Sizing Up Scotiabank After Strong 28% Surge and Rebound in Canadian Financials

Reviewed by Bailey Pemberton

Thinking about what to do with Bank of Nova Scotia stock? You’re not alone. Whether you already hold shares or are eyeing them for your portfolio, this is a name that’s sparked plenty of debate lately. The dividend is steady, the brand is trusted, and yet, its valuation story is never quite as simple as it looks at first glance.

Let’s talk about those price moves. Over the last year, the stock has climbed an impressive 27.8%, and year-to-date it’s already up 15.6%. Zoom out to a 5-year view, and you’re looking at returns over 100%. While the past week and month have been pretty quiet—with gains of just 0.5% and 0.4% respectively—the long-term tide has been much more exciting.

So, what’s behind this momentum? For starters, recent market optimism towards Canadian financials has helped shift sentiment for major banks like Bank of Nova Scotia. Investors seem to be reconsidering the risk profile of these stocks, with some speculative bets easing and traditional lenders reasserting their appeal in a changing market landscape. It is a classic case of evolving risk perception meeting solid fundamentals.

But what about value? Here is where things get interesting. According to a standardized valuation assessment, Bank of Nova Scotia is considered undervalued in just 1 out of 6 major checks—a value score of 1. On paper, that might not scream “bargain,” but as you'll see, numbers only tell part of the story. Let’s dig into the different ways analysts assess a bank’s valuation, and then, at the end, I’ll share what I think is the smartest lens for sizing up this stock.

Bank of Nova Scotia scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bank of Nova Scotia Excess Returns Analysis

The Excess Returns model evaluates how effectively a company generates returns on new investments above its cost of capital. In other words, it examines whether Bank of Nova Scotia makes more from its capital than it pays out to equity holders, and if this advantage can persist over time.

For Bank of Nova Scotia, analysts estimate a future average Return on Equity of 12.38%, supported by a stable Book Value of CA$67.45 per share and stable Earnings Per Share (EPS) of CA$7.95. The bank’s projected cost of equity stands at CA$5.37 per share, leading to an excess return of CA$2.58 per share. These forecasts reflect the consensus of nine analysts, grounding the outlook in a breadth of expert opinion. The stable Book Value is forecast to be CA$64.22 per share, reinforcing the view that asset quality remains strong.

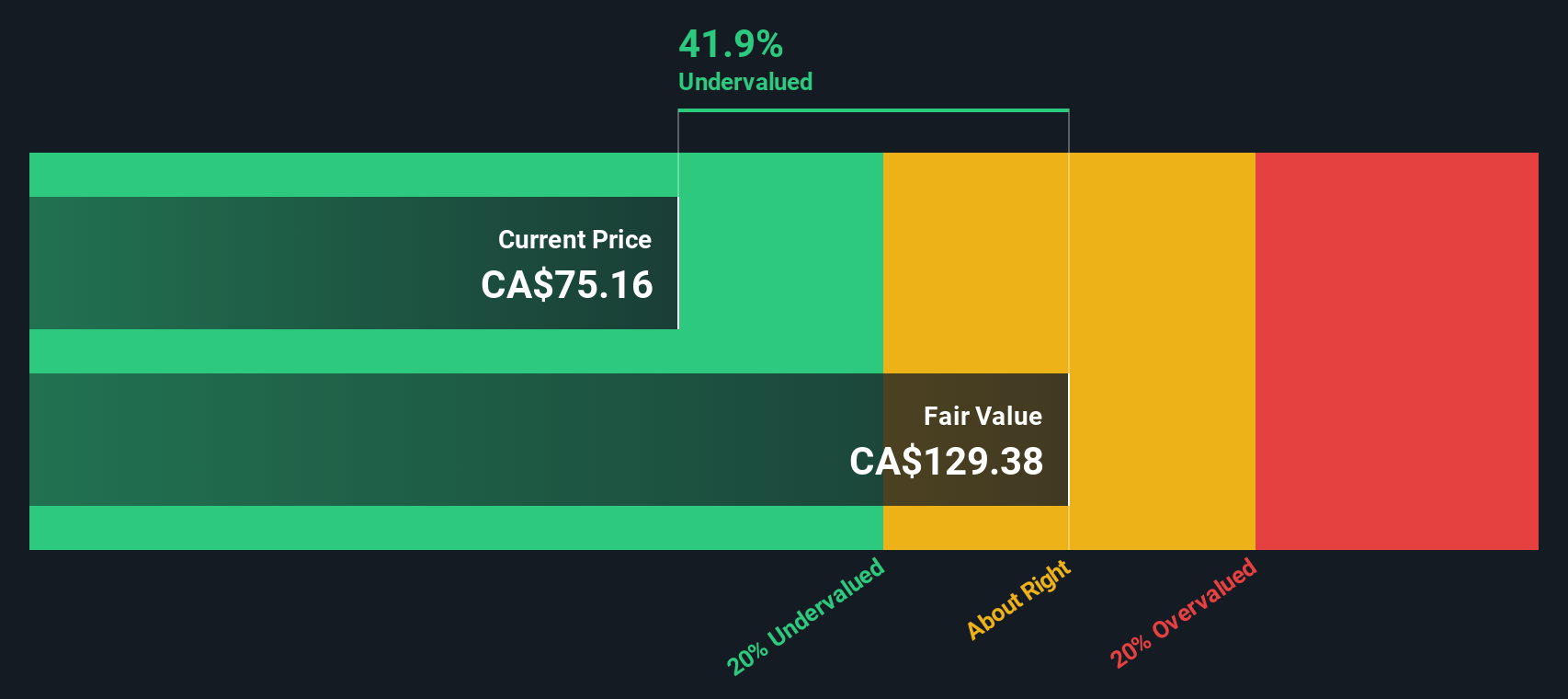

Based on these numbers, the Excess Returns model suggests an intrinsic value for Bank of Nova Scotia stock that is currently around 18.0% higher than its market price. This points to a notable discount and indicates that the stock is undervalued when evaluated on its ability to deliver excess returns to shareholders.

Result: UNDERVALUED

Our Excess Returns analysis suggests Bank of Nova Scotia is undervalued by 18.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bank of Nova Scotia Price vs Earnings

When valuing well-established, profitable companies like Bank of Nova Scotia, the Price-to-Earnings (PE) ratio stands out as a go-to metric. The PE ratio effectively measures how much investors are willing to pay today for a dollar of the company’s earnings, making it particularly relevant for financial institutions with steady profits.

What makes a “normal” PE ratio can vary based on expectations. If a company is forecast to grow rapidly, or if its earnings are perceived as safer than average, investors tend to pay a higher PE. Conversely, lower growth or above-average risks usually mean a lower PE is warranted.

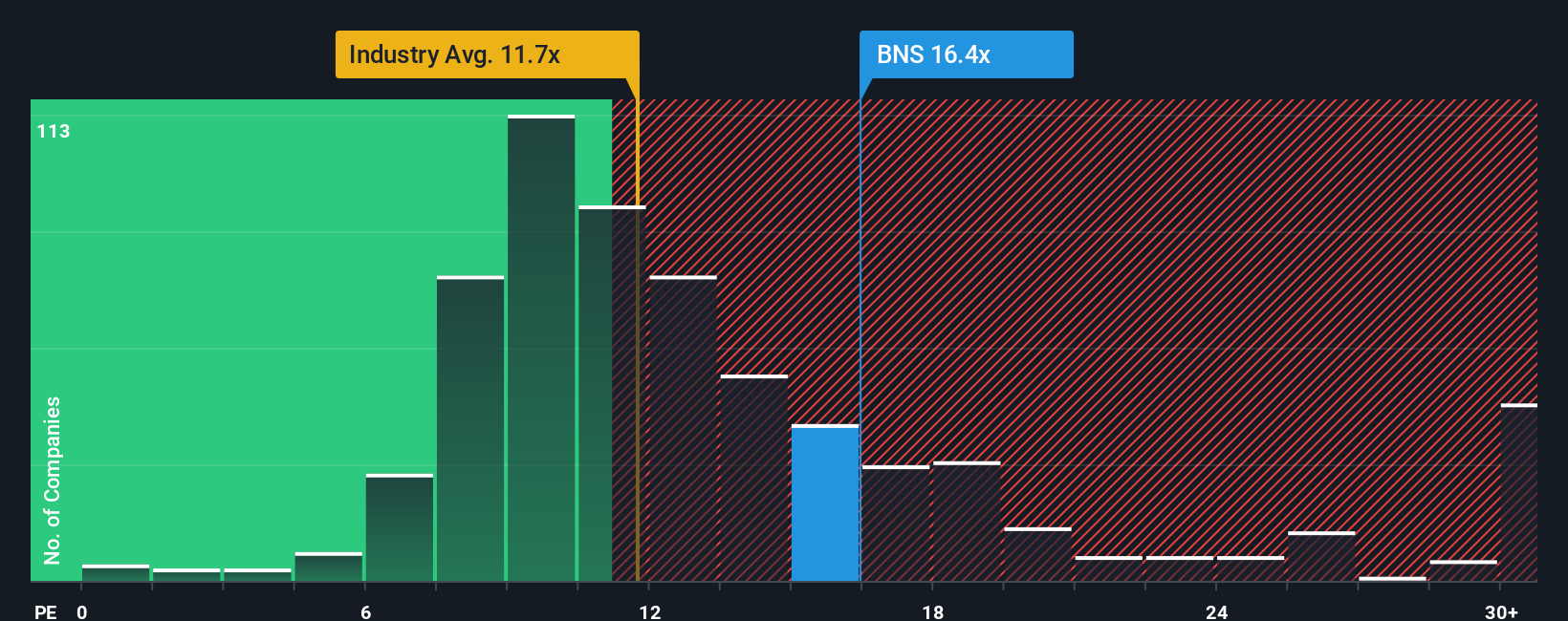

Currently, Bank of Nova Scotia trades at a PE of 16.6x. For context, this is above the average for Canadian banks (10.2x), and above its peer group (13.4x). However, these simple averages can miss nuances like differences in growth prospects or risk exposure between companies.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio for Bank of Nova Scotia is 15.0x, which incorporates not just industry trends and peer performance, but also factors like the company’s unique earnings growth outlook, risk factors, profitability, market cap, and other fundamentals. By balancing all these variables, the Fair Ratio gives a more tailored view than basic peer or industry averages ever could.

Comparing the real-world PE (16.6x) to the Fair Ratio (15.0x) suggests that the stock is trading a little above what would be considered “fair,” but the difference isn’t extreme.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bank of Nova Scotia Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your own story about a company's future, describing how you believe its revenue, earnings, and margins will evolve, paired with your fair value estimate based on those assumptions. Narratives go beyond raw numbers by letting you link your view of Bank of Nova Scotia's business drivers to a realistic financial forecast and a defensible fair value.

This approach is uniquely accessible and interactive on Simply Wall St’s Community page, where millions of investors share their perspectives in real time. Narratives empower you to see exactly where your view matches or differs from others, helping you decide whether to buy, hold, or sell by directly comparing your Fair Value to the current Price.

Unlike static reports, Narratives update dynamically the moment fresh news or earnings are released, ensuring your thesis stays relevant. For example, one investor may focus on Bank of Nova Scotia’s international digital growth and set a fair value near CA$94.0, while another may be cautious about Latin American risks and target CA$78.0. Whichever perspective you take, Narratives make it easy to track your rationale and adapt as the story changes.

Do you think there's more to the story for Bank of Nova Scotia? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives