In the last week, the Canadian market has been flat, with a notable 3.9% drop in the Materials sector. Despite this, the market is up 13% over the past year and earnings are forecast to grow by 15% annually. In such a dynamic environment, identifying undervalued small-cap stocks with insider action can offer unique opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Calfrac Well Services | 2.6x | 0.2x | 36.85% | ★★★★★★ |

| Trican Well Service | 7.8x | 1.0x | 11.60% | ★★★★★☆ |

| Nexus Industrial REIT | 3.6x | 3.6x | 21.99% | ★★★★★☆ |

| Rogers Sugar | 15.1x | 0.6x | 49.19% | ★★★★★☆ |

| Flagship Communities Real Estate Investment Trust | 3.6x | 3.8x | 45.49% | ★★★★★☆ |

| Hemisphere Energy | 5.8x | 2.2x | 12.80% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -42.88% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.0x | 3.2x | 41.21% | ★★★★☆☆ |

| VersaBank | 10.2x | 4.1x | -15.10% | ★★★☆☆☆ |

| Cascades | NA | 0.2x | -83.28% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Cascades (TSX:CAS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Cascades operates in the production and sale of tissue papers, containerboard packaging products, and specialty packaging products with a market capitalization of approximately CA$0.83 billion.

Operations: Cascades generates revenue primarily from its Tissue Papers ($1.58 billion), Packaging Products - Containerboard ($2.30 billion), and Packaging Products - Specialty Products ($644 million) segments. The company has experienced fluctuations in its net income margin, with notable periods of negative margins, such as -0.00908% for the quarter ending June 30, 2024. Gross profit margin has shown variability, reaching up to 46.46% in Q3 2022 but standing at 34.75% in the latest quarter (Q3 2024).

PE: -22.3x

Cascades, a notable player among Canada's undervalued small-cap stocks, has shown insider confidence with Alain Lemaire purchasing 26,500 shares worth C$255,135. Recent guidance suggests stronger Q3 earnings driven by improved Containerboard results and production efficiency. Despite higher pulp prices impacting the Tissue Papers segment, stable performance in Specialty Packaging is expected. Q2 2024 saw sales of C$1.18 billion and net income of C$1 million. The company declared a quarterly dividend of C$0.12 per share on September 5, 2024.

- Click here and access our complete valuation analysis report to understand the dynamics of Cascades.

Assess Cascades' past performance with our detailed historical performance reports.

Flagship Communities Real Estate Investment Trust (TSX:MHC.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Flagship Communities Real Estate Investment Trust operates in the residential real estate sector, focusing on manufactured housing communities, with a market cap of approximately $0.51 billion (CAD).

Operations: Flagship Communities Real Estate Investment Trust generates revenue primarily from its residential REIT segment, with recent quarterly revenue reaching $78.07 million. The company reported a gross profit margin of 66.12% for the latest period, reflecting its ability to manage costs effectively relative to its revenue.

PE: 3.6x

Flagship Communities Real Estate Investment Trust saw insider confidence with share purchases in the past six months, signaling faith in its prospects. For Q2 2024, Flagship reported sales of US$21.23 million and net income of US$43.46 million, more than doubling from last year’s US$21.39 million. The REIT consistently pays monthly dividends, recently affirming a cash distribution of US$0.0492 per unit for August 2024. Despite high-risk funding sources and forecasted earnings decline averaging 46% annually over the next three years, revenue is expected to grow by 8.9% per year, reflecting potential resilience amid market challenges.

VersaBank (TSX:VBNK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: VersaBank operates as a digital bank providing banking services and cybersecurity solutions, with a market cap of CA$0.30 billion.

Operations: The company generates revenue primarily from Digital Banking (CA$104.90 million) and DRTC (CA$10.56 million). Its operating expenses have fluctuated, impacting the net income margin, which has varied from 0.064% to 0.405%.

PE: 10.2x

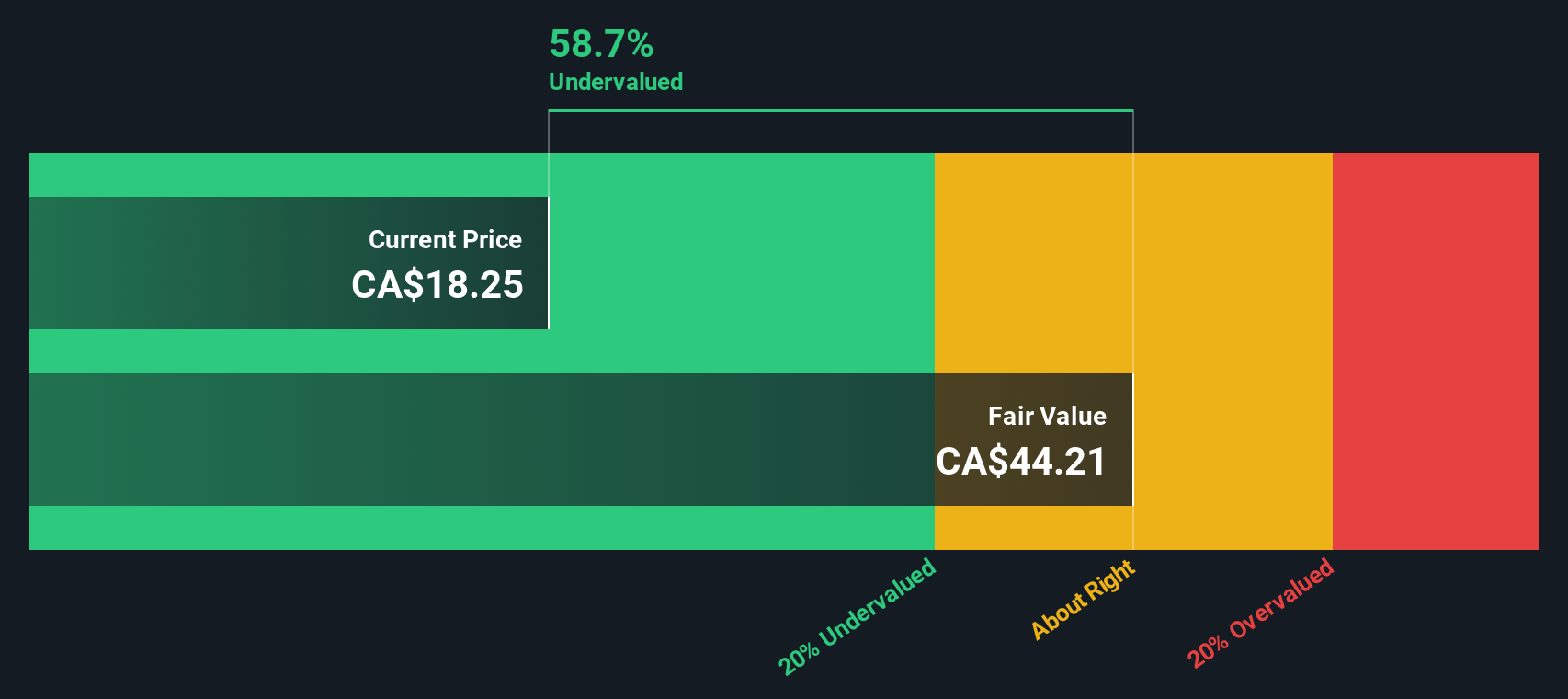

VersaBank, a small Canadian financial institution, is seeing insider confidence with recent share purchases by key executives. The bank's net income for Q2 2024 was C$11.83 million, up from C$10.26 million the previous year. Earnings are forecast to grow 22.69% annually, and the company maintains a low allowance for bad loans at 16%. With strategic expansion into the U.S., including new executive appointments and regulatory approvals, VersaBank is positioning itself for future growth in North America.

- Click here to discover the nuances of VersaBank with our detailed analytical valuation report.

Gain insights into VersaBank's historical performance by reviewing our past performance report.

Next Steps

- Unlock more gems! Our Undervalued TSX Small Caps With Insider Buying screener has unearthed 19 more companies for you to explore.Click here to unveil our expertly curated list of 22 Undervalued TSX Small Caps With Insider Buying.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VBNK

VersaBank

Provides various banking products and services in Canada and the United States.

Flawless balance sheet with high growth potential.