- Brazil

- /

- Water Utilities

- /

- BOVESPA:CSMG3

Here's What We Like About Companhia de Saneamento de Minas Gerais's (BVMF:CSMG3) Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Companhia de Saneamento de Minas Gerais (BVMF:CSMG3) is about to trade ex-dividend in the next 1 days. You can purchase shares before the 24th of June in order to receive the dividend, which the company will pay on the 18th of August.

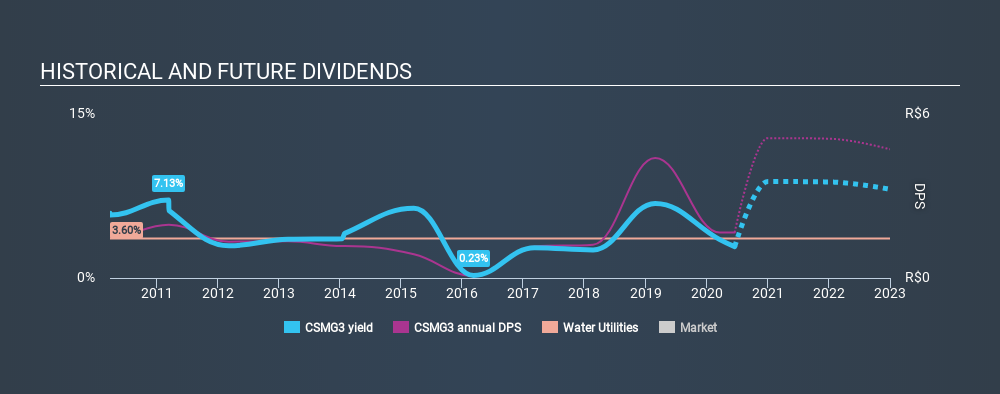

Companhia de Saneamento de Minas Gerais's upcoming dividend is R$0.35 a share, following on from the last 12 months, when the company distributed a total of R$1.67 per share to shareholders. Based on the last year's worth of payments, Companhia de Saneamento de Minas Gerais stock has a trailing yield of around 2.8% on the current share price of R$60.12. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Companhia de Saneamento de Minas Gerais

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Fortunately Companhia de Saneamento de Minas Gerais's payout ratio is modest, at just 28% of profit.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. For this reason, we're glad to see Companhia de Saneamento de Minas Gerais's earnings per share have risen 17% per annum over the last five years. Earnings per share have been growing rapidly and the company is retaining a majority of its earnings within the business. Fast-growing businesses that are reinvesting heavily are enticing from a dividend perspective, especially since they can often increase the payout ratio later.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last ten years, Companhia de Saneamento de Minas Gerais has lifted its dividend by approximately 1.1% a year on average. Earnings per share have been growing much quicker than dividends, potentially because Companhia de Saneamento de Minas Gerais is keeping back more of its profits to grow the business.

To Sum It Up

Is Companhia de Saneamento de Minas Gerais worth buying for its dividend? Companies like Companhia de Saneamento de Minas Gerais that are growing rapidly and paying out a low fraction of earnings, are usually reinvesting heavily in their business. Perhaps even more importantly - this can sometimes signal management is focused on the long term future of the business. Overall, Companhia de Saneamento de Minas Gerais looks like a promising dividend stock in this analysis, and we think it would be worth investigating further.

So while Companhia de Saneamento de Minas Gerais looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. For instance, we've identified 4 warning signs for Companhia de Saneamento de Minas Gerais (1 is concerning) you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About BOVESPA:CSMG3

Companhia de Saneamento de Minas Gerais

Plans, designs, performs, expands, remodels, manages, and provides water supply and sewage treatment services in Brazil and internationally.

Good value with mediocre balance sheet.

Market Insights

Community Narratives