- Canada

- /

- Auto Components

- /

- TSX:LNR

Linamar's (TSE:LNR) Shareholders Will Receive A Bigger Dividend Than Last Year

Linamar Corporation (TSE:LNR) will increase its dividend from last year's comparable payment on the 6th of June to CA$0.29. Although the dividend is now higher, the yield is only 1.9%, which is below the industry average.

We've discovered 2 warning signs about Linamar. View them for free.Linamar's Future Dividend Projections Appear Well Covered By Earnings

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. However, prior to this announcement, Linamar's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

Unless the company can turn things around, EPS could fall by 5.7% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could be 29%, which we are pretty comfortable with and we think is feasible on an earnings basis.

View our latest analysis for Linamar

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The annual payment during the last 10 years was CA$0.40 in 2015, and the most recent fiscal year payment was CA$1.16. This works out to be a compound annual growth rate (CAGR) of approximately 11% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Dividend Growth Is Doubtful

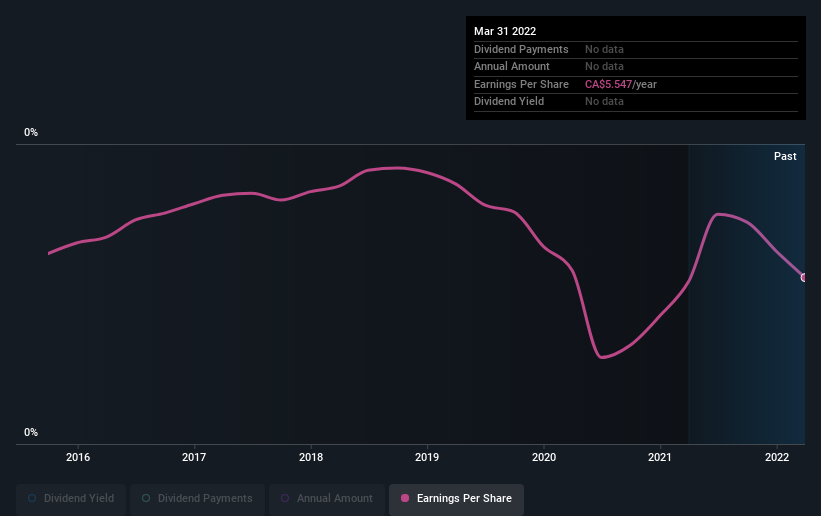

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Linamar has seen earnings per share falling at 5.7% per year over the last five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

Our Thoughts On Linamar's Dividend

Overall, we always like to see the dividend being raised, but we don't think Linamar will make a great income stock. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 2 warning signs for Linamar that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:LNR

Linamar

Manufactures and sells engineered products in Canada, Europe, the Asia Pacific, and rest of North America.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion