- Brazil

- /

- Healthcare Services

- /

- BOVESPA:HAPV3

Hapvida Participações e Investimentos S.A.'s (BVMF:HAPV3) Popularity With Investors Is Under Threat From Overpricing

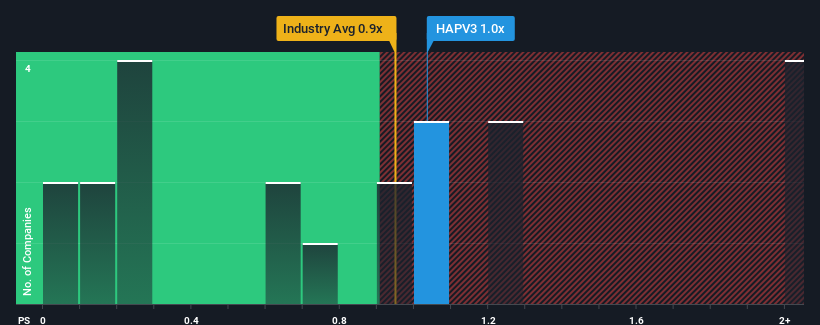

There wouldn't be many who think Hapvida Participações e Investimentos S.A.'s (BVMF:HAPV3) price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S for the Healthcare industry in Brazil is similar at about 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Hapvida Participações e Investimentos

How Has Hapvida Participações e Investimentos Performed Recently?

Hapvida Participações e Investimentos could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Hapvida Participações e Investimentos will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Hapvida Participações e Investimentos would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. Pleasingly, revenue has also lifted 220% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 8.1% each year as estimated by the nine analysts watching the company. That's shaping up to be materially lower than the 10% per year growth forecast for the broader industry.

With this in mind, we find it intriguing that Hapvida Participações e Investimentos' P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

When you consider that Hapvida Participações e Investimentos' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Hapvida Participações e Investimentos with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hapvida Participações e Investimentos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:HAPV3

Hapvida Participações e Investimentos

Operates in the healthcare sector in Brazil.

Good value with reasonable growth potential.

Market Insights

Community Narratives