- Brazil

- /

- Renewable Energy

- /

- BOVESPA:RNEW11

Renova Energia (BVMF:RNEW11) shareholders are up 11% this past week, but still in the red over the last five years

Renova Energia S.A. (BVMF:RNEW11) shareholders should be happy to see the share price up 24% in the last quarter. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Like a ship taking on water, the share price has sunk 70% in that time. So we don't gain too much confidence from the recent recovery. The million dollar question is whether the company can justify a long term recovery.

The recent uptick of 11% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Renova Energia

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Renova Energia moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

In contrast to the share price, revenue has actually increased by 11% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

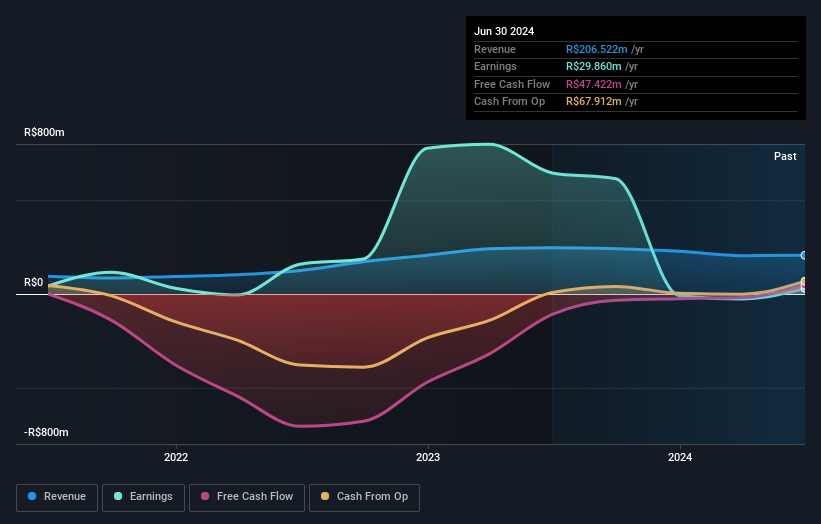

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 14% in the last year, Renova Energia shareholders lost 2.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Renova Energia (at least 1 which is significant) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:RNEW11

Renova Energia

Operates as a renewable energy generation company in Brazil.

Slight risk and slightly overvalued.

Market Insights

Community Narratives