TSX Growth Companies With High Insider Ownership In November 2025

Reviewed by Simply Wall St

In the current Canadian market, where the short-term growth outlook remains subdued due to factors like slower consumer spending and population growth, investors are closely watching for improvements anticipated in 2026 as interest-rate cuts and fiscal stimulus take effect. Amid these conditions, identifying growth companies with high insider ownership can be appealing because such ownership often suggests confidence in the company's future prospects and alignment of interests between insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Zedcor (TSXV:ZDC) | 19.2% | 122.6% |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.1% | 78% |

| Stingray Group (TSX:RAY.A) | 22.8% | 33.9% |

| Robex Resources (TSXV:RBX) | 20.6% | 97.7% |

| Propel Holdings (TSX:PRL) | 30.6% | 32.1% |

| PowerBank (NEOE:SUNN) | 16.1% | 59% |

| goeasy (TSX:GSY) | 21.7% | 27.3% |

| Enterprise Group (TSX:E) | 35.6% | 33.8% |

| CEMATRIX (TSX:CEMX) | 10.5% | 58.3% |

| Almonty Industries (TSX:AII) | 12.3% | 63.4% |

Let's dive into some prime choices out of the screener.

Aduro Clean Technologies (CNSX:ACT)

Simply Wall St Growth Rating: ★★★★★☆

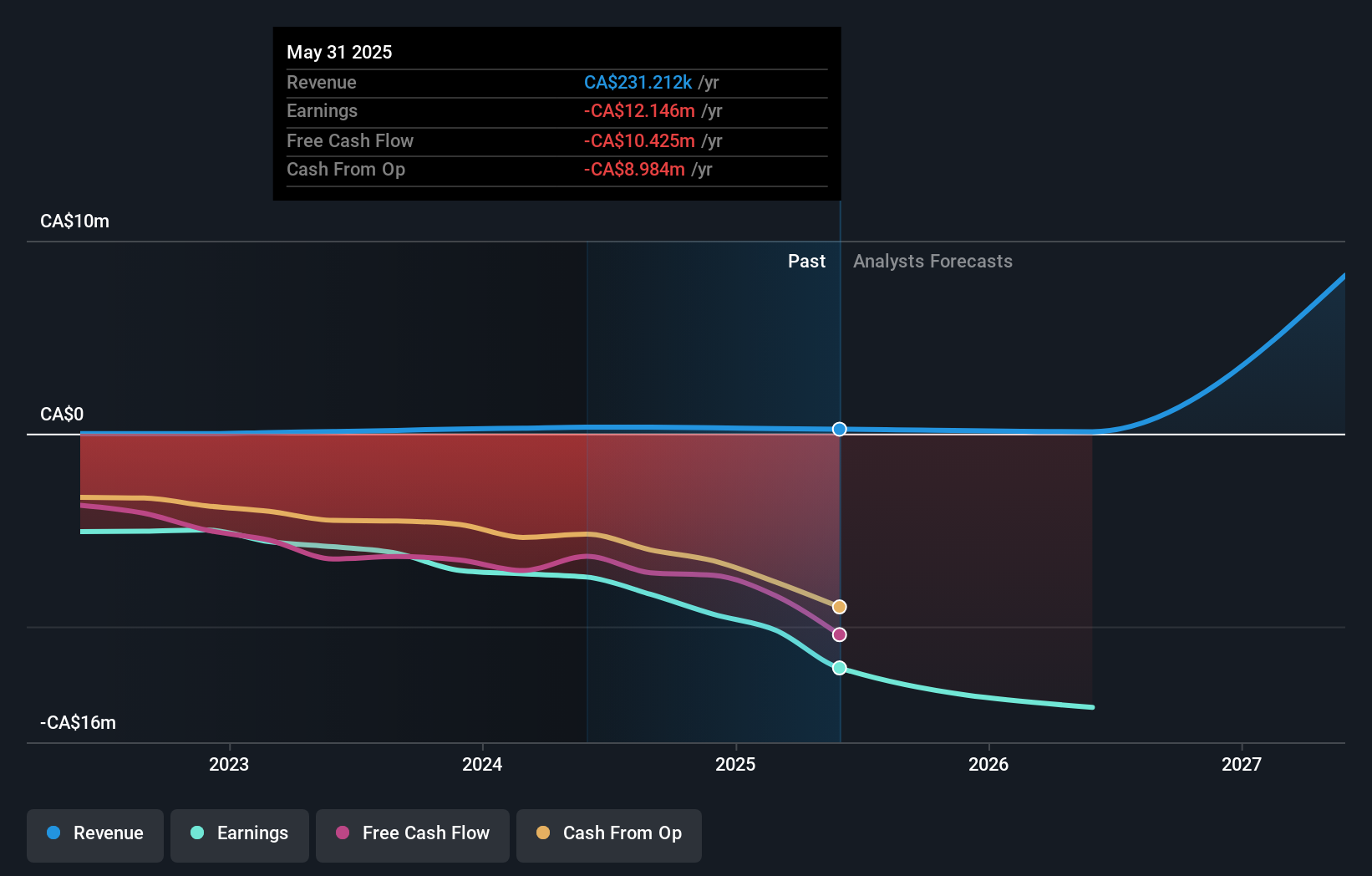

Overview: Aduro Clean Technologies Inc. develops water-based chemical recycling technologies and has a market cap of CA$490.36 million.

Operations: The company generates revenue through its Pollution and Treatment Control Products segment, totaling CA$0.22 million.

Insider Ownership: 36.3%

Aduro Clean Technologies is poised for significant growth, with forecasted revenue expansion of 70.1% annually, outpacing the Canadian market. Despite current low revenue levels (CA$221K), the company aims to become profitable within three years, surpassing average market growth expectations. Recent developments include a strategic move to acquire a site in the Netherlands for its Hydrochemolytic technology demonstration plant, enhancing integration into Europe's mature circular plastics ecosystem and aligning with EU regulatory trends.

- Navigate through the intricacies of Aduro Clean Technologies with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Aduro Clean Technologies' share price might be on the expensive side.

Knight Therapeutics (TSX:GUD)

Simply Wall St Growth Rating: ★★★★☆☆

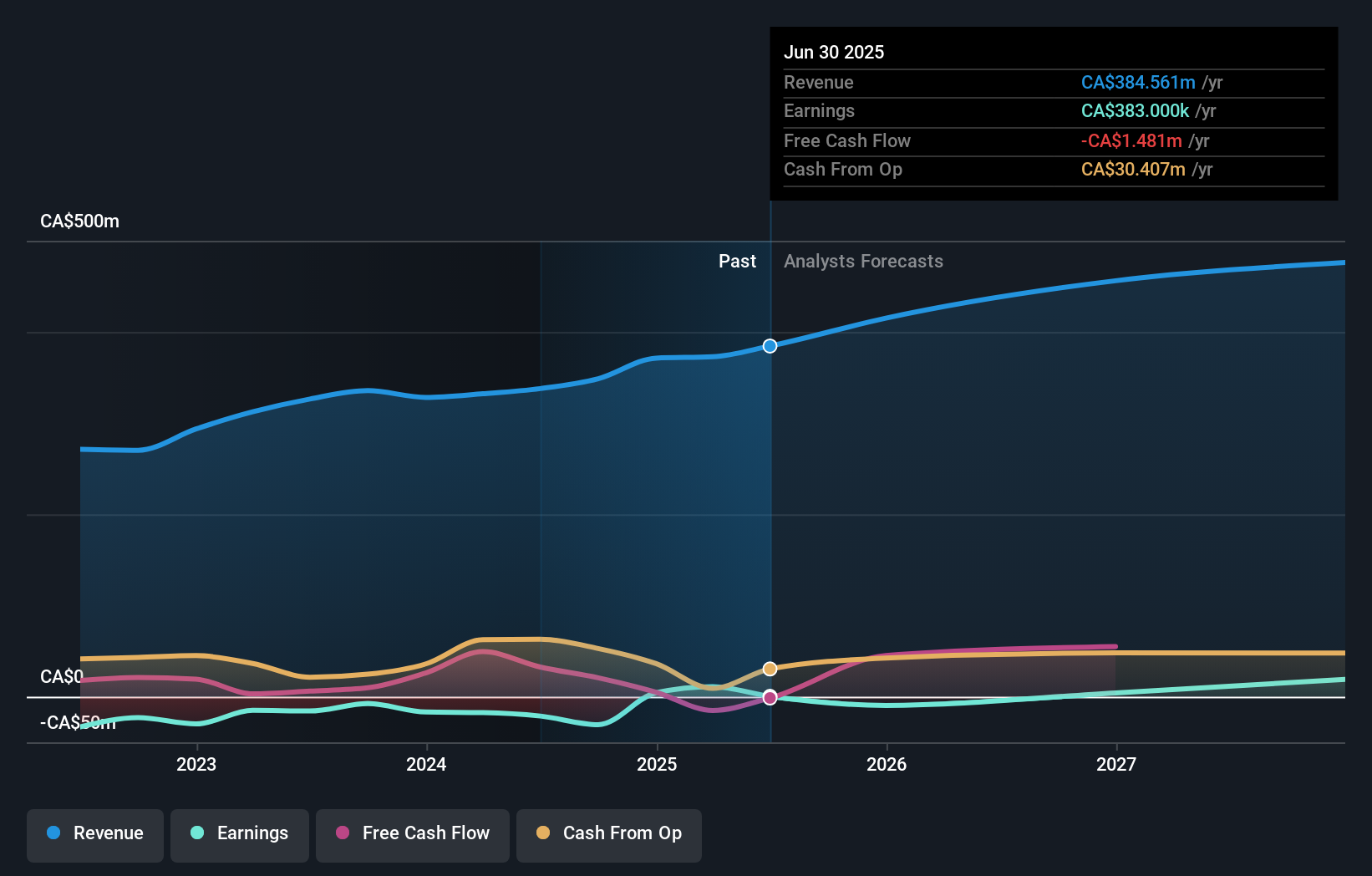

Overview: Knight Therapeutics Inc. is engaged in acquiring, in-licensing, out-licensing, marketing, and commercializing prescription pharmaceutical products in Canada and Latin America with a market cap of CA$607.65 million.

Operations: The company's revenue primarily comes from its pharmaceuticals segment, totaling CA$413.85 million.

Insider Ownership: 22.9%

Knight Therapeutics is positioned for growth with forecasted earnings expansion of 68.18% annually, driven by strategic product launches like JORNAY PM™ and MYFEMBREE® in Canada. Despite a net loss of CAD 3.79 million in Q3 2025, the company anticipates full-year revenues between CAD 430 million and CAD 440 million. The recent USD 100 million credit facility aims to bolster its growth strategy, though challenges include regaining distribution rights for TULSA-PRO® by Profound Medical Corp.

- Delve into the full analysis future growth report here for a deeper understanding of Knight Therapeutics.

- Insights from our recent valuation report point to the potential undervaluation of Knight Therapeutics shares in the market.

VersaBank (TSX:VBNK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VersaBank offers a range of banking products and services in Canada and the United States, with a market cap of CA$528.51 million.

Operations: The company's revenue is primarily derived from Digital Banking Canada, contributing CA$96.56 million, and DRTC, which encompasses cybersecurity services and banking and financial technology development, adding CA$8.83 million.

Insider Ownership: 11.1%

VersaBank demonstrates potential with insiders substantially increasing their holdings over the past three months, reflecting confidence in its growth trajectory. Despite a dip in net income to CAD 6.58 million for Q3 2025, revenue is forecasted to grow at 26.5% annually, outpacing the Canadian market significantly. Recent inclusion in the S&P Global BMI Index highlights its expanding market presence, while share buybacks indicate management's commitment to shareholder value amidst expected robust earnings growth of 71.7% annually.

- Unlock comprehensive insights into our analysis of VersaBank stock in this growth report.

- Our valuation report here indicates VersaBank may be overvalued.

Turning Ideas Into Actions

- Gain an insight into the universe of 47 Fast Growing TSX Companies With High Insider Ownership by clicking here.

- Want To Explore Some Alternatives? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:ACT

Aduro Clean Technologies

Engages in developing water-based chemical recycling technologies.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success