- Brazil

- /

- Infrastructure

- /

- BOVESPA:MOTV3

Risks To Shareholder Returns Are Elevated At These Prices For CCR S.A. (BVMF:CCRO3)

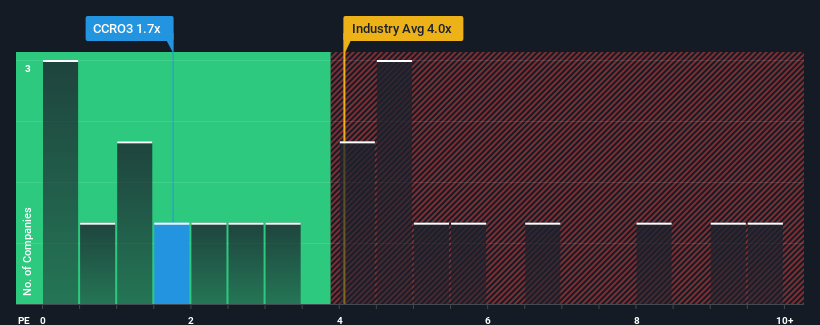

With a median price-to-sales (or "P/S") ratio of close to 1.7x in the Infrastructure industry in Brazil, you could be forgiven for feeling indifferent about CCR S.A.'s (BVMF:CCRO3) P/S ratio, which comes in at about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for CCR

How CCR Has Been Performing

CCR hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think CCR's future stacks up against the industry? In that case, our free report is a great place to start.How Is CCR's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like CCR's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 10%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 66% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 6.0% per annum as estimated by the six analysts watching the company. Meanwhile, the broader industry is forecast to expand by 4.0% per year, which paints a poor picture.

With this information, we find it concerning that CCR is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It appears that CCR currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

And what about other risks? Every company has them, and we've spotted 2 warning signs for CCR (of which 1 makes us a bit uncomfortable!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MOTV3

Motiva Infraestrutura de Mobilidade

Provides infrastructure services for highway, rail, and airport concessions in Brazil.

Moderate growth potential with questionable track record.

Market Insights

Community Narratives