- Brazil

- /

- Renewable Energy

- /

- BOVESPA:SRNA3

Some Confidence Is Lacking In Serena Energia S.A.'s (BVMF:SRNA3) P/S

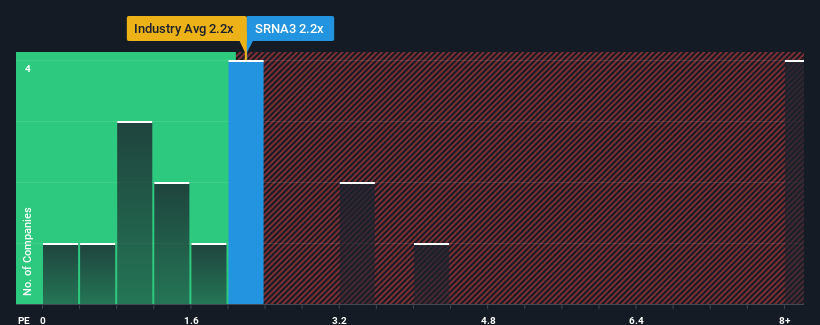

It's not a stretch to say that Serena Energia S.A.'s (BVMF:SRNA3) price-to-sales (or "P/S") ratio of 2.2x right now seems quite "middle-of-the-road" for companies in the Renewable Energy industry in Brazil, where the median P/S ratio is around 2.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Serena Energia

What Does Serena Energia's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Serena Energia has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Serena Energia will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Serena Energia would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The amazing performance means it was also able to grow revenue by 167% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 25% as estimated by the five analysts watching the company. Meanwhile, the broader industry is forecast to moderate by 9.8%, which indicates the company should perform poorly indeed.

In light of this, it's somewhat peculiar that Serena Energia's P/S sits in line with the majority of other companies. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Serena Energia's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Serena Energia's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. In addition, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. A positive change is needed in order to justify the current price-to-sales ratio.

Before you settle on your opinion, we've discovered 5 warning signs for Serena Energia (2 can't be ignored!) that you should be aware of.

If you're unsure about the strength of Serena Energia's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:SRNA3

Moderate growth potential with low risk.

Market Insights

Community Narratives