- Brazil

- /

- Communications

- /

- BOVESPA:INTB3

Does Intelbras - Indústria de Telecomunicação Eletrônica Brasileira (BVMF:INTB3) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Intelbras S.A. - Indústria de Telecomunicação Eletrônica Brasileira (BVMF:INTB3) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is Intelbras - Indústria de Telecomunicação Eletrônica Brasileira's Net Debt?

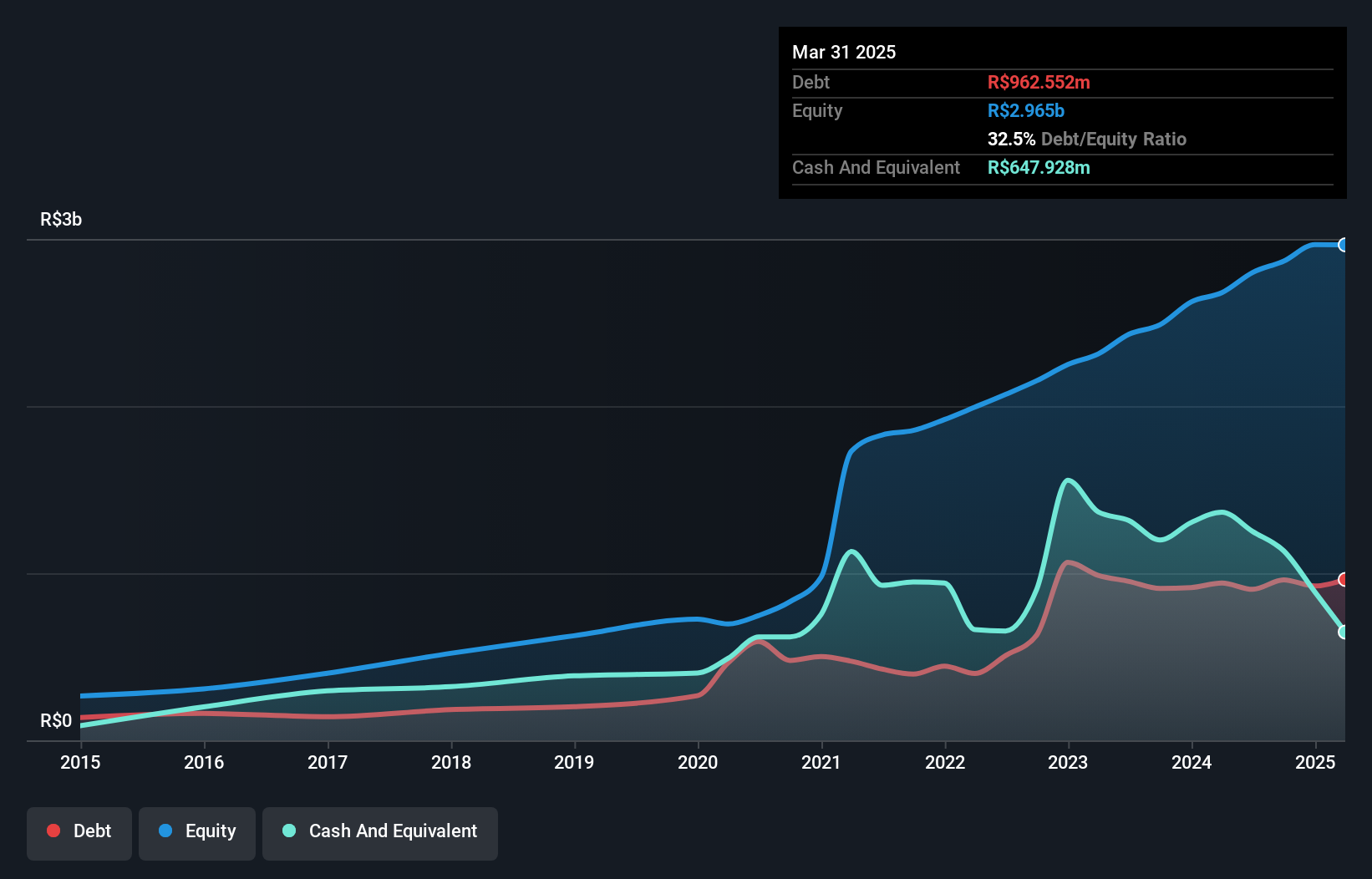

The chart below, which you can click on for greater detail, shows that Intelbras - Indústria de Telecomunicação Eletrônica Brasileira had R$962.6m in debt in March 2025; about the same as the year before. However, it does have R$647.9m in cash offsetting this, leading to net debt of about R$314.6m.

How Healthy Is Intelbras - Indústria de Telecomunicação Eletrônica Brasileira's Balance Sheet?

According to the last reported balance sheet, Intelbras - Indústria de Telecomunicação Eletrônica Brasileira had liabilities of R$1.31b due within 12 months, and liabilities of R$838.9m due beyond 12 months. Offsetting this, it had R$647.9m in cash and R$1.24b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by R$265.8m.

Given Intelbras - Indústria de Telecomunicação Eletrônica Brasileira has a market capitalization of R$4.95b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

View our latest analysis for Intelbras - Indústria de Telecomunicação Eletrônica Brasileira

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Intelbras - Indústria de Telecomunicação Eletrônica Brasileira has a low debt to EBITDA ratio of only 0.61. But the really cool thing is that it actually managed to receive more interest than it paid, over the last year. So it's fair to say it can handle debt like a hotshot teppanyaki chef handles cooking. On the other hand, Intelbras - Indústria de Telecomunicação Eletrônica Brasileira's EBIT dived 11%, over the last year. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Intelbras - Indústria de Telecomunicação Eletrônica Brasileira can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Intelbras - Indústria de Telecomunicação Eletrônica Brasileira's free cash flow amounted to 45% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

When it comes to the balance sheet, the standout positive for Intelbras - Indústria de Telecomunicação Eletrônica Brasileira was the fact that it seems able to cover its interest expense with its EBIT confidently. But the other factors we noted above weren't so encouraging. For instance it seems like it has to struggle a bit to grow its EBIT. Considering this range of data points, we think Intelbras - Indústria de Telecomunicação Eletrônica Brasileira is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 3 warning signs with Intelbras - Indústria de Telecomunicação Eletrônica Brasileira (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:INTB3

Intelbras - Indústria de Telecomunicação Eletrônica Brasileira

Engages in the manufacturing, developing, and sale of electronic security equipment and electronic surveillance and monitoring services in Brazil.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success