- Canada

- /

- Aerospace & Defense

- /

- CNSX:DPRO

Draganfly (CNSX:DPRO) Is Up 66.4% After Securing U.S. Army Drone Manufacturing and Training Deal—Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In late September 2025, the U.S. Army announced it had selected Draganfly Inc. to deliver Flex FPV drone systems, with plans for on-site manufacturing at overseas U.S. Forces facilities and comprehensive training for military personnel.

- This partnership brings agile drone manufacturing and operational capabilities directly to military sites, addressing modern defense needs and emphasizing the significance of decentralized innovation.

- We’ll examine how the focus on local drone production and military support shapes Draganfly’s investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Draganfly's Investment Narrative?

To be a shareholder in Draganfly right now, you have to believe in the long-term case for increased adoption of drones across defense, public safety, and other sectors, with a particular focus on whether the company can convert recent contracts into lasting revenue streams. The U.S. Army’s selection of Draganfly for Flex FPV drone supply and local production could be a gamechanger for short-term momentum, especially given the stock’s rapid recent gains and media coverage. This milestone not only demonstrates validation of Draganfly’s technology but may also shift the most immediate catalyst to successful execution on the Army contract, specifically, proving its ability to scale, deliver, and embed manufacturing close to operations. The biggest risks previously centered on high unprofitability, repeated shareholder dilution, and an expensive valuation multiple, but the new military contract could alter both the revenue outlook and risk balance, at least in the short term. On the other hand, execution risk and ongoing unprofitability remain stubborn realities investors should be aware of.

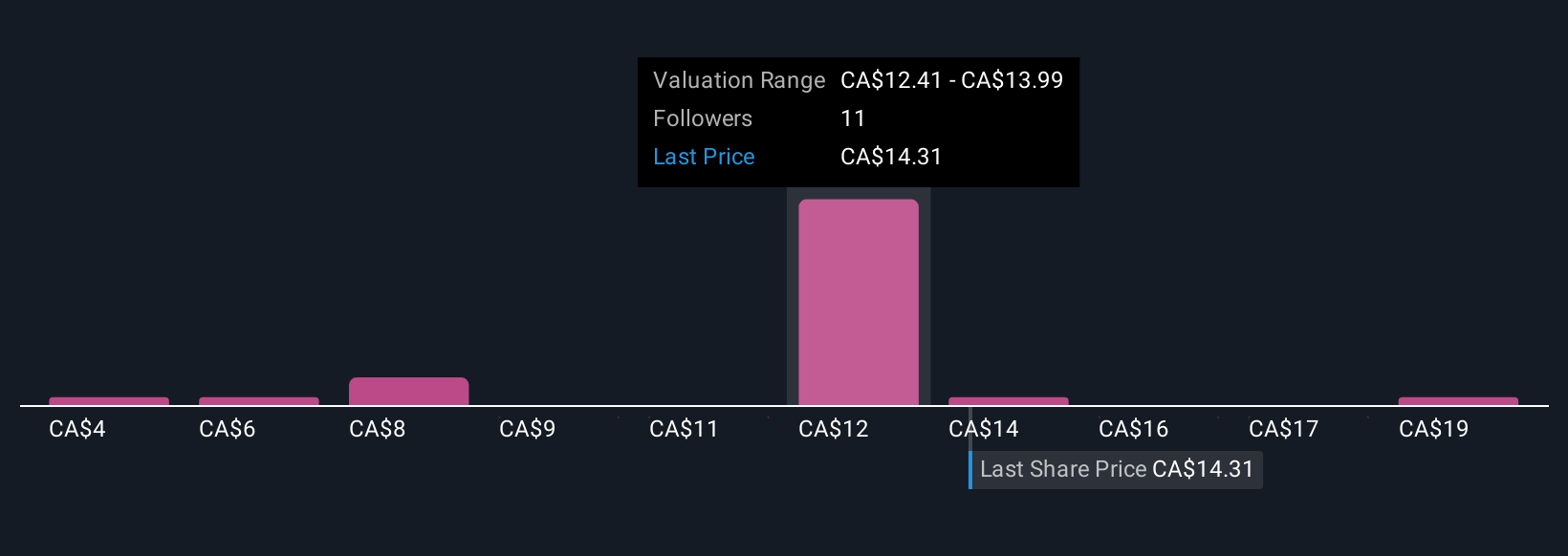

According our valuation report, there's an indication that Draganfly's share price might be on the expensive side.Exploring Other Perspectives

Explore 7 other fair value estimates on Draganfly - why the stock might be worth less than half the current price!

Build Your Own Draganfly Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Draganfly research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Draganfly research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Draganfly's overall financial health at a glance.

No Opportunity In Draganfly?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:DPRO

Draganfly

Develops, manufactures, and sells cutting-edge unmanned and remote data collection and analysis platforms and systems in the United States and Canada.

Flawless balance sheet with low risk.

Market Insights

Community Narratives