- Brazil

- /

- Renewable Energy

- /

- BOVESPA:AURE3

Auren Energia S.A.'s (BVMF:AURE3) Share Price Could Signal Some Risk

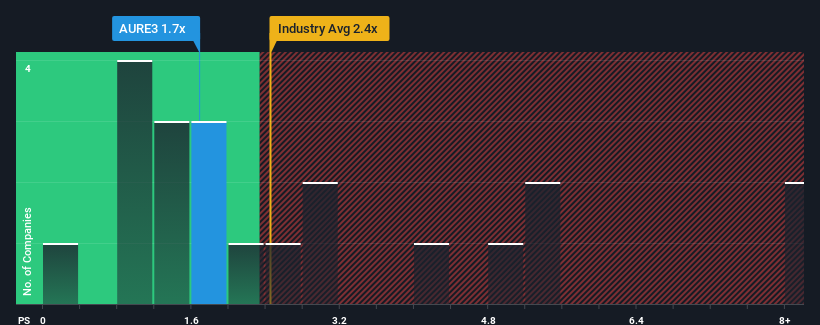

With a median price-to-sales (or "P/S") ratio of close to 2x in the Renewable Energy industry in Brazil, you could be forgiven for feeling indifferent about Auren Energia S.A.'s (BVMF:AURE3) P/S ratio of 1.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Auren Energia

How Auren Energia Has Been Performing

Recent times have been advantageous for Auren Energia as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Auren Energia will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Auren Energia's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 5.1% gain to the company's revenues. Pleasingly, revenue has also lifted 158% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company are not good at all, suggesting revenue should decline by 14% over the next year. Meanwhile, the broader industry is forecast to moderate by 5.0%, which indicates the company should perform poorly indeed.

In light of this, it's somewhat peculiar that Auren Energia's P/S sits in line with the majority of other companies. When revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

What Does Auren Energia's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Auren Energia's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. Even though the company's P/S is on par with the rest of the industry, the fact that it's revenue outlook is poorer than an already struggling industry suggests that the P/S isn't justified. We also have our reservations about the company's ability to sustain this level of performance amidst the challenging industry conditions. This presents a risk to investors if the P/S were to decline to a level that more accurately reflects the company's revenue prospects.

Before you take the next step, you should know about the 1 warning sign for Auren Energia that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:AURE3

Auren Energia

Engages in the investment platform for the management, operation, acquisition, development and construction of energy generation, transmission and trading assets in Brazil.

Good value with moderate growth potential.

Market Insights

Community Narratives