- Brazil

- /

- Metals and Mining

- /

- BOVESPA:PMAM3

Paranapanema S.A.'s (BVMF:PMAM3) 25% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Unfortunately for some shareholders, the Paranapanema S.A. (BVMF:PMAM3) share price has dived 25% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

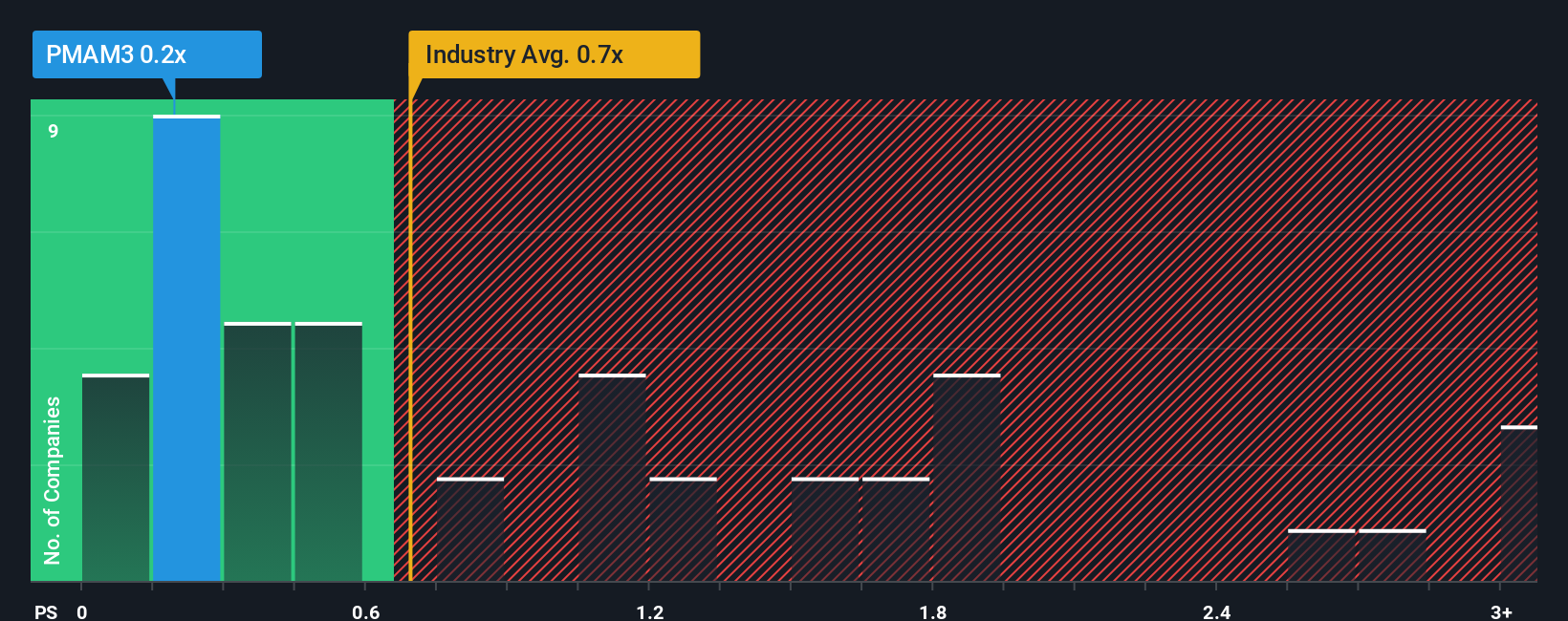

In spite of the heavy fall in price, it's still not a stretch to say that Paranapanema's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Metals and Mining industry in Brazil, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Paranapanema

How Paranapanema Has Been Performing

Revenue has risen firmly for Paranapanema recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on Paranapanema will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Paranapanema will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Paranapanema's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 85% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 1.6% shows the industry is more attractive on an annualised basis regardless.

In light of this, it's somewhat peculiar that Paranapanema's P/S sits in line with the majority of other companies. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Bottom Line On Paranapanema's P/S

Paranapanema's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Paranapanema revealed its sharp three-year contraction in revenue isn't impacting its P/S as much as we would have predicted, given the industry is set to shrink less severely. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. This would place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - Paranapanema has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:PMAM3

Paranapanema

Produces and sells copper and its byproducts in Brazil and internationally.

Moderate risk and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026