- Brazil

- /

- Transportation

- /

- BOVESPA:TGMA3

Tegma Gestão Logística (BVMF:TGMA3) Looks To Prolong Its Impressive Returns

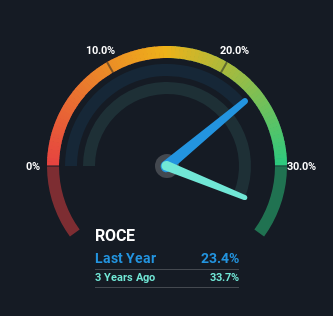

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, the ROCE of Tegma Gestão Logística (BVMF:TGMA3) looks attractive right now, so lets see what the trend of returns can tell us.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Tegma Gestão Logística is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.23 = R$216m ÷ (R$1.1b - R$205m) (Based on the trailing twelve months to March 2023).

Therefore, Tegma Gestão Logística has an ROCE of 23%. That's a fantastic return and not only that, it outpaces the average of 12% earned by companies in a similar industry.

Check out our latest analysis for Tegma Gestão Logística

In the above chart we have measured Tegma Gestão Logística's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Tegma Gestão Logística.

The Trend Of ROCE

We'd be pretty happy with returns on capital like Tegma Gestão Logística. The company has consistently earned 23% for the last five years, and the capital employed within the business has risen 51% in that time. Returns like this are the envy of most businesses and given it has repeatedly reinvested at these rates, that's even better. You'll see this when looking at well operated businesses or favorable business models.

In Conclusion...

In summary, we're delighted to see that Tegma Gestão Logística has been compounding returns by reinvesting at consistently high rates of return, as these are common traits of a multi-bagger. And the stock has followed suit returning a meaningful 61% to shareholders over the last five years. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

If you want to know some of the risks facing Tegma Gestão Logística we've found 2 warning signs (1 is potentially serious!) that you should be aware of before investing here.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

Valuation is complex, but we're here to simplify it.

Discover if Tegma Gestão Logística might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:TGMA3

Tegma Gestão Logística

Provides logistics management, transportation, and storage services in Brazil.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026