A Look at RBC (TSX:RY) Valuation Following Prime Rate Cut and Strategic Funding Moves

Reviewed by Simply Wall St

Royal Bank of Canada (TSX:RY) is adjusting its prime rate downward by 25 basis points to 4.45%. This move directly impacts how much the bank's customers pay or earn on loans and deposits.

See our latest analysis for Royal Bank of Canada.

RBC’s decision to trim its prime rate comes on the heels of several large fixed-income offerings and preferred share redemptions this month, all pointing to a deliberate shift in capital strategy. The market appears to be responding positively, with Royal Bank of Canada’s share price building strong momentum, up nearly 16% over the last three months and delivering a standout 24.9% total shareholder return over the past year. This has far outpaced typical TSX bank performance.

If the way RBC is navigating interest rate changes caught your attention, now could be a smart time to broaden your search and discover fast growing stocks with high insider ownership

With RBC’s share price running well ahead of its peers and management actively repositioning the balance sheet, the key question for investors is whether the current valuation leaves room for upside or if expectations for future growth are already reflected in the price.

Most Popular Narrative: 2.7% Undervalued

Royal Bank of Canada's most-followed narrative suggests the shares are trading just below fair value, with a modest gap between the current price and the estimated fair value. This sets the stage for one of the central arguments driving market sentiment right now.

Strategic investments in AI and digitalization, such as the ATOM Foundation and Lumina platform, expanded use of data analytics, and digital banking product launches, are driving cost efficiencies, deeper customer engagement, and higher transaction volumes. These trends are expected to support future revenue and net margin growth.

Want the inside scoop on what powers this valuation call? The real story is built on bold projections for AI-driven efficiency and ambitious margin targets. Dive in to uncover the key financial leaps and operational shifts fueling these analyst forecasts. Do not miss the pivotal details that set this price target apart from the crowd.

Result: Fair Value of $211.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent economic uncertainty and higher credit losses could slow RBC’s growth. These factors pose meaningful risks if market conditions deteriorate unexpectedly.

Find out about the key risks to this Royal Bank of Canada narrative.

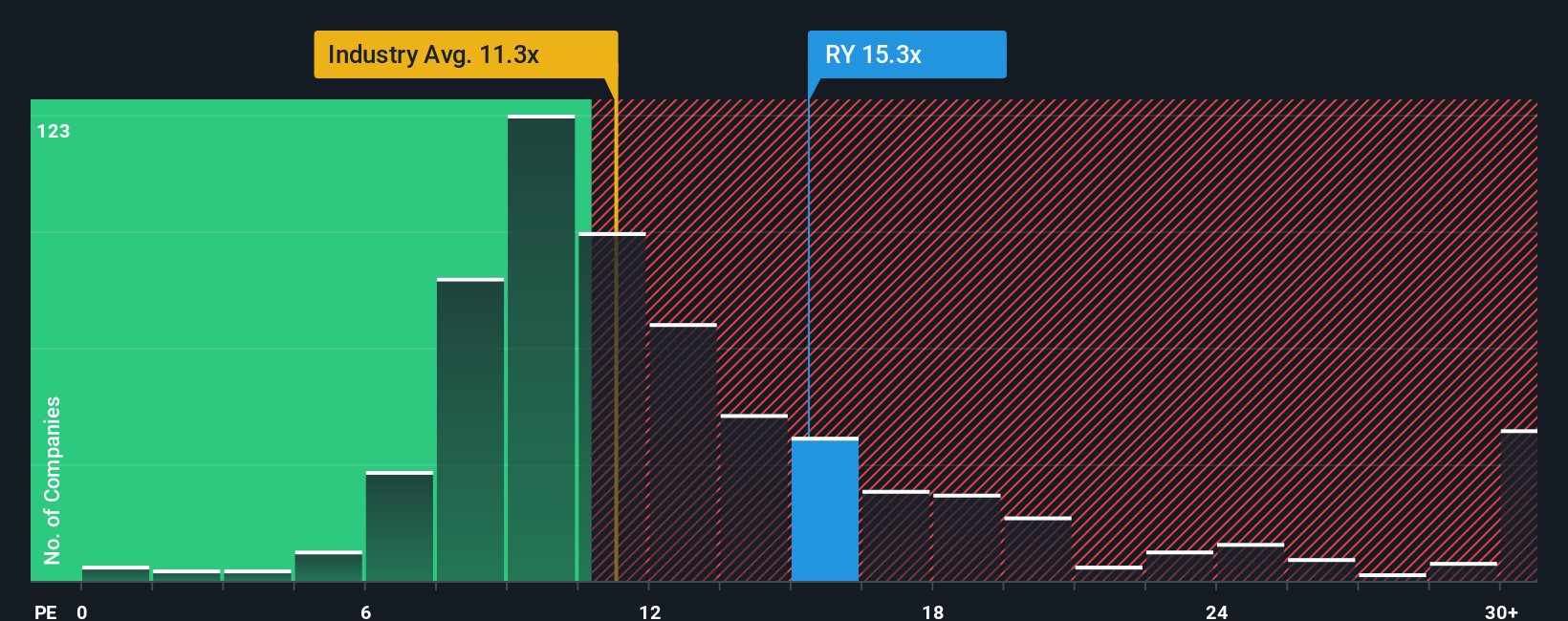

Another View: Multiples Tell a Different Story

Looking through the lens of price-to-earnings, Royal Bank of Canada trades at 15.4 times earnings, which is above both its peer average of 13.9 and the industry average of 11. The fair ratio, estimated at 14, suggests the shares might be priced at a premium. Is the market’s optimism justified, or does this expose investors to valuation risk if expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Royal Bank of Canada Narrative

If you see things differently or want to analyze RBC’s numbers for yourself, you can shape your own view in just a few minutes. Do it your way

A great starting point for your Royal Bank of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Make your next move count. Use the Simply Wall Street Screener to spot unique opportunities that could set your portfolio apart. Don’t let potential winners pass you by.

- Tap into cutting-edge artificial intelligence trends by reviewing these 27 AI penny stocks, which are positioned for long-term growth and innovation.

- Boost your passive income by checking out these 22 dividend stocks with yields > 3%, which offer attractive yields above 3% and strong payout histories.

- Seize potential bargains with these 840 undervalued stocks based on cash flows, currently priced below their fair value based on cash flows and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RY

Royal Bank of Canada

Operates as a diversified financial service company worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives