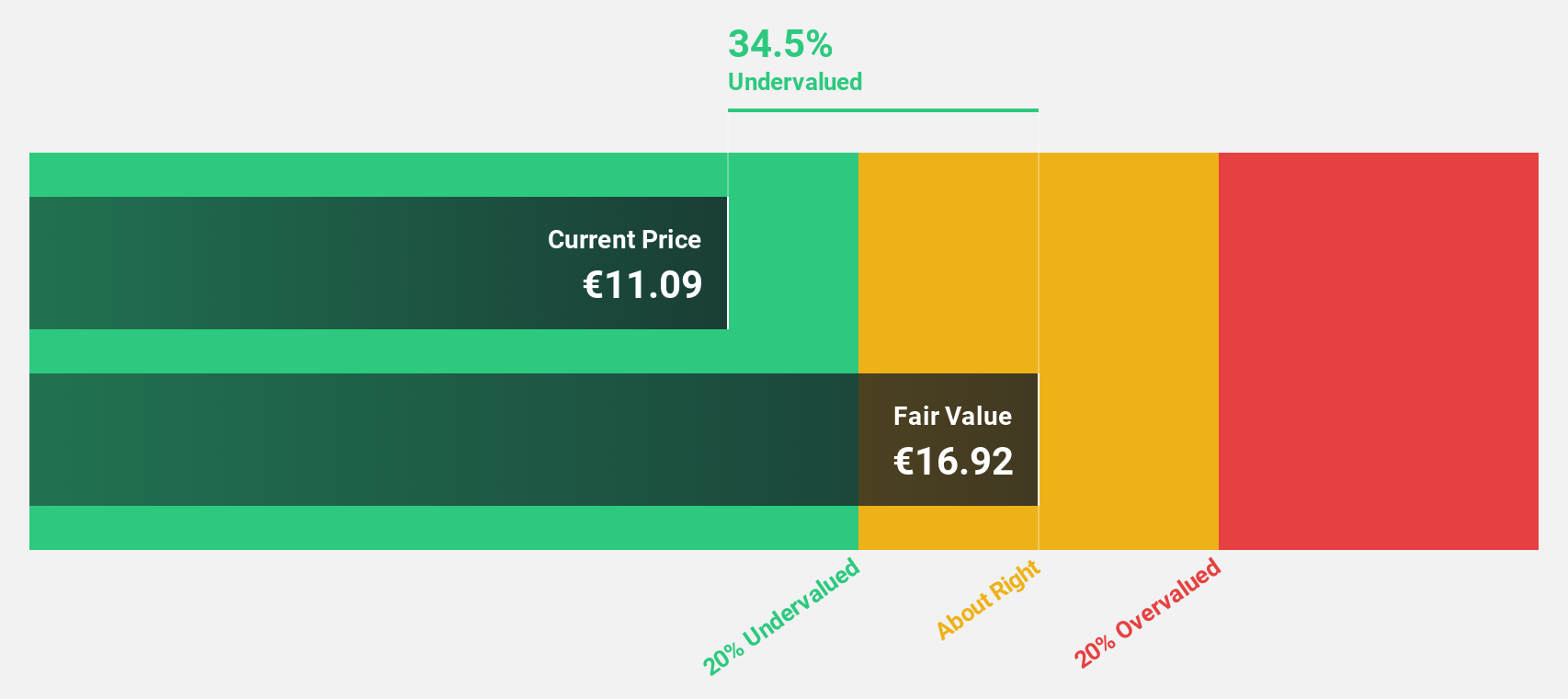

Maire (BIT:MAIRE)

Overview: MAIRE S.p.A. develops and implements solutions for the energy transition, with a market cap of €2.30 billion.

Operations: The company's revenue primarily comes from Integrated E&C Solutions, contributing €4.98 billion, and Sustainable Technology Solutions, adding €321.47 million.

Estimated Discount To Fair Value: 48.2%

Maire S.p.A. appears significantly undervalued, trading at €7.04, which is 48.2% below its estimated fair value of €13.58 based on discounted cash flow analysis. Recent earnings show strong growth with net income rising to €137.61 million from €82.2 million a year ago and revenue increasing to €4.13 billion from €3.09 billion, suggesting robust operational performance despite an unstable dividend track record and modest buyback activity.

- Our earnings growth report unveils the potential for significant increases in Maire's future results.

- Dive into the specifics of Maire here with our thorough financial health report.

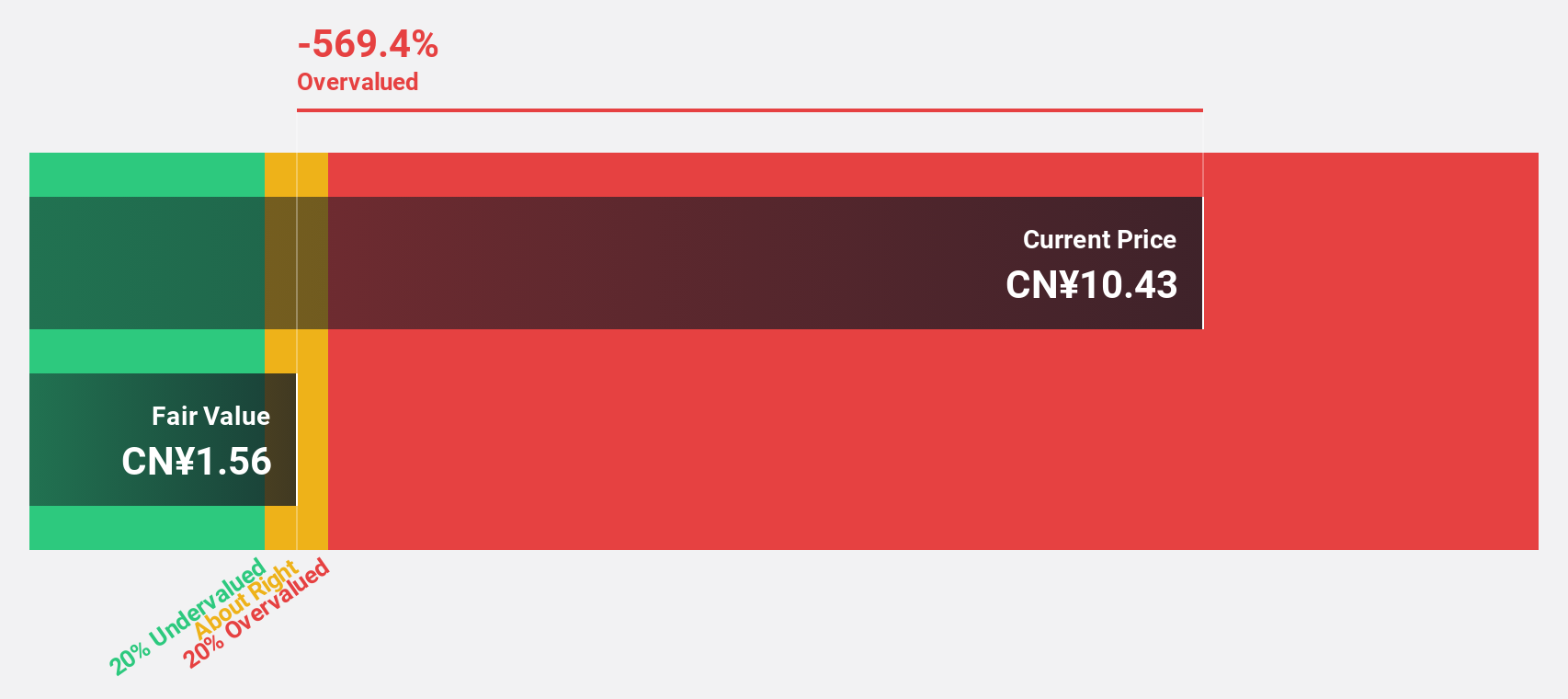

JA Solar Technology (SZSE:002459)

Overview: JA Solar Technology Co., Ltd. is a Chinese company specializing in the production and processing of monocrystalline silicon rods and wafers, with a market cap of approximately CN¥59.58 billion.

Operations: The company's revenue is primarily derived from the production and processing of monocrystalline silicon rods and wafers in China.

Estimated Discount To Fair Value: 28.4%

JA Solar Technology Co., Ltd. is trading at CNY 18.15, significantly below its fair value estimate of CNY 25.36, indicating potential undervaluation based on discounted cash flow analysis. Despite recent financial challenges, including a net loss of CNY 484.36 million for the nine months ended September 2024, the company is forecast to achieve profitability within three years with earnings expected to grow by over 73% annually, although interest payments remain inadequately covered by earnings.

- Insights from our recent growth report point to a promising forecast for JA Solar Technology's business outlook.

- Get an in-depth perspective on JA Solar Technology's balance sheet by reading our health report here.

AtkinsRéalis Group (TSX:ATRL)

Overview: AtkinsRéalis Group is an integrated professional services and project management company with global operations, and it has a market cap of CA$11.88 billion.

Operations: The company's revenue segments include Capital at CA$127.40 million, Nuclear at CA$1.20 billion, LSTK Projects at CA$318.44 million, and a Segment Adjustment of CA$7.46 billion.

Estimated Discount To Fair Value: 37.9%

AtkinsRéalis Group is trading at CA$67.96, significantly below its estimated fair value of CA$109.39, suggesting it may be undervalued based on discounted cash flow analysis. Despite debt not being well covered by operating cash flow, earnings are forecast to grow significantly at 26.3% annually over the next three years, outpacing the Canadian market's growth rate. Recent strategic partnerships in infrastructure and environmental projects further bolster its growth prospects and revenue streams.

- Upon reviewing our latest growth report, AtkinsRéalis Group's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of AtkinsRéalis Group.

Seize The Opportunity

- Unlock our comprehensive list of 955 Undervalued Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002459

JA Solar Technology

Engages in the production and processing of monocrystalline silicon rods and monocrystalline silicon wafers primarily in China.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives