- Brazil

- /

- Electric Utilities

- /

- BOVESPA:ALUP11

Alupar Investimento S.A.'s (BVMF:ALUP11) Shareholders Might Be Looking For Exit

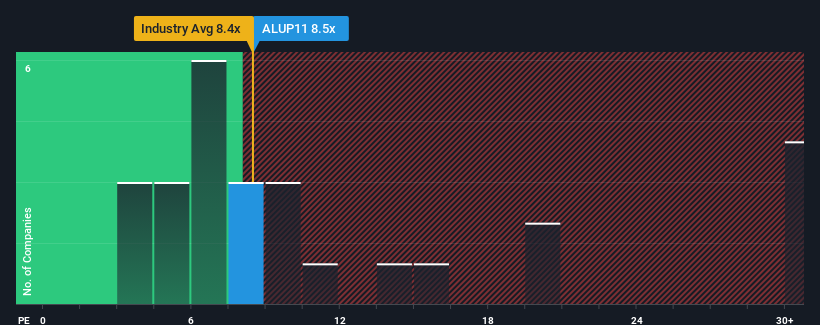

It's not a stretch to say that Alupar Investimento S.A.'s (BVMF:ALUP11) price-to-earnings (or "P/E") ratio of 8.5x right now seems quite "middle-of-the-road" compared to the market in Brazil, where the median P/E ratio is around 8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for Alupar Investimento as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Alupar Investimento

How Is Alupar Investimento's Growth Trending?

The only time you'd be comfortable seeing a P/E like Alupar Investimento's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 34% gain to the company's bottom line. Still, incredibly EPS has fallen 27% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 11% during the coming year according to the eight analysts following the company. With the market predicted to deliver 17% growth , that's a disappointing outcome.

In light of this, it's somewhat alarming that Alupar Investimento's P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On Alupar Investimento's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Alupar Investimento's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 2 warning signs for Alupar Investimento (1 is a bit unpleasant!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Alupar Investimento, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ALUP11

Alupar Investimento

Engages in the transmission, generation, and commercialization of energy in Brazil, Colombia, Peru, and Chile.

Proven track record with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.