- Brazil

- /

- Healthcare Services

- /

- BOVESPA:ONCO3

With A 25% Price Drop For Oncoclínicas do Brasil Serviços Médicos S.A. (BVMF:ONCO3) You'll Still Get What You Pay For

Oncoclínicas do Brasil Serviços Médicos S.A. (BVMF:ONCO3) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

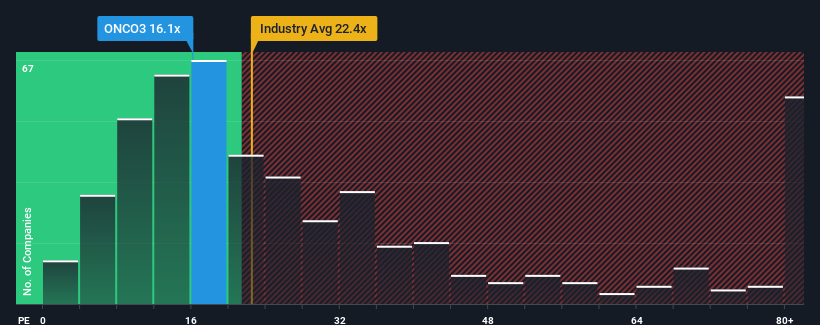

In spite of the heavy fall in price, Oncoclínicas do Brasil Serviços Médicos' price-to-earnings (or "P/E") ratio of 16.1x might still make it look like a strong sell right now compared to the market in Brazil, where around half of the companies have P/E ratios below 9x and even P/E's below 6x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Oncoclínicas do Brasil Serviços Médicos as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Oncoclínicas do Brasil Serviços Médicos

What Are Growth Metrics Telling Us About The High P/E?

Oncoclínicas do Brasil Serviços Médicos' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 21% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 32% per annum as estimated by the nine analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 17% per year, which is noticeably less attractive.

With this information, we can see why Oncoclínicas do Brasil Serviços Médicos is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

A significant share price dive has done very little to deflate Oncoclínicas do Brasil Serviços Médicos' very lofty P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Oncoclínicas do Brasil Serviços Médicos' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with Oncoclínicas do Brasil Serviços Médicos (including 2 which are potentially serious).

If these risks are making you reconsider your opinion on Oncoclínicas do Brasil Serviços Médicos, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ONCO3

Oncoclínicas do Brasil Serviços Médicos

Oncoclínicas do Brasil Serviços Médicos S.A.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives