- Brazil

- /

- Electric Utilities

- /

- BOVESPA:LIGT3

Light S.A. (BVMF:LIGT3) Not Doing Enough For Some Investors As Its Shares Slump 28%

Light S.A. (BVMF:LIGT3) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. The recent drop has obliterated the annual return, with the share price now down 3.6% over that longer period.

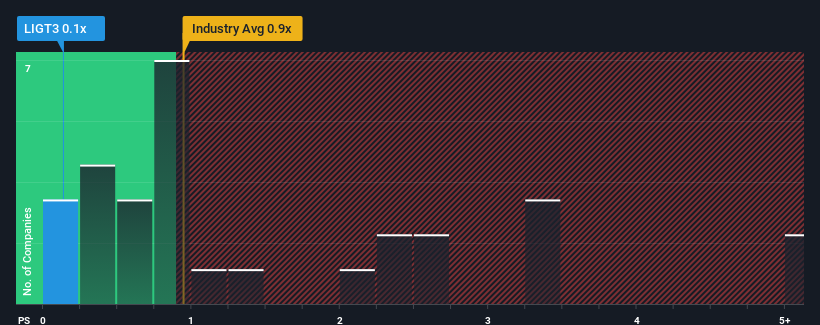

After such a large drop in price, Light may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Electric Utilities industry in Brazil have P/S ratios greater than 0.9x and even P/S higher than 3x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Light

How Has Light Performed Recently?

Light could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Light.How Is Light's Revenue Growth Trending?

In order to justify its P/S ratio, Light would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.1%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 1.4% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company are not good at all, suggesting revenue should decline by 6.3% over the next year. The industry is also set to see revenue decline 3.6% but the stock is shaping up to perform materially worse.

In light of this, it's understandable that Light's P/S sits below the majority of other companies. Nonetheless, with revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares heavily.

The Final Word

The southerly movements of Light's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Light's analyst forecasts revealed that its even shakier outlook against the industry is contributing factor to why its P/S is so low. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. However, we're still cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. In the meantime, unless the company's prospects improve they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Light (1 shouldn't be ignored!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:LIGT3

Light

Engages in the generation, transmission, distribution, and sale of electric power in Brazil.

Undervalued with acceptable track record.

Market Insights

Community Narratives