Did You Participate In Any Of Sinqia's (BVMF:SQIA3) Incredible 919% Return?

Buying shares in the best businesses can build meaningful wealth for you and your family. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the Sinqia S.A. (BVMF:SQIA3) share price. It's 887% higher than it was five years ago. If that doesn't get you thinking about long term investing, we don't know what will. We note the stock price is up 4.3% in the last seven days.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Sinqia

We don't think that Sinqia's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Sinqia saw its revenue grow at 20% per year. That's well above most pre-profit companies. Arguably, this is well and truly reflected in the strong share price gain of 58%(per year) over the same period. It's never too late to start following a top notch stock like Sinqia, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

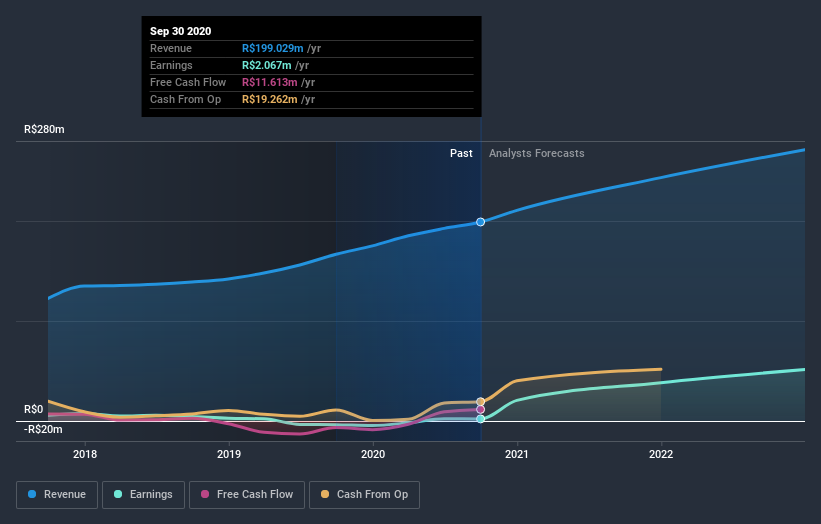

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Sinqia has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Sinqia will earn in the future (free profit forecasts).

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Sinqia's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Sinqia's TSR of 919% over the last 5 years is better than the share price return.

A Different Perspective

While the broader market gained around 5.3% in the last year, Sinqia shareholders lost 2.0%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 59% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Sinqia may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

If you’re looking to trade Sinqia, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BOVESPA:SQIA3

Sinqia

Sinqia S.A. operates as a technology provider for the financial industry in Brazil.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026