- Canada

- /

- Construction

- /

- TSX:ARE

Investors Still Aren't Entirely Convinced By Aecon Group Inc.'s (TSE:ARE) Revenues Despite 26% Price Jump

Those holding Aecon Group Inc. (TSE:ARE) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking further back, the 15% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

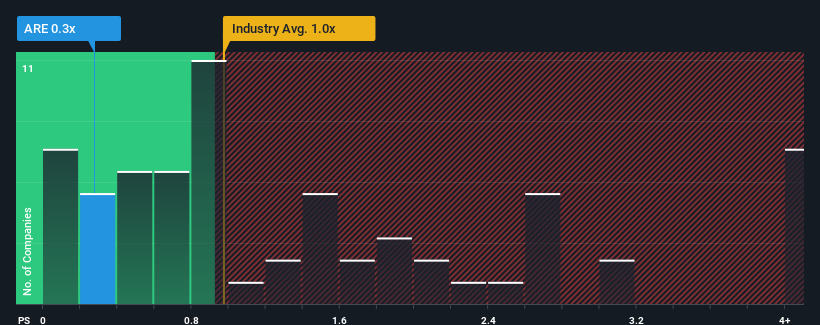

Although its price has surged higher, considering around half the companies operating in Canada's Construction industry have price-to-sales ratios (or "P/S") above 1.6x, you may still consider Aecon Group as an solid investment opportunity with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Aecon Group

How Has Aecon Group Performed Recently?

Recent times haven't been great for Aecon Group as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Aecon Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Aecon Group?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Aecon Group's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 5.9% in total over the last three years. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 11% during the coming year according to the eleven analysts following the company. With the rest of the industry predicted to shrink by 2.7%, that would be a fantastic result.

With this in mind, we find it intriguing that Aecon Group's P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Despite Aecon Group's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Aecon Group currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Aecon Group that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ARE

Aecon Group

Aecon Group Inc., together with its subsidiaries, provide construction and infrastructure development services to private and public sector clients in Canada, the United States, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives