- Brazil

- /

- Specialty Stores

- /

- BOVESPA:BHIA3

Can You Imagine How Elated Via Varejo's (BVMF:VVAR3) Shareholders Feel About Its 313% Share Price Gain?

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. But when you hold the right stock for the right time period, the rewards can be truly huge. One bright shining star stock has been Via Varejo S.A. (BVMF:VVAR3), which is 313% higher than three years ago. It's also good to see the share price up 69% over the last quarter.

View our latest analysis for Via Varejo

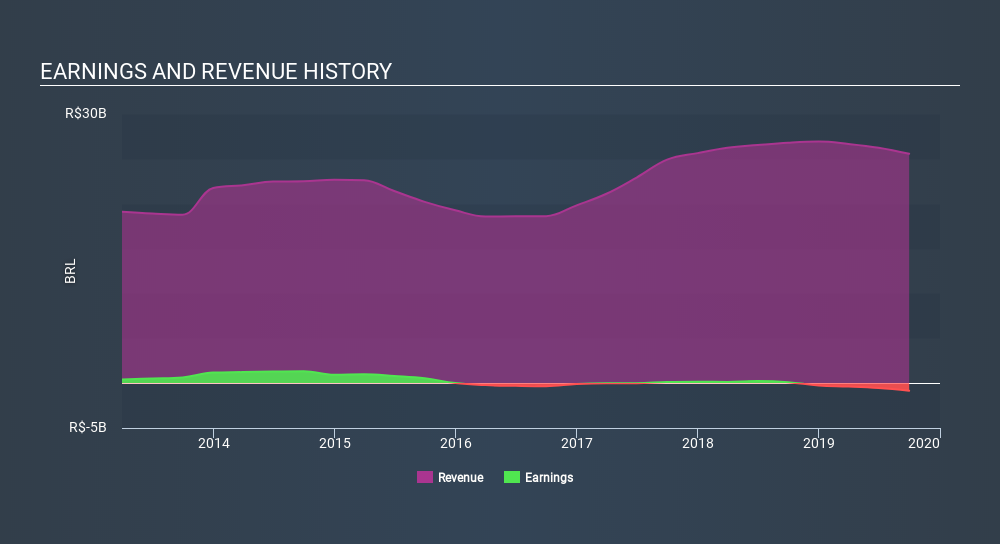

Via Varejo isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years Via Varejo has grown its revenue at 10% annually. That's a very respectable growth rate. Arguably the very strong share price gain of 60% a year is very generous when compared to the revenue growth. After a price rise like that many will have the business, and plenty of them will be wondering whether the price moved too high, too fast.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Via Varejo is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Via Varejo will earn in the future (free analyst consensus estimates)

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Via Varejo's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Via Varejo's TSR of 315% over the last 3 years is better than the share price return.

A Different Perspective

It's nice to see that Via Varejo shareholders have received a total shareholder return of 169% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 12% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Via Varejo you should be aware of, and 1 of them is a bit concerning.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BOVESPA:BHIA3

Grupo Casas Bahia

Grupo Casas Bahia S.A., together with its subsidiaries, retails electronics, home appliances, and furniture in Brazil.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives