Canadian Imperial Bank of Commerce (TSE:CM) Ticks All The Boxes When It Comes To Earnings Growth

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Canadian Imperial Bank of Commerce (TSE:CM), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Canadian Imperial Bank of Commerce

Canadian Imperial Bank of Commerce's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Canadian Imperial Bank of Commerce managed to grow EPS by 6.8% per year, over three years. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

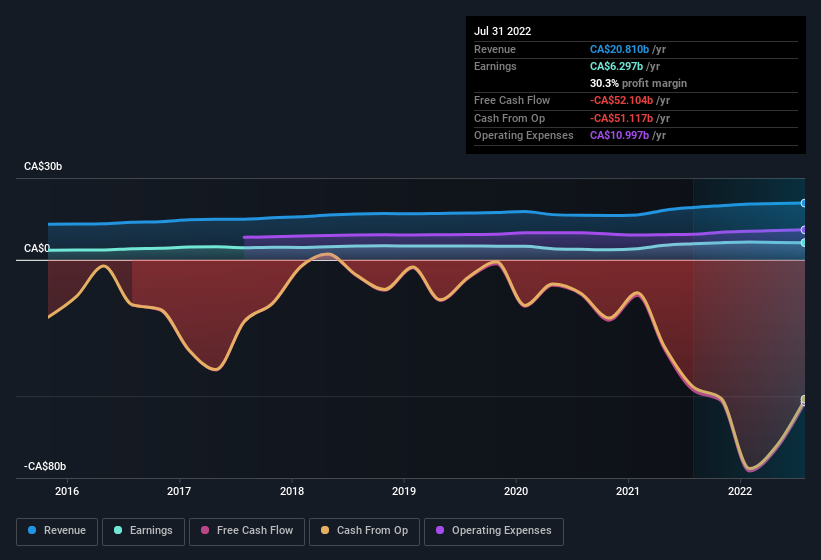

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Canadian Imperial Bank of Commerce's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Canadian Imperial Bank of Commerce maintained stable EBIT margins over the last year, all while growing revenue 8.5% to CA$21b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Canadian Imperial Bank of Commerce's forecast profits?

Are Canadian Imperial Bank of Commerce Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the real excitement comes from the CA$100k that Senior EVP & Group Head of Personal and Business Banking - Canada Laura Dottori-Attanasio spent buying shares (at an average price of about CA$70.00). Purchases like this clue us in to the to the faith management has in the business' future.

The good news, alongside the insider buying, for Canadian Imperial Bank of Commerce bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have CA$25m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.05% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Canadian Imperial Bank of Commerce To Your Watchlist?

One positive for Canadian Imperial Bank of Commerce is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Canadian Imperial Bank of Commerce is trading on a high P/E or a low P/E, relative to its industry.

The good news is that Canadian Imperial Bank of Commerce is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CM

Canadian Imperial Bank of Commerce

A diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.