Stock Analysis

- Brazil

- /

- Food and Staples Retail

- /

- BOVESPA:RADL3

June 2024 Insight Into Three Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets continue to navigate through a landscape marked by modest gains and shifts in investor sentiment, understanding the foundational elements of robust growth companies becomes increasingly pertinent. High insider ownership often signals strong confidence in the company's future prospects, aligning well with current market conditions where discerning stability and commitment is key.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 30.1% |

| Gaming Innovation Group (OB:GIG) | 20.2% | 36.2% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.9% | 84.1% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

Here's a peek at a few of the choices from the screener.

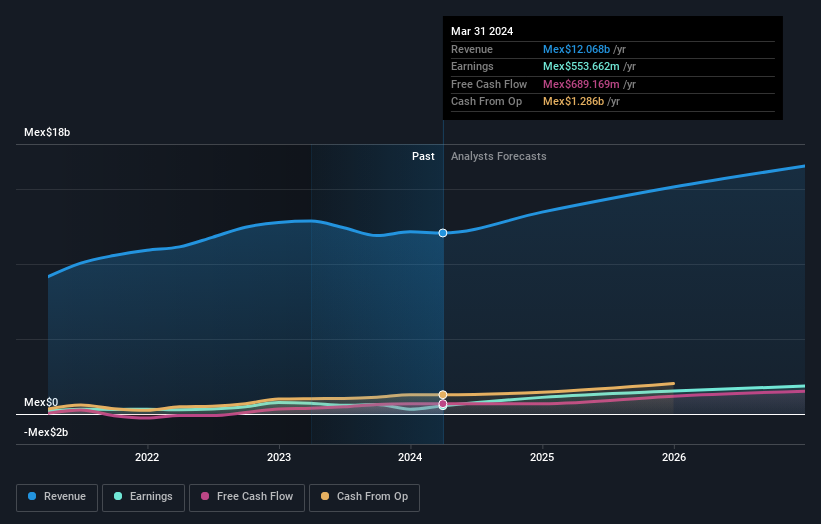

Grupo Rotoplas. de (BMV:AGUA *)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Grupo Rotoplas S.A.B. de C.V. specializes in the manufacture, purchase, sale, and installation of plastic containers and accessories for water storage, conduction, and improvement solutions across Mexico, Argentina, the United States and other international markets with a market capitalization of MX$13.03 billion.

Operations: The company generates revenue primarily through its Individual Solutions segment, which brought in MX$11.36 billion, and its Comprehensive Solutions segment, which contributed MX$0.71 billion.

Insider Ownership: 37.9%

Earnings Growth Forecast: 28.9% p.a.

Grupo Rotoplas S.A.B. de C.V. is trading at 66% below its estimated fair value, signaling potential undervaluation. Analysts predict a significant price increase of 61.6%, with earnings expected to grow by 28.9% annually, outpacing the broader Mexican market's forecast of 11.2%. However, the company has a high level of debt and a history of shareholder dilution over the past year, alongside an unstable dividend track record. Recent financials show substantial improvement in net income and earnings per share as of Q1 2024.

- Get an in-depth perspective on Grupo Rotoplas. de's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Grupo Rotoplas. de's current price could be quite moderate.

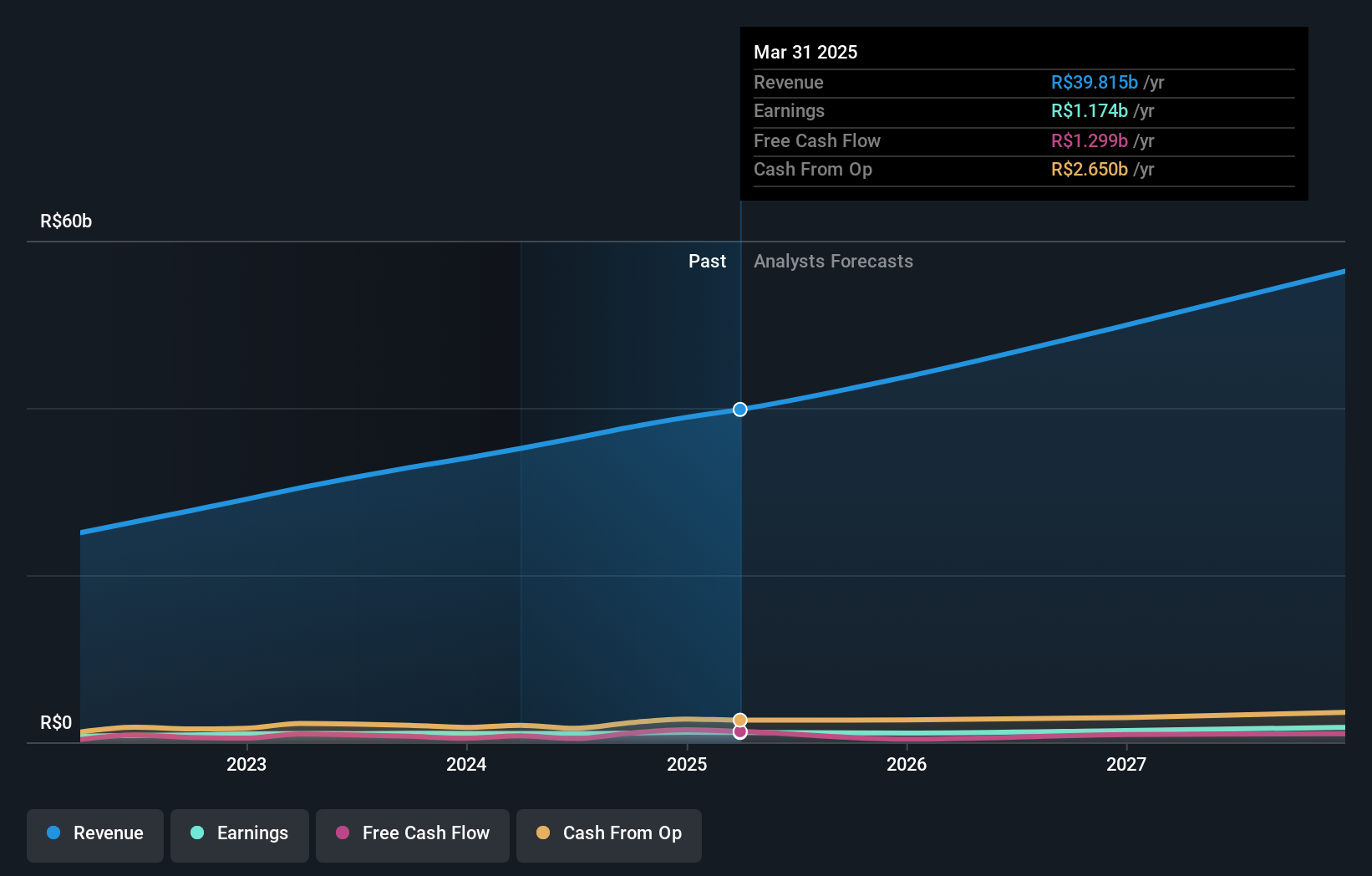

Raia Drogasil (BOVESPA:RADL3)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Raia Drogasil S.A. is a Brazilian retailer specializing in medicines, personal care, and beauty products, with a market capitalization of R$44.25 billion.

Operations: The company generates R$35.14 billion primarily from the sale of medicines, cosmetics, and hygiene products.

Insider Ownership: 21.2%

Earnings Growth Forecast: 25.4% p.a.

Raia Drogasil S.A. has demonstrated robust financial performance with a 14.1% annual earnings growth over the past five years, and its future looks promising with expected revenue and earnings growth outpacing the Brazilian market at 12.8% and 25.4% per year, respectively. Despite a slight dip in net income this quarter to BRL 187.81 million from BRL 192.26 million last year, the company maintains strong growth projections and high forecasted Return on Equity of 27.4%.

- Click here and access our complete growth analysis report to understand the dynamics of Raia Drogasil.

- Insights from our recent valuation report point to the potential overvaluation of Raia Drogasil shares in the market.

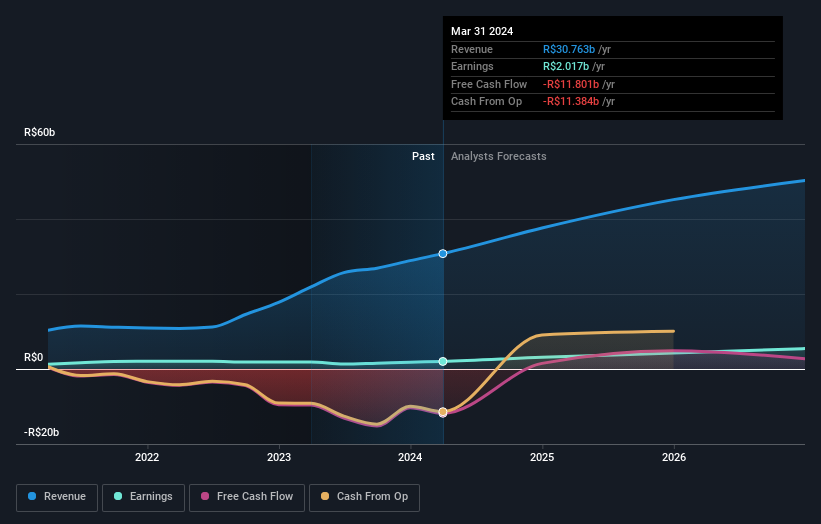

Localiza Rent a Car (BOVESPA:RENT3)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Localiza Rent a Car S.A. operates in the car and fleet rental sector both within Brazil and globally, with a market capitalization of approximately R$44.26 billion.

Operations: The company generates R$30.75 billion in revenue from its car and fleet rental operations.

Insider Ownership: 19.1%

Earnings Growth Forecast: 33.3% p.a.

Localiza Rent a Car has shown strong financial performance, with first-quarter sales increasing to BRL 8.69 billion from BRL 6.83 billion year-over-year, and net income rising to BRL 733.82 million from BRL 522.81 million. The company's revenue and earnings are forecasted to grow at rates of 17.4% and 33.3% per year respectively, outpacing the Brazilian market averages of 7.2% and 14.1%. However, its dividends are not well-covered by cash flows, indicating potential concerns about sustainability despite high insider ownership influencing stability and growth prospects.

- Delve into the full analysis future growth report here for a deeper understanding of Localiza Rent a Car.

- The analysis detailed in our Localiza Rent a Car valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Access the full spectrum of 1447 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Raia Drogasil is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:RADL3

Raia Drogasil

Engages in the retail sale of medicines, perfumery, personal care and beauty products, cosmetics, dermocosmetics, and specialty medicines in Brazil.

High growth potential with excellent balance sheet.