Canadian Imperial Bank of Commerce (TSX:CM) Announces $25 Redemption for Series 43 Preferred Shares

Reviewed by Simply Wall St

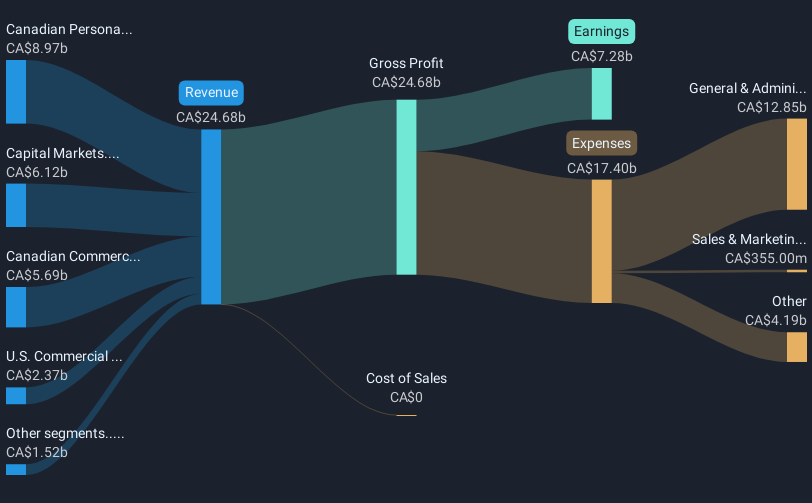

Canadian Imperial Bank of Commerce (TSX:CM) recently announced its intention to redeem all Series 43 preferred shares, which likely supported the company's impressive 18% share price increase over the last quarter. This price movement coincides with the broader market's upward trend, which rose 2% in the past week and 12% over the year. CIBC's strong Q2 earnings, including a substantial rise in both net interest income and net income, further bolstered investor confidence. Ongoing stock buybacks and dividend affirmations might have added weight to the company’s performance relative to market expectations.

The recent announcement by Canadian Imperial Bank of Commerce (TSX:CM) to redeem all Series 43 preferred shares could further enhance investor confidence, adding to the company's robust performance narrative about digital banking expansion and capital market achievements. The decision seems timely, given the company's focus on strengthening client relationships in the mass affluent and private wealth sectors, which may support the company's revenue and earnings forecasts. This development aligns with their strategy to enhance high-margin revenue and operating leverage, which could positively influence future financial results.

Over the last five years, CIBC's total return, including share price and dividends, was 171.23%. This showcases a substantial growth period for the shareholders, emphasizing the bank's strong position in the financial landscape. While the company has exceeded the Canadian Banks industry return of 27% over the past year, the comprehensive five-year return further underscores its long-term potential.

The current share price increase of 18% over the last quarter places it at CA$86.47, closely aligning with the analyst consensus price target of CA$95.64, only a 9.6% higher increment. The recent price surge appears in tandem with strong Q2 earnings, likely affecting the revenue and earnings forecasts. As analysts predict revenue growth to CA$29.9 billion and earnings to CA$9.2 billion by 2028, the price target assumes a PE ratio adjustment, which is lower than the current industry norm. Investors should assess whether this target aligns with their expectations and market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CM

Canadian Imperial Bank of Commerce

A diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives