- Canada

- /

- Auto Components

- /

- TSX:MG

Here's Why Magna International (TSE:MG) Can Manage Its Debt Responsibly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Magna International Inc. (TSE:MG) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View 1 warning sign we detected for Magna International

How Much Debt Does Magna International Carry?

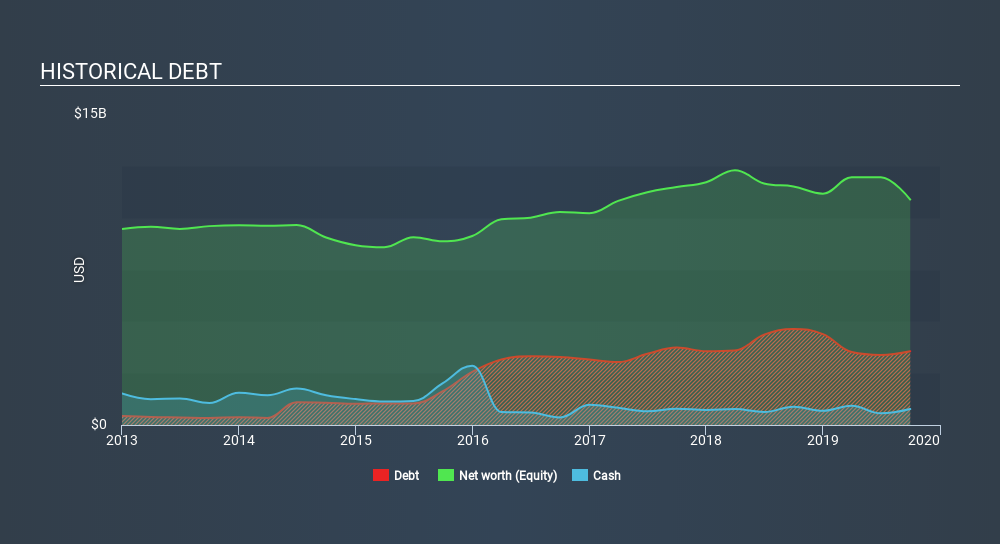

As you can see below, Magna International had US$3.56b of debt at September 2019, down from US$4.63b a year prior. However, it does have US$769.0m in cash offsetting this, leading to net debt of about US$2.79b.

How Strong Is Magna International's Balance Sheet?

According to the last reported balance sheet, Magna International had liabilities of US$9.52b due within 12 months, and liabilities of US$5.92b due beyond 12 months. On the other hand, it had cash of US$769.0m and US$7.09b worth of receivables due within a year. So it has liabilities totalling US$7.58b more than its cash and near-term receivables, combined.

This deficit isn't so bad because Magna International is worth a massive US$16.8b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Magna International's net debt is only 0.69 times its EBITDA. And its EBIT easily covers its interest expense, being 28.2 times the size. So we're pretty relaxed about its super-conservative use of debt. On the other hand, Magna International's EBIT dived 13%, over the last year. If that rate of decline in earnings continues, the company could find itself in a tight spot. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 1 warning sign for Magna International which any shareholder or potential investor should be aware of.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, Magna International recorded free cash flow worth 73% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Magna International's interest cover was a real positive on this analysis, as was its conversion of EBIT to free cash flow. In contrast, our confidence was undermined by its apparent struggle to grow its EBIT. When we consider all the elements mentioned above, it seems to us that Magna International is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Magna International insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:MG

Magna International

Manufactures and supplies vehicle engineering, contract, and automotive space.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives