A Look at Bank of Montreal (TSX:BMO) Valuation After Recent 12% Share Price Rise

Reviewed by Simply Wall St

Bank of Montreal (TSX:BMO) shares have been catching the eye of investors after a string of moderate gains in recent weeks. The stock has risen about 12% over the past 3 months, reflecting renewed interest across the Canadian banking sector.

See our latest analysis for Bank of Montreal.

Momentum has been picking up for Bank of Montreal, as a series of solid gains pushed its share price up more than 12% over the last 90 days. Looking at the bigger picture, the bank has delivered a robust total shareholder return of 41% over the past year, which has helped to restore confidence after a more muted period for Canadian financials.

If sustained results from big banks have you rethinking your watchlist, this is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

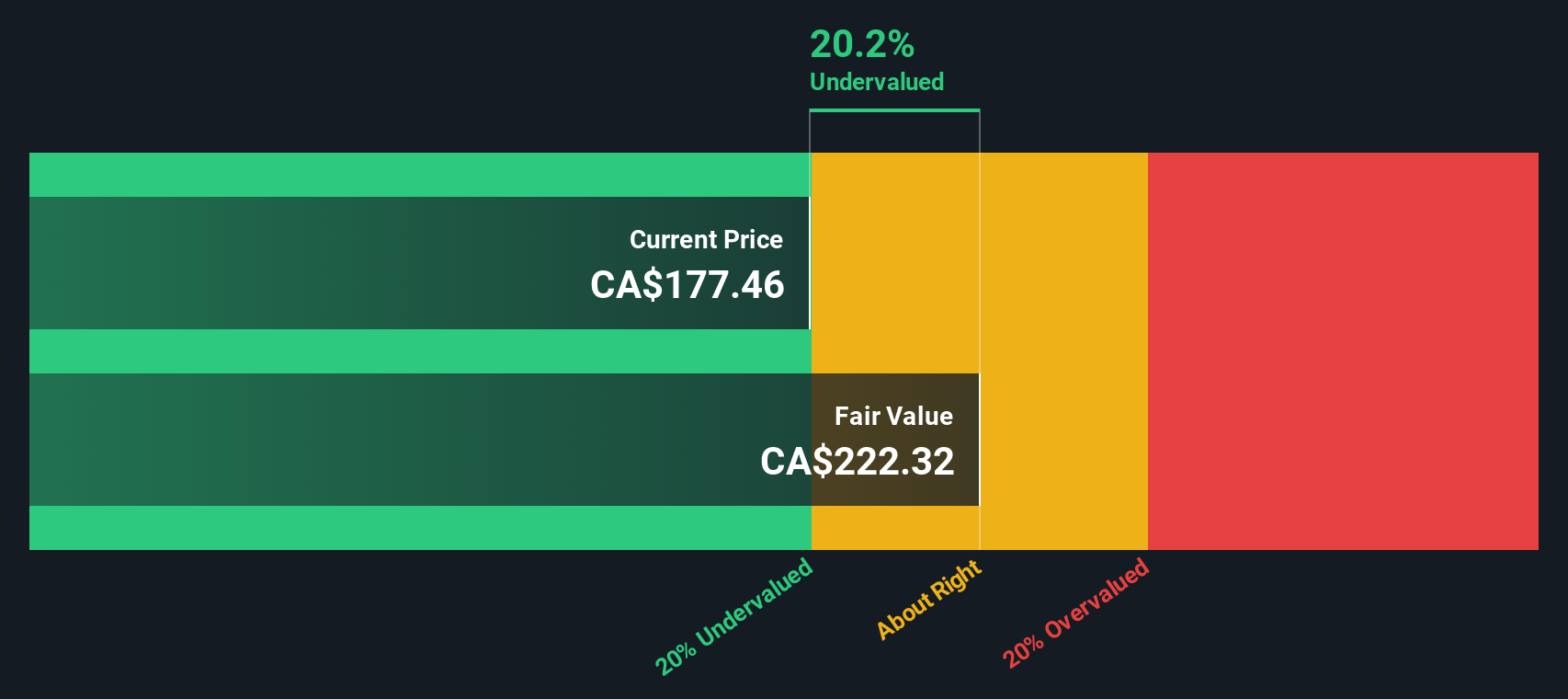

But after this impressive run, the key question is whether Bank of Montreal shares still have room to climb. Is the stock trading below its true value, or is the market already pricing in the bank’s future growth potential?

Most Popular Narrative: 3% Overvalued

Bank of Montreal’s most widely watched narrative sees its fair value coming in just below the latest closing price. This suggests that current optimism may already be priced in, leaving little margin for upside, unless future growth or profitability surprises to the upside.

BMO's continued investment in digital and AI-powered banking platforms, such as the LUMI Assistant and multiple award-winning payment innovations, is improving operational efficiency and customer engagement, which should drive increased net margins and persistently positive operating leverage.

What bold financial projections drive this tight valuation gap? The heart of this narrative is a series of ambitious targets for future profits and margin shifts, all hinging on rapid execution and market expansion. Want to uncover exactly which numbers tip the scale? Dive in to see what gives this fair value its edge.

Result: Fair Value of $171 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing credit risks or a slowdown in economic growth could quickly change the outlook and challenge BMO’s steady trajectory of earnings expansion.

Find out about the key risks to this Bank of Montreal narrative.

Another View: Discounted Cash Flow Signals Hidden Value

While analysts' price targets and earnings multiples suggest Bank of Montreal is slightly overvalued, our SWS DCF model presents a different perspective. Based on projected cash flows, BMO shares currently trade at a steep 27% discount to fair value, indicating possible overlooked upside. Can this value gap persist, or will the market recognize the opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of Montreal for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of Montreal Narrative

If you think there’s more to the story, or want to run the numbers your own way, it’s easy to generate a personalized narrative in just minutes. Do it your way

A great starting point for your Bank of Montreal research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Investment Opportunities?

Unlock your next move with handpicked stock ideas tailored to what matters most in today’s markets. You don’t want to let these standout trends pass you by.

- Pinpoint high-potential growth by scanning these 883 undervalued stocks based on cash flows, which delivers real value off the market’s radar.

- Seize your share of innovation with these 27 quantum computing stocks as it powers advances in quantum computing and the new tech frontier.

- Accelerate your returns by tracking these 14 dividend stocks with yields > 3%, offering steady income and robust dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Montreal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BMO

Bank of Montreal

Engages in the provision of diversified financial services primarily in North America.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives