- Australia

- /

- Capital Markets

- /

- ASX:MFG

Undervalued Small Caps In Global With Insider Action To Consider

Reviewed by Simply Wall St

In recent weeks, global markets have experienced mixed performances, with large-cap technology stocks driving gains in major U.S. indices while smaller-cap indexes like the S&P 600 have faced declines. Amid this backdrop, a temporary trade truce between the U.S. and China has provided some relief to market sentiment, although concerns about inflation and economic growth persist. In such an environment, identifying small-cap stocks that are potentially undervalued can be appealing to investors seeking opportunities for growth. Factors such as strong fundamentals and insider activity can indicate promising prospects in the current economic landscape.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.5x | 1.0x | 22.01% | ★★★★★★ |

| Bytes Technology Group | 16.5x | 4.0x | 21.04% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 28.60% | ★★★★★☆ |

| Morguard North American Residential Real Estate Investment Trust | 4.9x | 1.7x | 25.18% | ★★★★★☆ |

| Eastnine | 12.0x | 7.6x | 49.19% | ★★★★☆☆ |

| BWP Trust | 10.3x | 13.4x | 12.49% | ★★★★☆☆ |

| Sagicor Financial | 6.9x | 0.4x | -69.10% | ★★★★☆☆ |

| Bumitama Agri | 11.8x | 1.7x | 44.26% | ★★★☆☆☆ |

| Chinasoft International | 24.5x | 0.8x | -1371.75% | ★★★☆☆☆ |

| Senior | 24.9x | 0.8x | 19.41% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

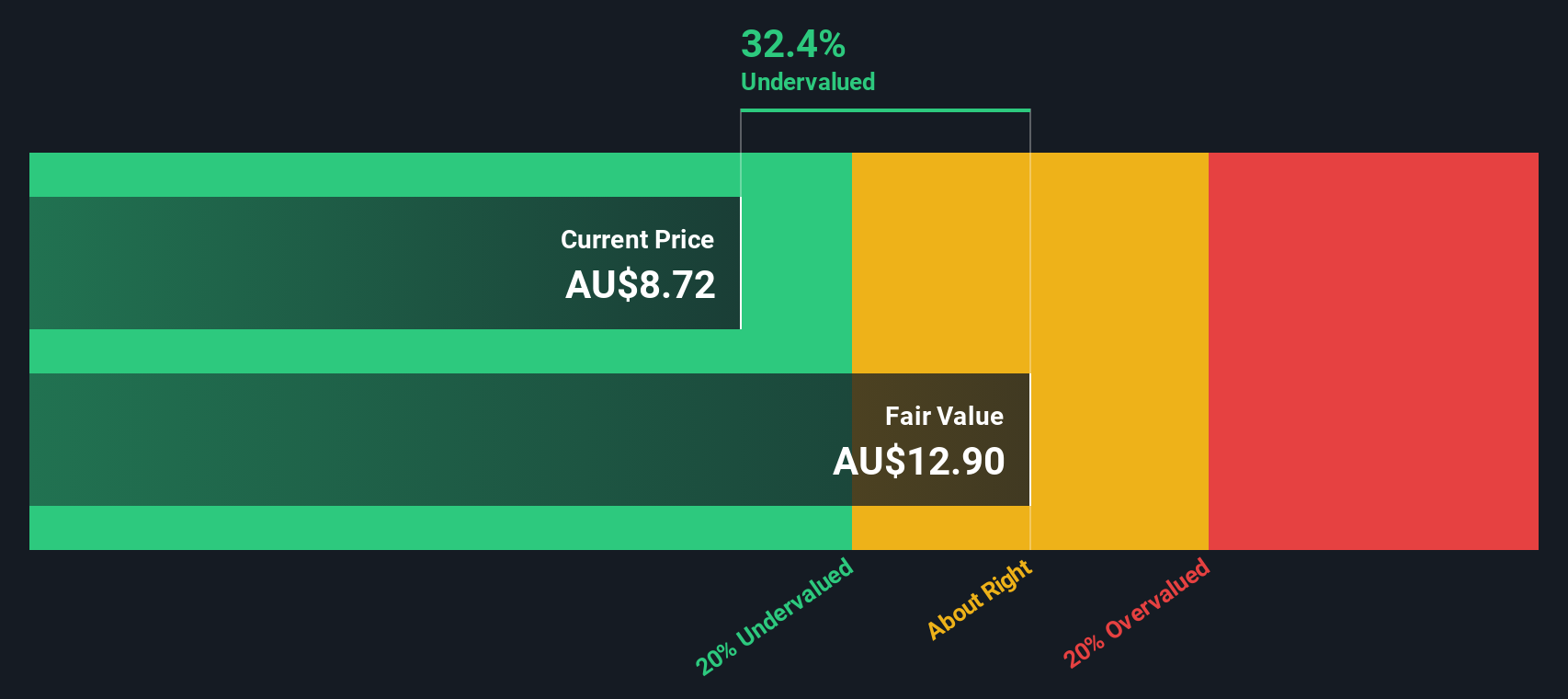

Magellan Financial Group (ASX:MFG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magellan Financial Group operates as an investment management company, providing services across corporate, partnerships and investments, and investment management services segments with a market capitalization of A$3.5 billion.

Operations: Magellan Financial Group generates revenue primarily from its Investment Management Services, which is the largest contributor at A$248.46 million, followed by Partnerships & Investments at A$42.43 million. The company experienced fluctuations in its net income margin, with a notable peak of 69.63% in June 2022 and a more recent figure of 51.78% in March 2025. Operating expenses include significant allocations to general and administrative costs, which were A$31.23 million as of June 2025.

PE: 10.1x

Magellan Financial Group, a smaller company in the investment sector, has been actively engaging in strategic buybacks, repurchasing 7.2 million shares for A$56.16 million between January and June 2025. This move reflects confidence in its potential despite a dip in revenue to A$318.95 million from A$378.63 million the previous year. Recent leadership changes, including new board appointments and a refreshed corporate brand strategy under Magellan Investment Partners with approximately $40 billion assets under management, signal an adaptive approach to future growth opportunities while maintaining focus on delivering premium solutions through strategic partnerships.

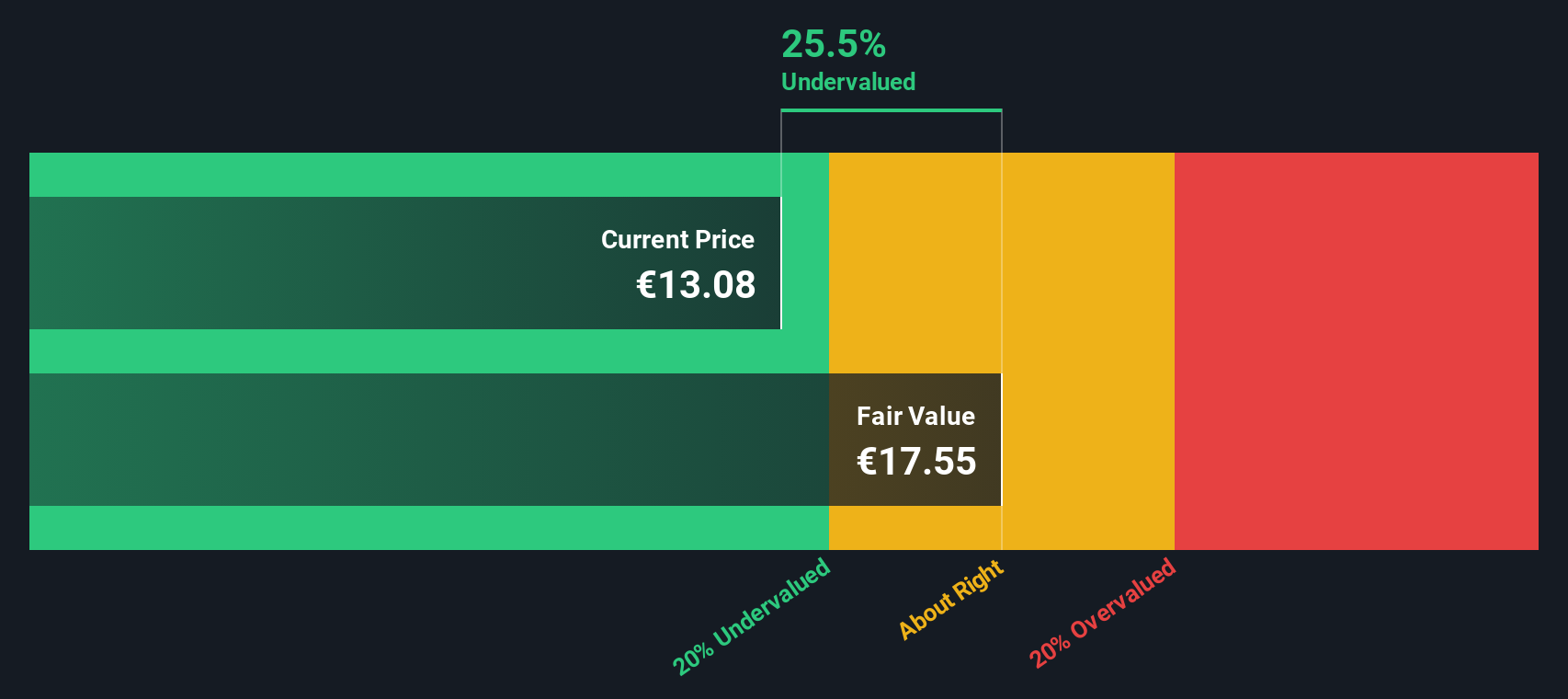

Fiskars Oyj Abp (HLSE:FSKRS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Fiskars Oyj Abp is a Finnish company known for its consumer goods, particularly in the home, garden, and outdoor categories, with a market capitalization of approximately €1.70 billion.

Operations: Vita and Fiskars are the primary revenue streams, generating €609.90 million and €530.90 million, respectively. The gross profit margin has shown a rising trend, reaching 47.20% by September 2025 from 40.46% in December 2014. Operating expenses have consistently been a significant component of costs, with sales and marketing expenses being notably high among them.

PE: 39.5x

Fiskars Oyj Abp, a smaller company in the investment landscape, has recently seen insider confidence with executives purchasing shares in September 2025. Despite lowering its earnings guidance to €90 million to €100 million for 2025, the company reported a positive sales trend in Q3 with €259.3 million in sales and net income of €5.3 million, reversing last year's loss. With Jyri Luomakoski now leading as CEO, Fiskars aims to leverage his extensive industry experience for strategic growth amid financial challenges from higher-risk funding sources like external borrowing.

- Delve into the full analysis valuation report here for a deeper understanding of Fiskars Oyj Abp.

Examine Fiskars Oyj Abp's past performance report to understand how it has performed in the past.

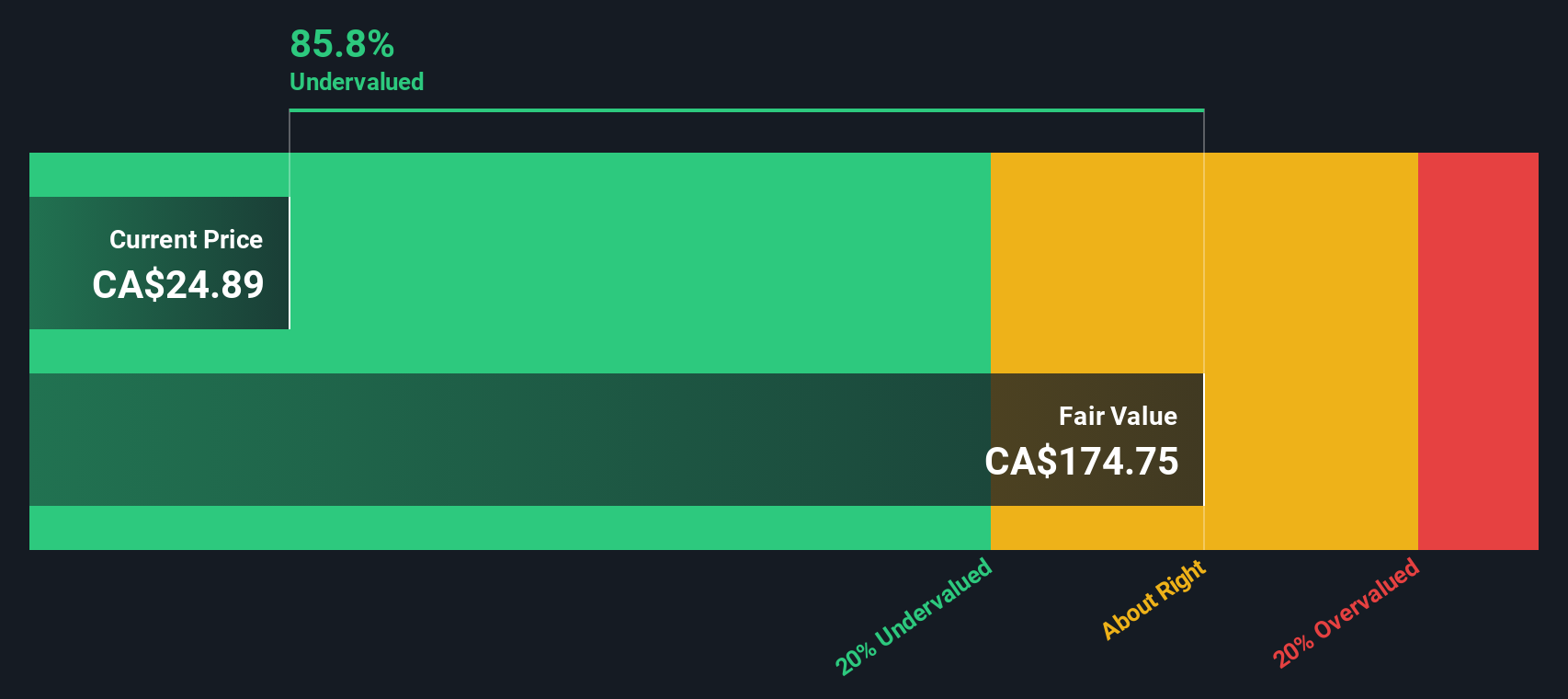

Aecon Group (TSX:ARE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aecon Group is a Canadian construction and infrastructure development company with operations in concessions and construction, having a market cap of approximately CA$469.97 million.

Operations: The company generates revenue primarily from its Construction segment, contributing CA$5.14 billion, with the Concessions segment adding a smaller portion at CA$9.99 million. The gross profit margin has shown variability, recently recorded at 5.36% as of September 2023 and reaching up to 11.78% in past periods like March 2018. Operating expenses have fluctuated but remain a significant component of the cost structure, impacting overall profitability alongside non-operating expenses and depreciation & amortization costs.

PE: 231.1x

Aecon Group, a construction company with a significant contract backlog of C$10.8 billion as of Q3 2025, is poised for revenue growth driven by strategic acquisitions and solid demand in its recurring programs. Recent projects include the Port of Montreal expansion and a joint venture for small modular reactors, enhancing its industry footprint. Despite lower net income in Q3 2025 compared to the previous year, insider confidence is evident through recent share purchases, signaling potential future optimism.

Make It Happen

- Take a closer look at our Undervalued Global Small Caps With Insider Buying list of 117 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFG

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion