- Brazil

- /

- Entertainment

- /

- BOVESPA:SHOW3

The Market Lifts T4F Entretenimento S.A. (BVMF:SHOW3) Shares 28% But It Can Do More

The T4F Entretenimento S.A. (BVMF:SHOW3) share price has done very well over the last month, posting an excellent gain of 28%. Looking back a bit further, it's encouraging to see the stock is up 25% in the last year.

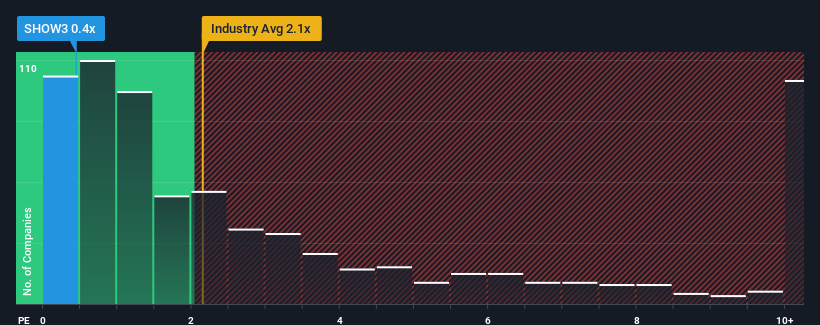

Even after such a large jump in price, given about half the companies operating in Brazil's Entertainment industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider T4F Entretenimento as an attractive investment with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for T4F Entretenimento

How Has T4F Entretenimento Performed Recently?

With revenue growth that's exceedingly strong of late, T4F Entretenimento has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Although there are no analyst estimates available for T4F Entretenimento, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as T4F Entretenimento's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 35%. The latest three year period has also seen an excellent 229% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 12% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that T4F Entretenimento is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From T4F Entretenimento's P/S?

T4F Entretenimento's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of T4F Entretenimento revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with T4F Entretenimento, and understanding these should be part of your investment process.

If you're unsure about the strength of T4F Entretenimento's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if T4F Entretenimento might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:SHOW3

T4F Entretenimento

Operates as a live entertainment company in South America.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives