- Brazil

- /

- Transportation

- /

- BOVESPA:MOVI3

Movida Participações S.A. (BVMF:MOVI3) Not Doing Enough For Some Investors As Its Shares Slump 27%

Movida Participações S.A. (BVMF:MOVI3) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 29% in the last year.

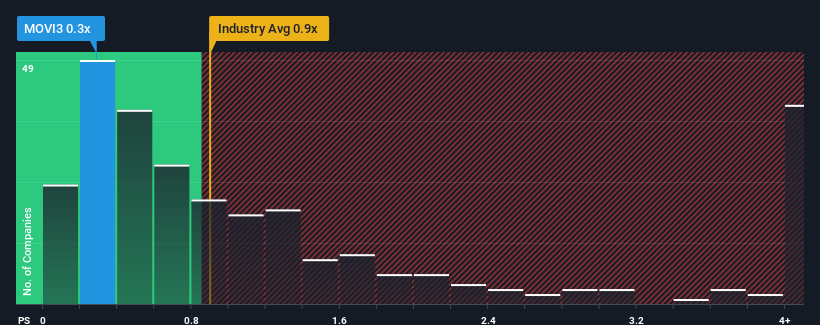

Since its price has dipped substantially, considering around half the companies operating in Brazil's Transportation industry have price-to-sales ratios (or "P/S") above 1.2x, you may consider Movida Participações as an solid investment opportunity with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Movida Participações

How Has Movida Participações Performed Recently?

With revenue growth that's inferior to most other companies of late, Movida Participações has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Movida Participações' future stacks up against the industry? In that case, our free report is a great place to start.How Is Movida Participações' Revenue Growth Trending?

Movida Participações' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. The latest three year period has also seen an excellent 156% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the nine analysts following the company. With the industry predicted to deliver 29% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Movida Participações' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Movida Participações' P/S

The southerly movements of Movida Participações' shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Movida Participações' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware Movida Participações is showing 3 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If these risks are making you reconsider your opinion on Movida Participações, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MOVI3

Movida Participações

Through its subsidiaries, provides car rental services in Brazil.

High growth potential and fair value.

Market Insights

Community Narratives