- Canada

- /

- Auto Components

- /

- TSX:MG

Magna International (TSX:MG) Sees Strong Q2 Sales and Strategic Cost Management, Signals Potential Growth

Reviewed by Simply Wall St

Delve into the full analysis report here for a deeper understanding of Magna International.

Strengths: Core Advantages Driving Sustained Success For Magna International

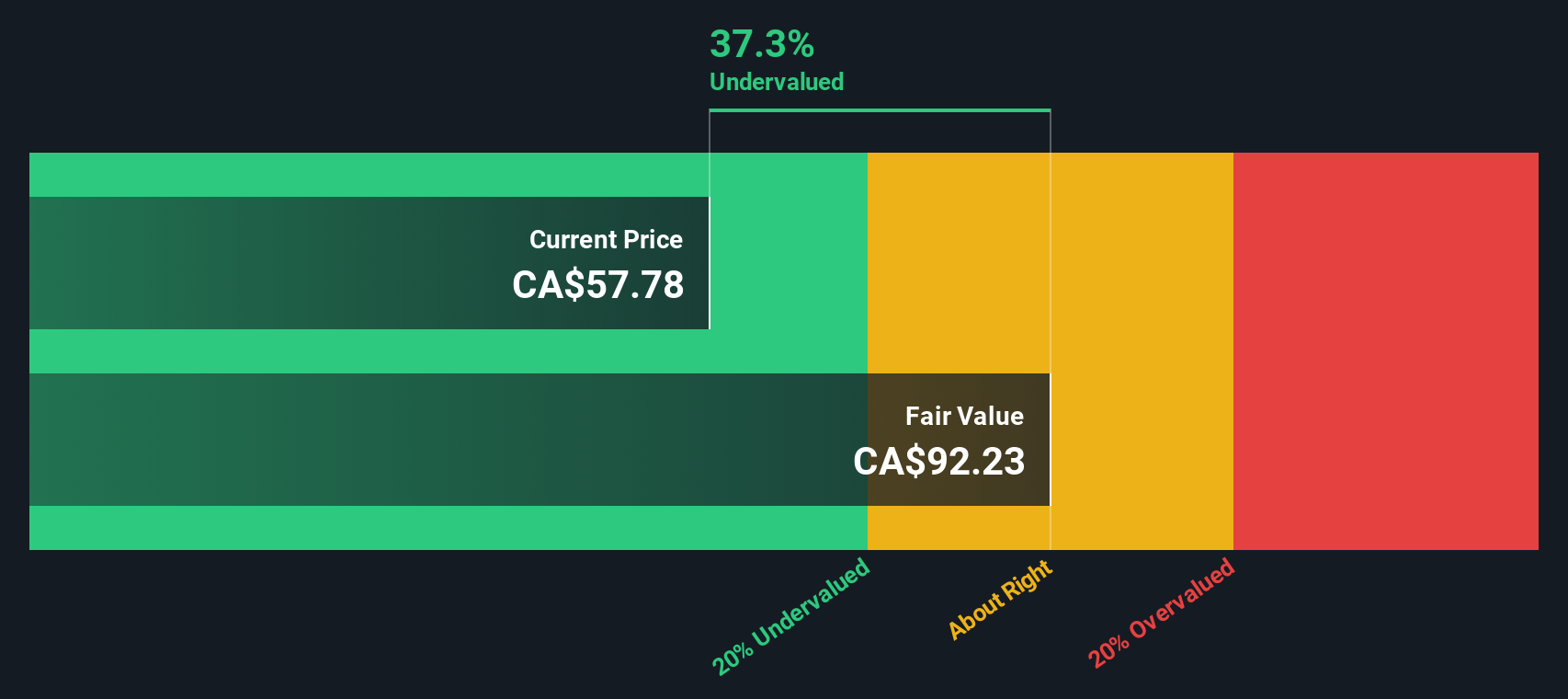

Magna International has demonstrated robust sales and margin performance, with Q2 sales reaching $11 billion and an adjusted EBIT margin of 5.3%, as highlighted by CEO Swamy Kotagiri. The company's operational excellence initiatives are on track to contribute approximately 75 basis points to margin expansion during 2024 and 2025. Additionally, Magna's strategic cost management efforts have led to further reductions in expected CapEx by $100 million, totaling up to $200 million for 2024. The company is also maintaining a strong cash flow outlook, with a range of $600 million to $800 million. Notably, Magna's acquisition of HE Systems for $52 million is expected to accelerate the development of power modules, enhancing its product offerings. Furthermore, the company is currently trading at CA$56.96, which is significantly below its estimated fair value of CA$334.08, indicating potential undervaluation.

Weaknesses: Critical Issues Affecting Magna's Performance and Areas For Growth

Magna International faces several financial challenges, including a decline in its adjusted EBIT margin by 30 basis points to 5.3%, as noted by CFO Patrick McCann. The company's adjusted EPS also decreased by 12% year-over-year, reflecting lower EBIT and higher interest expenses. On an organic basis, sales decreased by 1% year-over-year, indicating a minus 1% growth over the market in the second quarter. Additionally, the company's interest expense increased by $20 million due to higher short-term borrowings and net debt raised. Despite these challenges, Magna's Price-To-Earnings Ratio of 12.3x is higher compared to its peers' average of 9x, suggesting it may be expensive relative to its direct competitors.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Magna International has several opportunities to enhance its market position and capitalize on emerging trends. The company is winning business on key programs across its portfolio, as emphasized by CEO Swamy Kotagiri. Innovation in product offerings is another significant opportunity, with successful commercialization efforts underway. Magna is also making progress on vertical integration of critical subsystems, which is expected to strengthen its product offerings. Additionally, the company is driving engineering spend reductions for 2026 of up to $200 million while ensuring continued investment in future priorities. These strategic initiatives are expected to support Magna's forecasted earnings growth of 19.35% per year, outpacing the Canadian market's expected growth of 14.9% per year.

Threats: Key Risks and Challenges That Could Impact Magna's Success

Magna International faces several external threats that could impact its growth and market share. The company is experiencing slower BEV adoption than anticipated, particularly in North America, which could affect its sales expectations. OEM recalibrations, resulting in program delays or cancellations and reduced volumes, pose additional risks. Competition from Chinese OEMs in the Chinese market also presents a significant challenge. Economic uncertainty further complicates the outlook, with three broad categories impacting Magna's 2026 sales expectations. These factors highlight the need for the company to navigate a complex and evolving market landscape to maintain its competitive edge.

Conclusion

Magna International's strong sales and margin performance, combined with strategic cost management and operational excellence initiatives, position the company for future growth. Despite challenges such as declining EBIT margins and increased interest expenses, the company's focus on innovation and vertical integration offers significant opportunities to enhance its market position. The current share price of CA$56.96, which is significantly below the estimated fair value of CA$334.08, suggests that the market may be underestimating Magna's potential. This discrepancy indicates a promising outlook for investors, as the company is well-equipped to navigate external threats and capitalize on emerging trends to drive sustained success.

Seize The Opportunity

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:MG

Magna International

Manufactures and supplies vehicle engineering, contract, and automotive space.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives