- Brazil

- /

- Real Estate

- /

- BOVESPA:LPSB3

Subdued Growth No Barrier To LPS Brasil - Consultoria de Imóveis S.A. (BVMF:LPSB3) With Shares Advancing 31%

LPS Brasil - Consultoria de Imóveis S.A. (BVMF:LPSB3) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

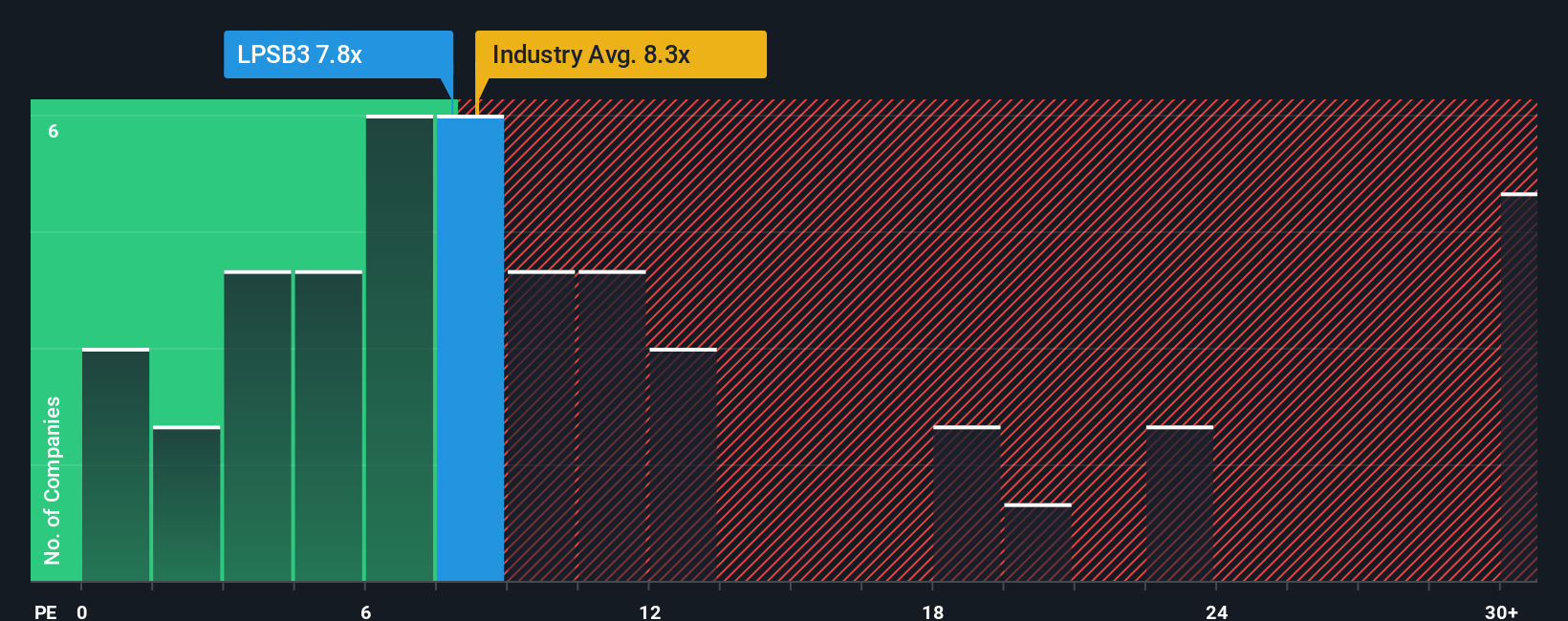

In spite of the firm bounce in price, there still wouldn't be many who think LPS Brasil - Consultoria de Imóveis' price-to-earnings (or "P/E") ratio of 7.8x is worth a mention when the median P/E in Brazil is similar at about 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Earnings have risen firmly for LPS Brasil - Consultoria de Imóveis recently, which is pleasing to see. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Check out our latest analysis for LPS Brasil - Consultoria de Imóveis

Does Growth Match The P/E?

LPS Brasil - Consultoria de Imóveis' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 17%. However, this wasn't enough as the latest three year period has seen a very unpleasant 47% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 18% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's somewhat alarming that LPS Brasil - Consultoria de Imóveis' P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Its shares have lifted substantially and now LPS Brasil - Consultoria de Imóveis' P/E is also back up to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that LPS Brasil - Consultoria de Imóveis currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with LPS Brasil - Consultoria de Imóveis, and understanding them should be part of your investment process.

You might be able to find a better investment than LPS Brasil - Consultoria de Imóveis. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:LPSB3

LPS Brasil - Consultoria de Imóveis

Provides real estate brokerage services in Brazil.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives