- Brazil

- /

- Telecom Services and Carriers

- /

- BOVESPA:BRIT3

Earnings are growing at Brisanet Participações (BVMF:BRIT3) but shareholders still don't like its prospects

The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in Brisanet Participações S.A. (BVMF:BRIT3) have tasted that bitter downside in the last year, as the share price dropped 50%. That's well below the market decline of 13%. We wouldn't rush to judgement on Brisanet Participações because we don't have a long term history to look at. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days.

Since Brisanet Participações has shed R$120m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Brisanet Participações

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Brisanet Participações share price fell, it actually saw its earnings per share (EPS) improve by 23%. Of course, the situation might betray previous over-optimism about growth.

It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's well worth checking out some other metrics, too.

Given the yield is quite low, at 0.1%, we doubt the dividend can shed much light on the share price. Brisanet Participações' revenue is actually up 35% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

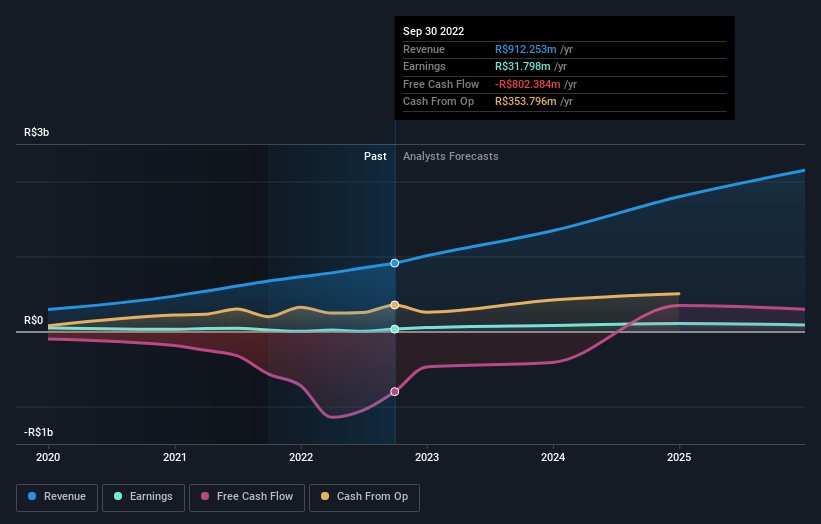

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Brisanet Participações has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Brisanet Participações in this interactive graph of future profit estimates.

A Different Perspective

We doubt Brisanet Participações shareholders are happy with the loss of 50% over twelve months (even including dividends). That falls short of the market, which lost 13%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 24%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Brisanet Participações (2 are a bit unpleasant!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Brisanet Participações might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:BRIT3

Brisanet Participações

Provides telecommunications services and SCM equipment services in Brazil.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026