- Brazil

- /

- Infrastructure

- /

- BOVESPA:ECOR3

EcoRodovias Infraestrutura e Logística S.A.'s (BVMF:ECOR3) 27% Dip In Price Shows Sentiment Is Matching Earnings

To the annoyance of some shareholders, EcoRodovias Infraestrutura e Logística S.A. (BVMF:ECOR3) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 46% in that time.

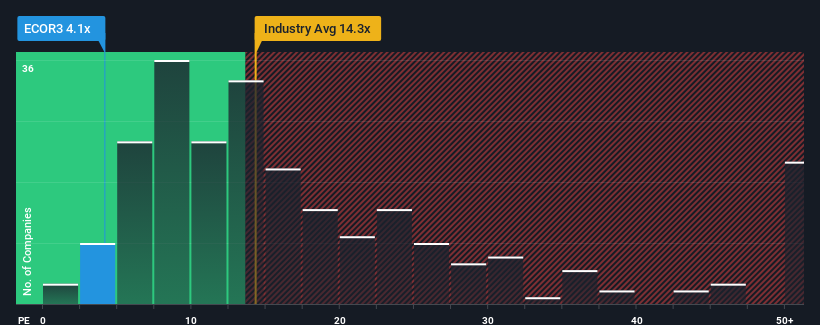

Since its price has dipped substantially, EcoRodovias Infraestrutura e Logística's price-to-earnings (or "P/E") ratio of 4.1x might make it look like a strong buy right now compared to the market in Brazil, where around half of the companies have P/E ratios above 9x and even P/E's above 14x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

EcoRodovias Infraestrutura e Logística certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for EcoRodovias Infraestrutura e Logística

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as EcoRodovias Infraestrutura e Logística's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 55% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 6.4% each year as estimated by the six analysts watching the company. With the market predicted to deliver 15% growth per year, that's a disappointing outcome.

With this information, we are not surprised that EcoRodovias Infraestrutura e Logística is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From EcoRodovias Infraestrutura e Logística's P/E?

Having almost fallen off a cliff, EcoRodovias Infraestrutura e Logística's share price has pulled its P/E way down as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that EcoRodovias Infraestrutura e Logística maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - EcoRodovias Infraestrutura e Logística has 3 warning signs (and 2 which don't sit too well with us) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if EcoRodovias Infraestrutura e Logística might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ECOR3

EcoRodovias Infraestrutura e Logística

EcoRodovias Infraestrutura e Logística S.A.

Slightly overvalued with questionable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026