- Canada

- /

- Auto Components

- /

- TSX:MG

Does Magna International's (TSE:MG) Share Price Gain of 33% Match Its Business Performance?

By buying an index fund, investors can approximate the average market return. But if you pick the right individual stocks, you could make more than that. For example, Magna International Inc. (TSE:MG) shareholders have seen the share price rise 33% over three years, well in excess of the market return (7.0%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 11% , including dividends .

View our latest analysis for Magna International

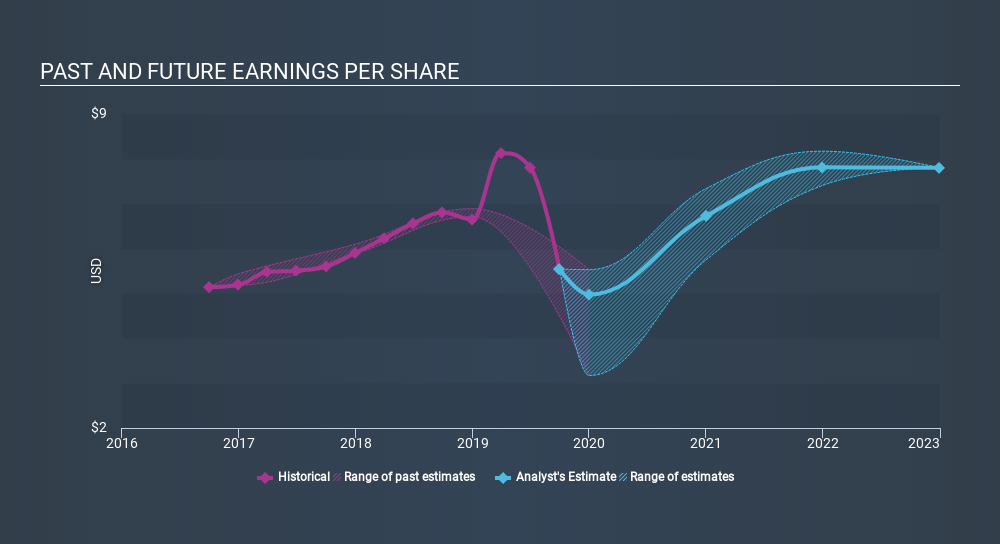

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Magna International was able to grow its EPS at 2.5% per year over three years, sending the share price higher. In comparison, the 10% per year gain in the share price outpaces the EPS growth. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. It is quite common to see investors become enamoured with a business, after a few years of solid progress.

You can see below how EPS has changed over time.

It might be well worthwhile taking a look at our free report on Magna International's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Magna International's TSR for the last 3 years was 44%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Magna International shareholders gained a total return of 11% during the year. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 6.0% per year over five year. This suggests the company might be improving over time. If you would like to research Magna International in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:MG

Magna International

Manufactures and supplies vehicle engineering, contract, and automotive space.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026