- Brazil

- /

- Consumer Services

- /

- BOVESPA:ARND3

We Think GetNinjas (BVMF:NINJ3) Can Easily Afford To Drive Business Growth

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether GetNinjas (BVMF:NINJ3) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for GetNinjas

When Might GetNinjas Run Out Of Money?

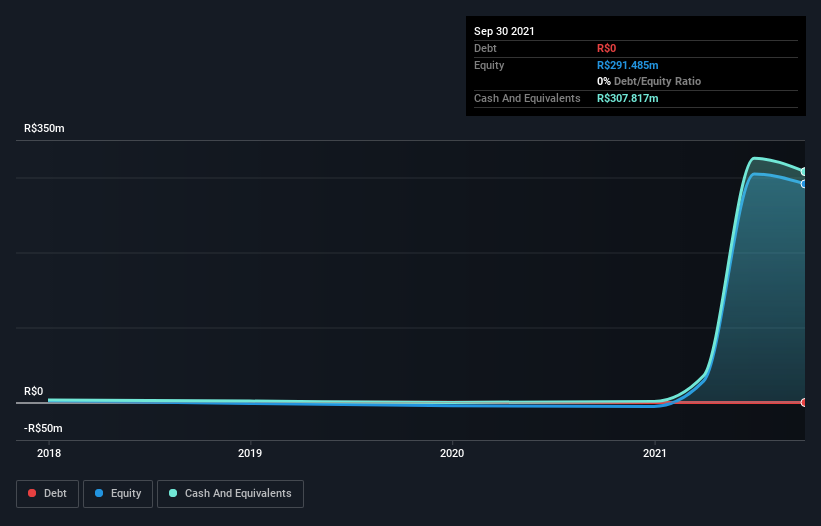

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In September 2021, GetNinjas had R$308m in cash, and was debt-free. Importantly, its cash burn was R$25m over the trailing twelve months. That means it had a cash runway of very many years as of September 2021. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. The image below shows how its cash balance has been changing over the last few years.

Is GetNinjas' Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because GetNinjas actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. We think that it's fairly positive to see that revenue grew 36% in the last twelve months. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For GetNinjas To Raise More Cash For Growth?

While GetNinjas is showing solid revenue growth, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

GetNinjas' cash burn of R$25m is about 9.6% of its R$258m market capitalisation. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is GetNinjas' Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way GetNinjas is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. But it's fair to say that its cash burn relative to its market cap was also very reassuring. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. On another note, GetNinjas has 4 warning signs (and 1 which is concerning) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:ARND3

Arandu Investimentos

REAG Investimentos S.A. operates an online platform that connects professionals with seeking quotes and hire services in Brazil.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026