Assessing TD Bank (TSX:TD) Valuation after Recent 12% Share Price Gain

Reviewed by Simply Wall St

Toronto-Dominion Bank (TSX:TD) shares have seen a steady climb over the past 3 months, gaining 12%. Investors are taking a closer look at how the bank’s recent performance lines up with its long-term value and growth outlook.

See our latest analysis for Toronto-Dominion Bank.

Toronto-Dominion’s steady 12% share price gain over the past three months builds on strong momentum, with a remarkable year-to-date share price return of over 50% and a one-year total shareholder return near 54%. Investors seem to be warming to the bank’s resilience and potential as market sentiment improves, even as broader trends in the sector remain at the forefront.

If you’re interested in spotting other potential winners with strong momentum, this could be the perfect time to discover fast growing stocks with high insider ownership

But with recent gains pushing the share price near analyst targets, the key question for investors is whether Toronto-Dominion Bank is still undervalued or if the market has already accounted for its future growth prospects.

Most Popular Narrative: Fairly Valued

Toronto-Dominion Bank’s narrative fair value estimate of CA$113.14 is almost identical to the last closing price of CA$114.93. This suggests the share price now fully reflects analysts’ expectations. The stage is set for investors to dig deeper into the forces behind this consensus view.

Persistent investment in compliance, notably elevated AML remediation, cyber, and fraud prevention costs, is expected to drive higher structural expenses. This may weigh on net margins and overall earnings growth well into 2026 and 2027 as regulatory scrutiny and associated operational costs remain elevated.

Curious about what bold financial forecasts drive this valuation? There is a single critical assumption that stands out. The outlook hinges on shrinking profits and thinner margins, but there is more to the story. Crack open the narrative to see the key numbers analysts are betting on.

Result: Fair Value of $113.14 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, steady gains could be tested if credit losses rise sharply or if U.S. operations struggle to deliver the expected earnings improvements.

Find out about the key risks to this Toronto-Dominion Bank narrative.

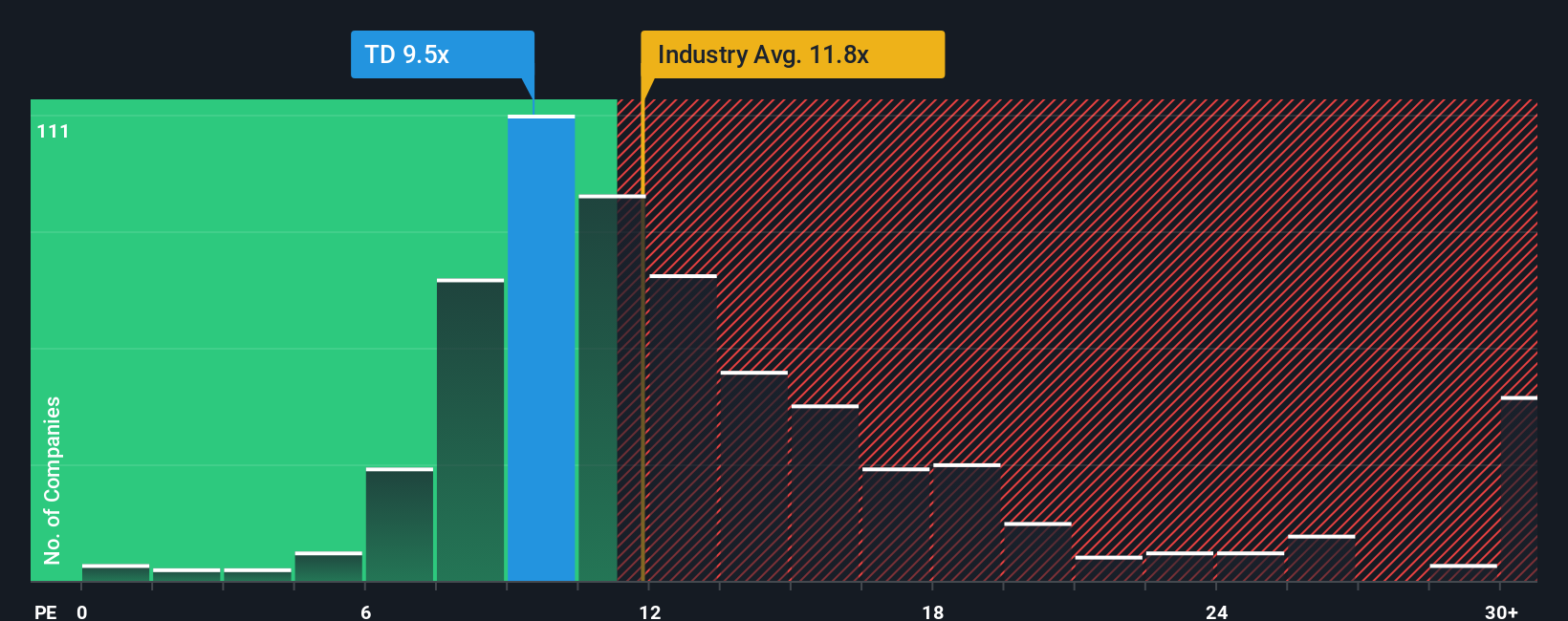

Another View: The Multiples Comparison

Looking at the market’s favored price-to-earnings yardstick, TD’s shares trade at 9.7x, which is well below the peer group at 15.5x and also under the sector’s fair ratio of 11x. This sizable gap could mean the stock is priced with caution, or possibly a hidden opportunity. Which side will the market take next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Toronto-Dominion Bank Narrative

If you see the story through a different lens or want a hands-on look at the data, crafting your own take can take just a few minutes. Do it your way

A great starting point for your Toronto-Dominion Bank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let today’s market leaders overshadow tomorrow’s opportunity. Unlock what’s next by targeting fresh ideas and powerful trends with these proven stock screens:

- Grow your portfolio income and see which companies stand out for consistent payouts by checking out these 18 dividend stocks with yields > 3% with yields above 3%.

- Capitalize on tomorrow’s breakthroughs by searching for potential trailblazers among these 27 AI penny stocks poised to benefit from the AI revolution.

- Tap into explosive potential by spotting these 3588 penny stocks with strong financials with resilient financials and promising upside before the crowd arrives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toronto-Dominion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TD

Toronto-Dominion Bank

Provides various financial products and services in Canada, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives