- Canada

- /

- Auto Components

- /

- TSX:MRE

Here's Why We Think Martinrea International (TSE:MRE) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Martinrea International (TSE:MRE). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Martinrea International

How Fast Is Martinrea International Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It is awe-striking that Martinrea International's EPS went from CA$0.30 to CA$2.26 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Martinrea International is growing revenues, and EBIT margins improved by 4.2 percentage points to 5.8%, over the last year. Both of which are great metrics to check off for potential growth.

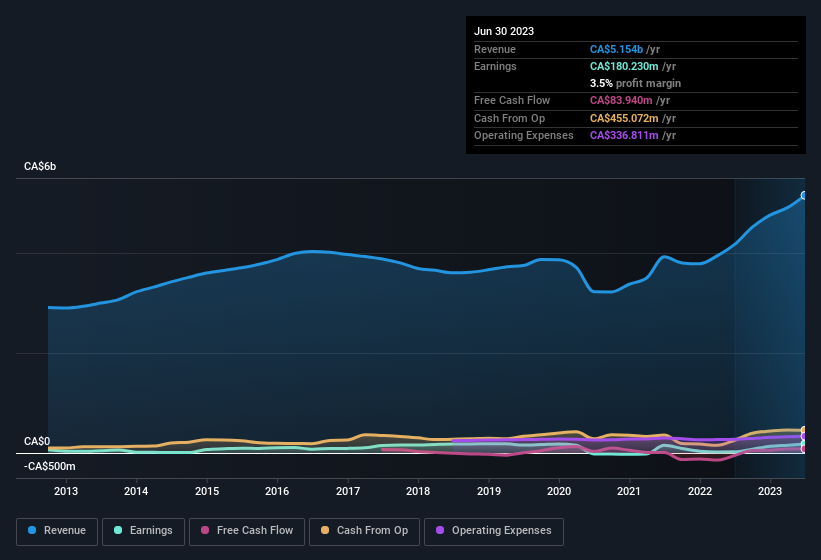

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Martinrea International's future profits.

Are Martinrea International Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The CA$17k worth of shares that insiders sold during the last 12 months pales in comparison to the CA$1.1m they spent on acquiring shares in the company. We find this encouraging because it suggests they are optimistic about Martinrea International'sfuture. We also note that it was the President, Frank D'Eramo, who made the biggest single acquisition, paying CA$207k for shares at about CA$13.77 each.

The good news, alongside the insider buying, for Martinrea International bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have CA$20m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 1.9%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does Martinrea International Deserve A Spot On Your Watchlist?

Martinrea International's earnings per share growth have been climbing higher at an appreciable rate. What's more, insiders own a significant stake in the company and have been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Martinrea International belongs near the top of your watchlist. Even so, be aware that Martinrea International is showing 1 warning sign in our investment analysis , you should know about...

The good news is that Martinrea International is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MRE

Martinrea International

Engages in the design, development, manufacture, and sale of engineered, value-added lightweight structures, and propulsion systems for automotive sector in North America, Europe, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives