- Brazil

- /

- Healthcare Services

- /

- BOVESPA:HAPV3

Hapvida Participações e Investimentos (BVMF:HAPV3 shareholders incur further losses as stock declines 10% this week, taking three-year losses to 74%

As an investor, mistakes are inevitable. But really bad investments should be rare. So consider, for a moment, the misfortune of Hapvida Participações e Investimentos S.A. (BVMF:HAPV3) investors who have held the stock for three years as it declined a whopping 74%. That would certainly shake our confidence in the decision to own the stock. The falls have accelerated recently, with the share price down 22% in the last three months.

Since Hapvida Participações e Investimentos has shed R$2.8b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Hapvida Participações e Investimentos

Given that Hapvida Participações e Investimentos didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Hapvida Participações e Investimentos saw its revenue grow by 34% per year, compound. That is faster than most pre-profit companies. So why has the share priced crashed 20% per year, in the same time? The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. If the company is low on cash, it may have to raise capital soon.

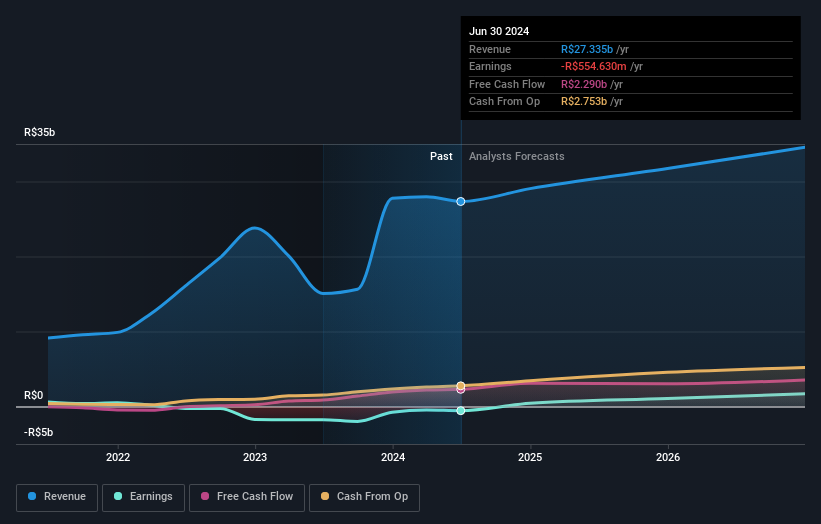

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Hapvida Participações e Investimentos is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Hapvida Participações e Investimentos in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 10% in the last year, Hapvida Participações e Investimentos shareholders lost 16%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. You could get a better understanding of Hapvida Participações e Investimentos' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hapvida Participações e Investimentos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:HAPV3

Hapvida Participações e Investimentos

Operates in the health sector in Brazil.

Undervalued with reasonable growth potential.