Is Now The Time To Put Bank of Nova Scotia (TSE:BNS) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Bank of Nova Scotia (TSE:BNS), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Bank of Nova Scotia

How Quickly Is Bank of Nova Scotia Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Bank of Nova Scotia has grown EPS by 6.3% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

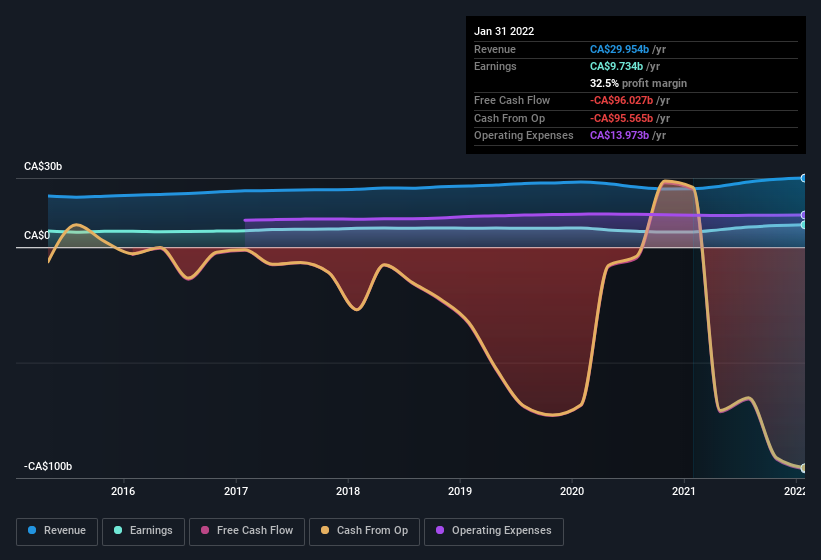

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Bank of Nova Scotia's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Bank of Nova Scotia maintained stable EBIT margins over the last year, all while growing revenue 18% to CA$30b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Bank of Nova Scotia EPS 100% free.

Are Bank of Nova Scotia Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Bank of Nova Scotia shareholders can gain quiet confidence from the fact that insiders shelled out CA$544k to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the Group Head of International Banking & Digital Transformation, Ignacio Deschamps, who made the biggest single acquisition, paying CA$299k for shares at about CA$85.40 each.

On top of the insider buying, it's good to see that Bank of Nova Scotia insiders have a valuable investment in the business. Indeed, they hold CA$30m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.03% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Bank of Nova Scotia To Your Watchlist?

As I already mentioned, Bank of Nova Scotia is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. Now, you could try to make up your mind on Bank of Nova Scotia by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Bank of Nova Scotia, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion