- Brazil

- /

- Communications

- /

- BOVESPA:INTB3

Intelbras S.A. - Indústria de Telecomunicação Eletrônica Brasileira's (BVMF:INTB3) Business Is Trailing The Market But Its Shares Aren't

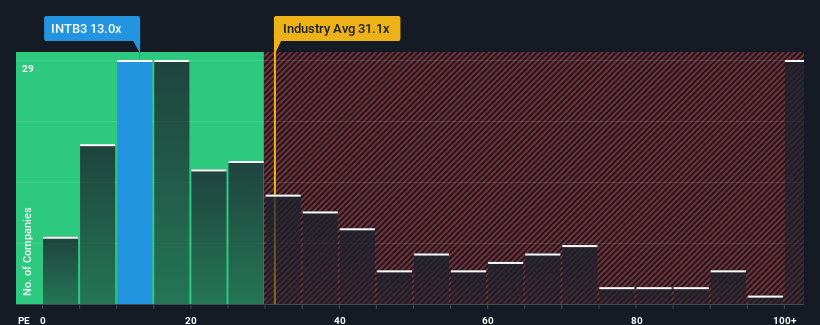

Intelbras S.A. - Indústria de Telecomunicação Eletrônica Brasileira's (BVMF:INTB3) price-to-earnings (or "P/E") ratio of 13x might make it look like a sell right now compared to the market in Brazil, where around half of the companies have P/E ratios below 10x and even P/E's below 7x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

There hasn't been much to differentiate Intelbras - Indústria de Telecomunicação Eletrônica Brasileira's and the market's earnings growth lately. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Intelbras - Indústria de Telecomunicação Eletrônica Brasileira

Is There Enough Growth For Intelbras - Indústria de Telecomunicação Eletrônica Brasileira?

In order to justify its P/E ratio, Intelbras - Indústria de Telecomunicação Eletrônica Brasileira would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 10% last year. EPS has also lifted 15% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 12% per annum as estimated by the six analysts watching the company. That's shaping up to be materially lower than the 17% per year growth forecast for the broader market.

With this information, we find it concerning that Intelbras - Indústria de Telecomunicação Eletrônica Brasileira is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Intelbras - Indústria de Telecomunicação Eletrônica Brasileira's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 1 warning sign for Intelbras - Indústria de Telecomunicação Eletrônica Brasileira that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:INTB3

Intelbras - Indústria de Telecomunicação Eletrônica Brasileira

Engages in the manufacturing, developing, and sale of electronic security equipment and electronic surveillance and monitoring services in Brazil.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success