- Brazil

- /

- Healthcare Services

- /

- BOVESPA:ONCO3

Oncoclínicas do Brasil Serviços Médicos S.A. (BVMF:ONCO3) Stocks Pounded By 29% But Not Lagging Market On Growth Or Pricing

Unfortunately for some shareholders, the Oncoclínicas do Brasil Serviços Médicos S.A. (BVMF:ONCO3) share price has dived 29% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 66% loss during that time.

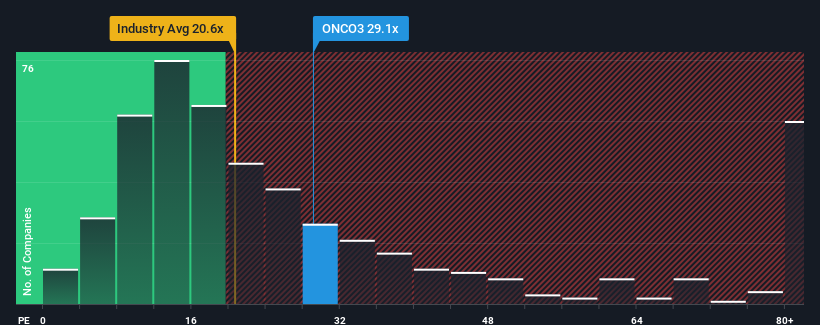

Although its price has dipped substantially, given close to half the companies in Brazil have price-to-earnings ratios (or "P/E's") below 9x, you may still consider Oncoclínicas do Brasil Serviços Médicos as a stock to avoid entirely with its 29.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Oncoclínicas do Brasil Serviços Médicos hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Oncoclínicas do Brasil Serviços Médicos

What Are Growth Metrics Telling Us About The High P/E?

Oncoclínicas do Brasil Serviços Médicos' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 71%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 85% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 15% per year, which is noticeably less attractive.

In light of this, it's understandable that Oncoclínicas do Brasil Serviços Médicos' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

A significant share price dive has done very little to deflate Oncoclínicas do Brasil Serviços Médicos' very lofty P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Oncoclínicas do Brasil Serviços Médicos' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Oncoclínicas do Brasil Serviços Médicos (of which 2 are significant!) you should know about.

You might be able to find a better investment than Oncoclínicas do Brasil Serviços Médicos. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ONCO3

Oncoclínicas do Brasil Serviços Médicos

Oncoclínicas do Brasil Serviços Médicos S.A.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives