- Brazil

- /

- Real Estate

- /

- BOVESPA:MTRE3

Mitre Realty Empreendimentos e Participações' (BVMF:MTRE3) Stock Price Has Reduced 25% In The Past Year

Mitre Realty Empreendimentos e Participações S.A. (BVMF:MTRE3) shareholders should be happy to see the share price up 15% in the last quarter. But that doesn't change the fact that the returns over the last year have been less than pleasing. The cold reality is that the stock has dropped 25% in one year, under-performing the market.

View our latest analysis for Mitre Realty Empreendimentos e Participações

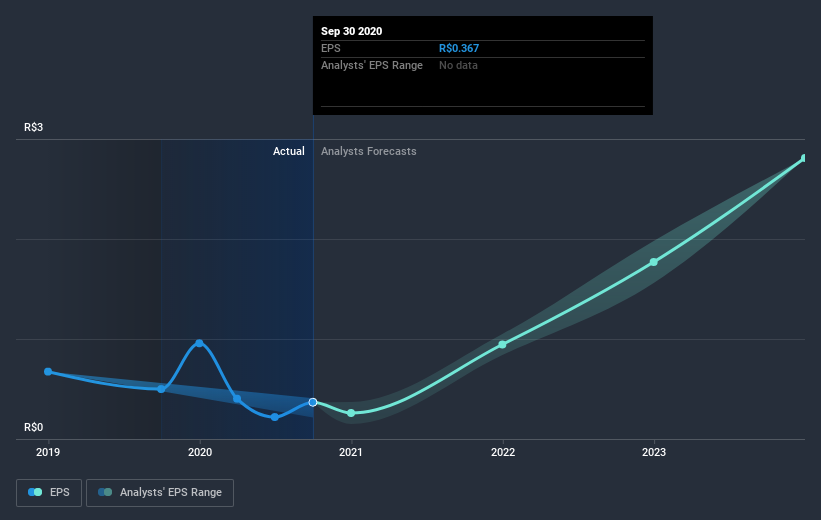

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, Mitre Realty Empreendimentos e Participações had to report a 27% decline in EPS over the last year. We note that the 25% share price drop is very close to the EPS drop. Given the lower EPS we might have expected investors to lose confidence in the stock, but that doesn't seemed to have happened. Rather, the share price is remains a similar multiple of the EPS, suggesting the outlook remains the same.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Mitre Realty Empreendimentos e Participações has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While Mitre Realty Empreendimentos e Participações shareholders are down 25% for the year (even including dividends), the market itself is up 4.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 15% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand Mitre Realty Empreendimentos e Participações better, we need to consider many other factors. Even so, be aware that Mitre Realty Empreendimentos e Participações is showing 2 warning signs in our investment analysis , and 1 of those is significant...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

When trading Mitre Realty Empreendimentos e Participações or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Mitre Realty Empreendimentos e Participações, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:MTRE3

Mitre Realty Empreendimentos e Participações

Engages in the development, construction, and sale of residential and commercial real estate properties for middle-class and upper middle-class customers in Brazil.

Excellent balance sheet and good value.

Market Insights

Community Narratives