Exco Technologies Limited (TSE:XTC) will pay a dividend of CA$0.105 on the 30th of September. Based on this payment, the dividend yield on the company's stock will be 4.8%, which is an attractive boost to shareholder returns.

Check out our latest analysis for Exco Technologies

Exco Technologies' Earnings Easily Cover The Distributions

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, Exco Technologies was paying out a fairly large proportion of earnings, and it wasn't generating positive free cash flows either. This is a pretty unsustainable practice, and could be risky if continued for the long term.

The next year is set to see EPS grow by 72.2%. If the dividend continues along recent trends, we estimate the payout ratio will be 49%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

Exco Technologies Has A Solid Track Record

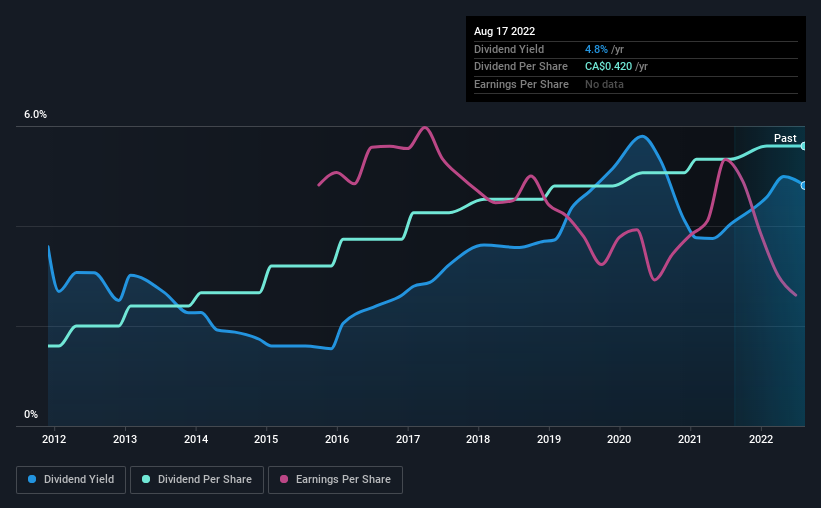

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from an annual total of CA$0.12 in 2012 to the most recent total annual payment of CA$0.42. This works out to be a compound annual growth rate (CAGR) of approximately 13% a year over that time. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Let's not jump to conclusions as things might not be as good as they appear on the surface. Earnings per share has been sinking by 13% over the last five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

The Dividend Could Prove To Be Unreliable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Exco Technologies' payments, as there could be some issues with sustaining them into the future. Although they have been consistent in the past, we think the payments are a little high to be sustained. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 2 warning signs for Exco Technologies that investors need to be conscious of moving forward. Is Exco Technologies not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Exco Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:XTC

Exco Technologies

Designs, develops, manufactures, and sells dies, molds, components and assemblies, and consumable equipment for the die-cast, extrusion, and automotive industries.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion