Is National Bank a Hidden Gem After 29% Surge and Expansion Headlines in 2025?

Reviewed by Bailey Pemberton

- Wondering if National Bank of Canada stock is a bargain, overpriced, or hiding in plain sight? You are not alone in asking, especially if you are tracking the market for value opportunities.

- The stock has climbed an impressive 29.0% year-to-date and boasts a 26.3% gain over the last year. This signals that investors are paying attention to its potential and possibly reassessing its risks.

- Recent headlines have focused on the bank's expansion efforts and its push into new markets, helping to fuel market optimism. Announcements around strategic partnerships are also generating buzz, giving investors fresh reasons to reconsider their outlook on the stock.

- Despite that momentum, National Bank of Canada currently scores just 2 out of 6 on our undervaluation checks. While growth is one part of the story, the real question is how fairly valued the stock is right now. Let us dig into the valuation approaches analysts use, and stay tuned for a smarter way to judge value that goes beyond traditional metrics.

National Bank of Canada scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: National Bank of Canada Excess Returns Analysis

The Excess Returns valuation model measures whether a company can generate returns on its invested capital above its cost of equity, highlighting the value created beyond what investors require as compensation for risk. For National Bank of Canada, this approach is particularly relevant given the steady returns and robust earnings expected by analysts.

Based on the latest forecasts, the bank posts a Book Value of CA$81.03 per share and a stable Earnings Per Share (EPS) of CA$12.26, as projected from the weighted future Return on Equity estimates by 9 analysts. The Cost of Equity is calculated at CA$6.29 per share. The resulting Excess Return, the main component of value in this model, stands at CA$5.98 per share. The bank’s average Return on Equity is 14.15%. In addition, analysts anticipate a Stable Book Value of CA$86.67 per share, reflecting a healthy trajectory for equity growth.

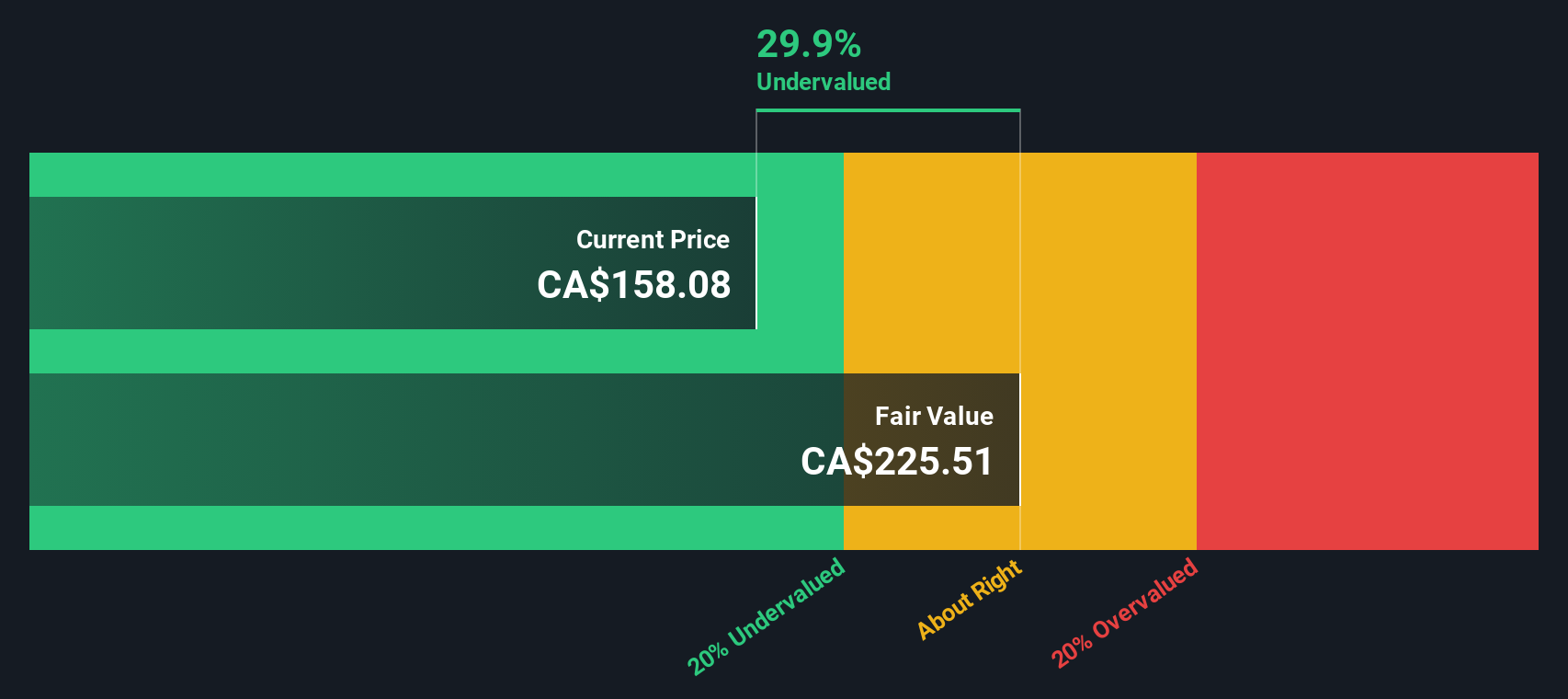

The Excess Returns model estimates National Bank of Canada’s intrinsic value at CA$219.37 per share. With the implied discount from this model at roughly 23.3%, the current market price suggests the stock is undervalued when compared to its intrinsic worth.

Result: UNDERVALUED

Our Excess Returns analysis suggests National Bank of Canada is undervalued by 23.3%. Track this in your watchlist or portfolio, or discover 932 more undervalued stocks based on cash flows.

Approach 2: National Bank of Canada Price vs Earnings

For established, consistently profitable companies like National Bank of Canada, the Price-to-Earnings (PE) ratio is a widely used valuation metric. The PE ratio measures how much investors are willing to pay for each dollar of the company’s earnings, making it straightforward to compare valuation levels across companies and industries.

“Fair” PE ratios can vary significantly depending on expectations for future earnings growth and the risks associated with the business. Typically, higher growth companies or those seen as less risky command higher PE ratios, while slower-growing or riskier firms trade at lower ratios.

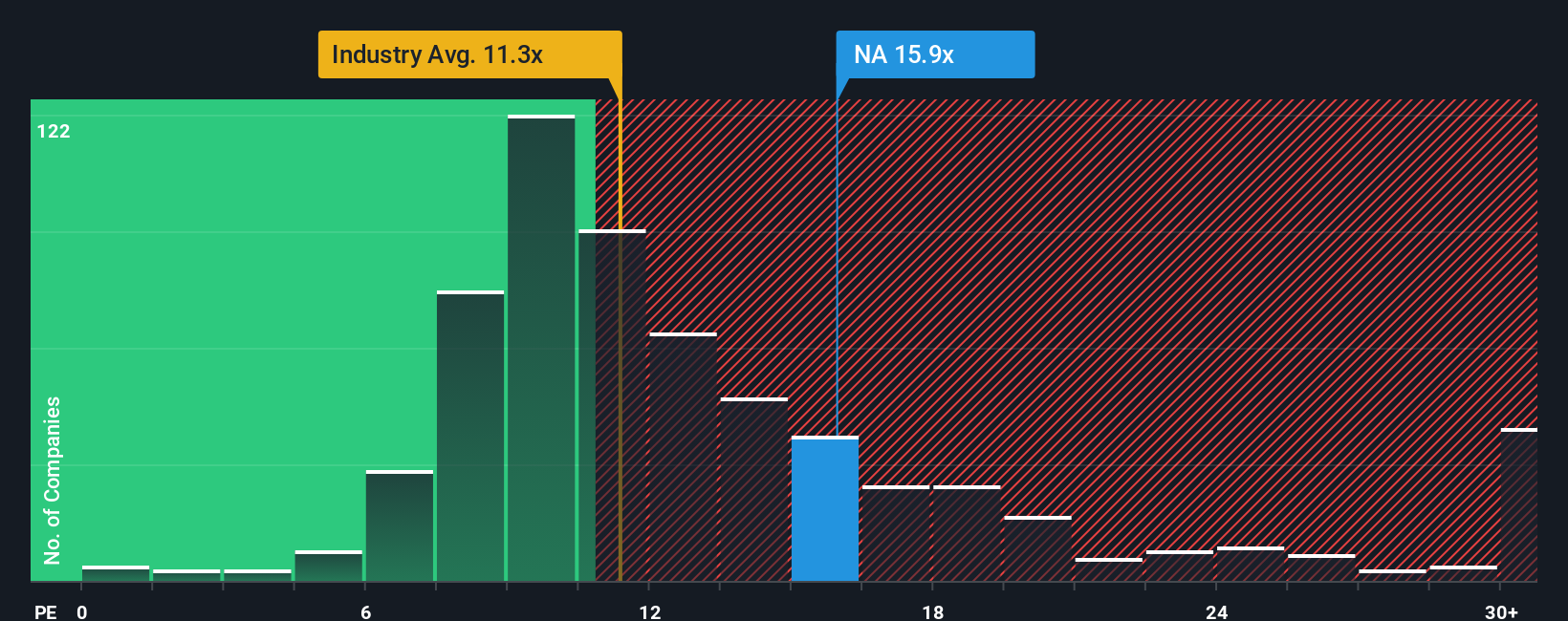

National Bank of Canada is currently trading at a PE ratio of 17.5x. This is above the Canadian banking industry average of 10.4x and the average among its closest peers at 14.3x. While these comparisons are informative, Simply Wall St provides a proprietary “Fair Ratio,” which for National Bank of Canada is calculated at 13.0x. The Fair Ratio is designed to reflect the company’s unique growth prospects, earnings stability, industry dynamics and specific risk profile. Unlike simple industry or peer averages, it provides a more holistic measure of what the market should pay for the stock by factoring in company size, profit margins and anticipated growth.

Given that the current PE ratio of 17.5x is noticeably higher than the Fair Ratio of 13.0x, the stock appears overvalued using this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your National Bank of Canada Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a smarter, more dynamic approach that lets you tell the story behind the numbers by tying together your unique perspective on a company with specific financial forecasts and arriving at your own fair value.

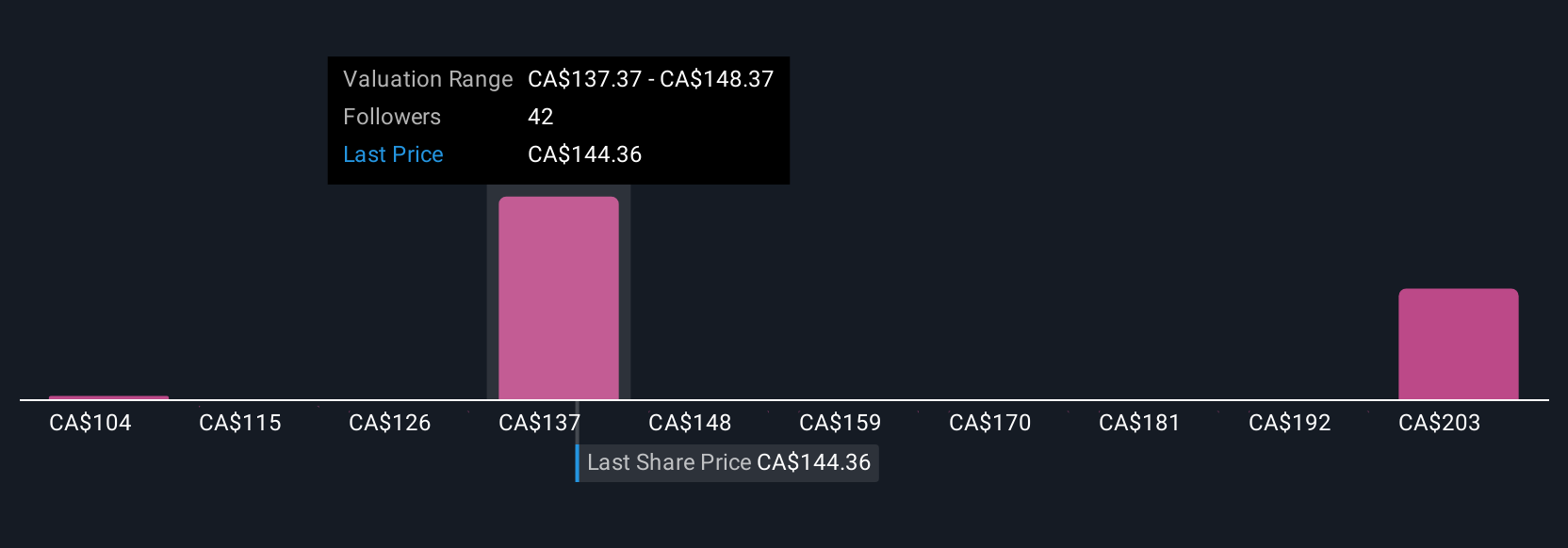

Instead of relying on static ratios, Narratives connect the dots from business strategy and industry trends to future revenue, profit margins, and what you believe the company should be worth. On Simply Wall St’s Community page, millions of investors use Narratives to lay out their logic for when to buy, sell, or hold, using their assumptions about the future and then instantly seeing if price and value are out of step.

What makes Narratives especially powerful is that they update automatically when fresh news or results come in, so your view always keeps pace with reality. For example, some investors might see National Bank of Canada’s expansion and digital investments as a path to stronger earnings and a fair value of CA$166.00 per share, while others, more cautious about risks, set a fair value closer to CA$113.00. Narratives let you and the market see the reasoning behind both perspectives, making it clearer when opportunity or caution makes sense.

Do you think there's more to the story for National Bank of Canada? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Canada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NA

National Bank of Canada

Provides financial services to individuals, businesses, institutional clients, and governments in Canada and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success