- Brazil

- /

- Metals and Mining

- /

- BOVESPA:PMAM3

Paranapanema S.A. (BVMF:PMAM3) May Have Run Too Fast Too Soon With Recent 27% Price Plummet

The Paranapanema S.A. (BVMF:PMAM3) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 31% in that time.

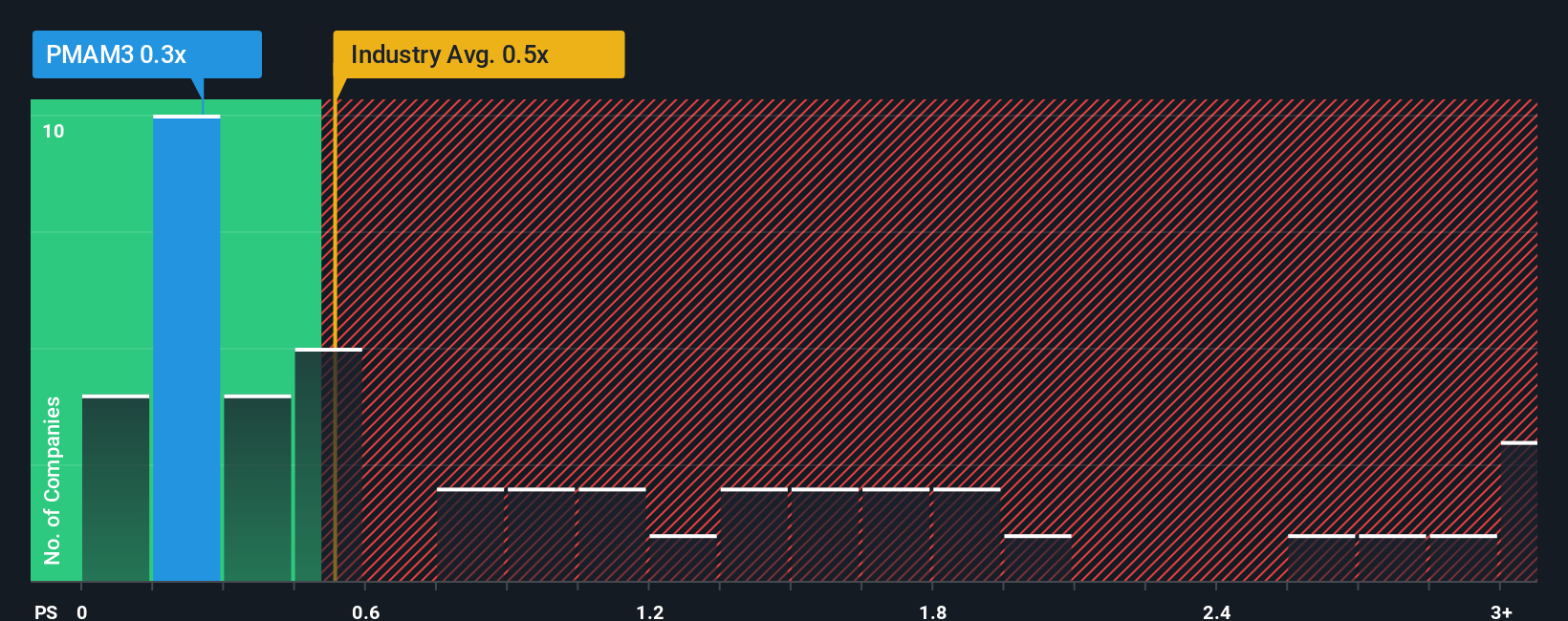

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Paranapanema's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in Brazil is also close to 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Paranapanema

What Does Paranapanema's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Paranapanema over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Paranapanema, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Paranapanema's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 88% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to decline by 1.8% over the next year, or less than the company's recent medium-term annualised revenue decline.

In light of this, it's somewhat peculiar that Paranapanema's P/S sits in line with the majority of other companies. In general, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

With its share price dropping off a cliff, the P/S for Paranapanema looks to be in line with the rest of the Metals and Mining industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Paranapanema revealed its sharp three-year contraction in revenue isn't impacting its P/S as much as we would have predicted, given the industry is set to shrink less severely. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. This would place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - Paranapanema has 5 warning signs (and 3 which are a bit concerning) we think you should know about.

If you're unsure about the strength of Paranapanema's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:PMAM3

Paranapanema

Produces and sells copper and its byproducts in Brazil and internationally.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives