Scotiabank (TSX:BNS) Valuation in Focus After New Bond Offerings and Agent Transition

Reviewed by Kshitija Bhandaru

Bank of Nova Scotia (TSX:BNS) has been drawing attention after announcing new senior unsecured note offerings and transitions in its bond servicing agents. Investors are watching these moves as potential signals on the bank’s capital strategy.

See our latest analysis for Bank of Nova Scotia.

With the latest moves in its debt offerings and servicing arrangements, Bank of Nova Scotia has stayed largely steady. Momentum is slow, but its 1-year total shareholder return of 0.33% shows a modest edge over the 1-year share price gains. While the broader market narrative continues shifting, these updates keep the focus on how the bank is navigating today’s capital conditions and what that means for long-term value.

If the pulse of banking inspires your search, now might be the perfect time to step back and discover fast growing stocks with high insider ownership

With recent bond activity and steady performance, the question remains: Is Bank of Nova Scotia's current price a bargain for value-seeking investors, or is the market already factoring in the bank's future growth prospects?Most Popular Narrative: 4% Overvalued

With Bank of Nova Scotia's fair value set at CA$87.07 in the most widely followed narrative and the last close at CA$90.87, the consensus points to a slight premium in the market price. This gap places the spotlight on the core business drivers powering future earnings expectations behind the current valuation.

“Strategic expansion in high-growth international markets and focus on digital innovation are set to drive operational efficiency and support robust revenue growth. Emphasis on wealth management, cross-selling, and balance sheet optimization diversifies earnings and strengthens long-term profitability and client relationships.”

Wondering if digital innovation and global ambitions truly justify today's price tag? The narrative’s full calculation relies on major growth assumptions, margin shifts, and a reimagined profit mix. Ready to find out the specific numbers and bold projections that support this market outlook? Start exploring now and see the catalysts the crowd is betting on.

Result: Fair Value of $87.07 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent slow loan growth in Canada or economic turmoil in key Latin American markets could quickly challenge the optimistic outlook for Bank of Nova Scotia.

Find out about the key risks to this Bank of Nova Scotia narrative.

Another View: What Do Multiples Say?

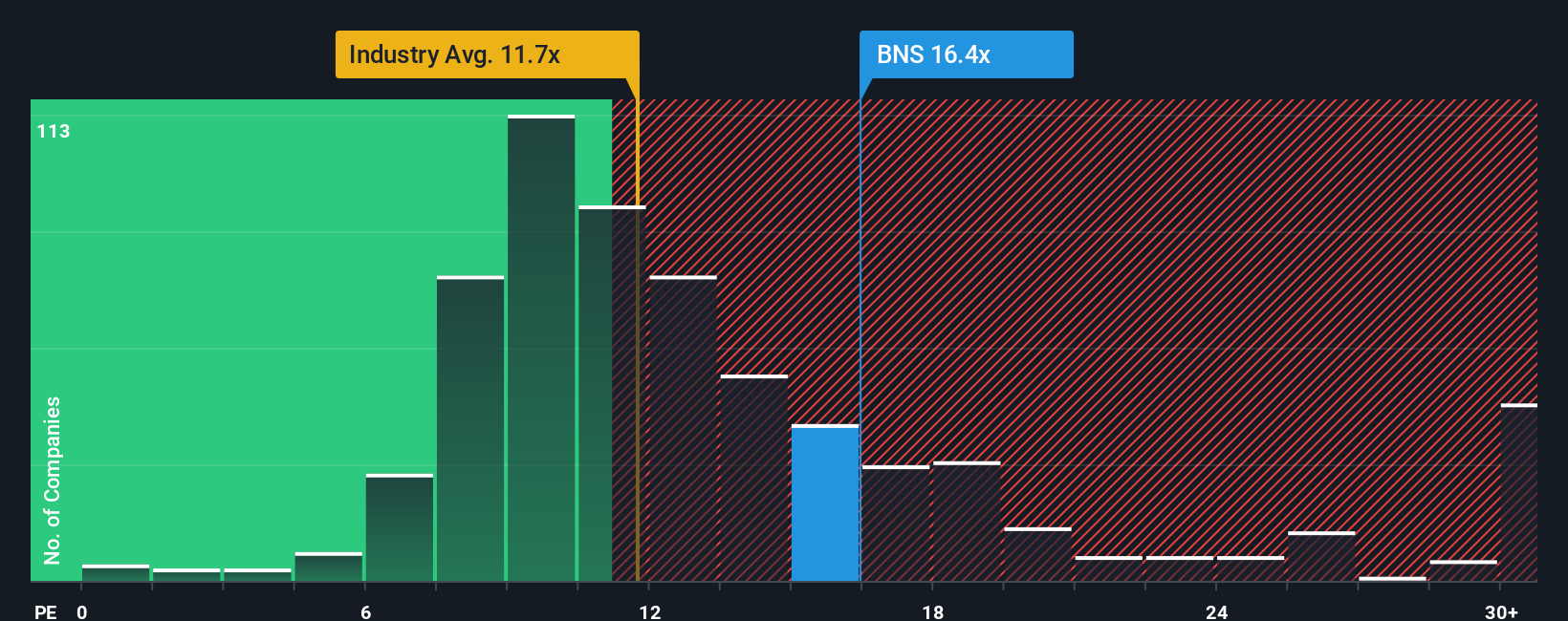

Looking at Bank of Nova Scotia’s valuation through its price-to-earnings ratio offers a different angle. The bank trades at 16.9x earnings, which is noticeably higher than both its industry average of 11.8x and the peer average of 13.5x. The fair ratio, based on our analysis, is 14.8x. This suggests that the market may be pricing in extra optimism or risk.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of Nova Scotia for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of Nova Scotia Narrative

Keep in mind, if you see things differently or want to examine the data firsthand, creating your own perspective takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bank of Nova Scotia.

Looking for more investment ideas?

If you want results that stand out, use the Simply Wall Street Screener to spot opportunities most investors miss and set yourself up for smarter decisions.

- Unlock growth potential from overlooked companies by checking out these 3568 penny stocks with strong financials, featuring businesses on the move with resilience and strong fundamentals.

- Capture high yields and lasting income with these 19 dividend stocks with yields > 3%, a resource highlighting steady performers that deliver above-average dividends year after year.

- Get ahead of innovation trends by exploring these 31 healthcare AI stocks, a category focused on how artificial intelligence is accelerating breakthroughs in health and biotech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026