Shareholders Will Probably Not Have Any Issues With Sharc International Systems Inc.'s (CSE:SHRC) CEO Compensation

Key Insights

- Sharc International Systems to hold its Annual General Meeting on 12th of September

- CEO Lynn Mueller's total compensation includes salary of CA$228.3k

- The overall pay is 42% below the industry average

- Sharc International Systems' three-year loss to shareholders was 5.8% while its EPS grew by 11% over the past three years

The performance at Sharc International Systems Inc. (CSE:SHRC) has been rather lacklustre of late and shareholders may be wondering what CEO Lynn Mueller is planning to do about this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 12th of September. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. In our opinion, CEO compensation does not look excessive and we discuss why.

Check out our latest analysis for Sharc International Systems

Comparing Sharc International Systems Inc.'s CEO Compensation With The Industry

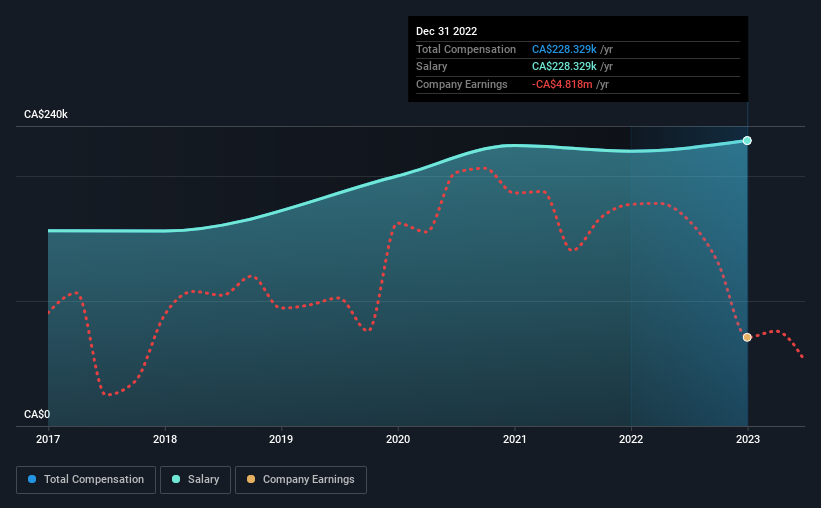

Our data indicates that Sharc International Systems Inc. has a market capitalization of CA$38m, and total annual CEO compensation was reported as CA$228k for the year to December 2022. That's a fairly small increase of 3.9% over the previous year. Notably, the salary of CA$228k is the entirety of the CEO compensation.

In comparison with other companies in the Canadian Machinery industry with market capitalizations under CA$273m, the reported median total CEO compensation was CA$391k. Accordingly, Sharc International Systems pays its CEO under the industry median.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | CA$228k | CA$220k | 100% |

| Other | - | - | - |

| Total Compensation | CA$228k | CA$220k | 100% |

Speaking on an industry level, nearly 71% of total compensation represents salary, while the remainder of 29% is other remuneration. At the company level, Sharc International Systems pays Lynn Mueller solely through a salary, preferring to go down a conventional route. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Sharc International Systems Inc.'s Growth Numbers

Sharc International Systems Inc.'s earnings per share (EPS) grew 11% per year over the last three years. In the last year, its revenue is down 40%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Sharc International Systems Inc. Been A Good Investment?

Since shareholders would have lost about 5.8% over three years, some Sharc International Systems Inc. investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Sharc International Systems pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The uninspiring share price returns contrasts with the strong EPS growth, suggesting that there may be other factors at play causing it to diverge from fundamentals. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board and assess if the board's plan is likely to improve company performance.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 5 warning signs (and 2 which are a bit unpleasant) in Sharc International Systems we think you should know about.

Switching gears from Sharc International Systems, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:SHRC

Sharc International Systems

Together with its subsidiary, provides wastewater energy transfer products and services for commercial, industrial, public utilities, and residential development projects in Canada and the United States.

Medium-low risk with weak fundamentals.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion